Premium Only Content

The names of the employees of Cox Security Systems and their regular salaries are shown in the

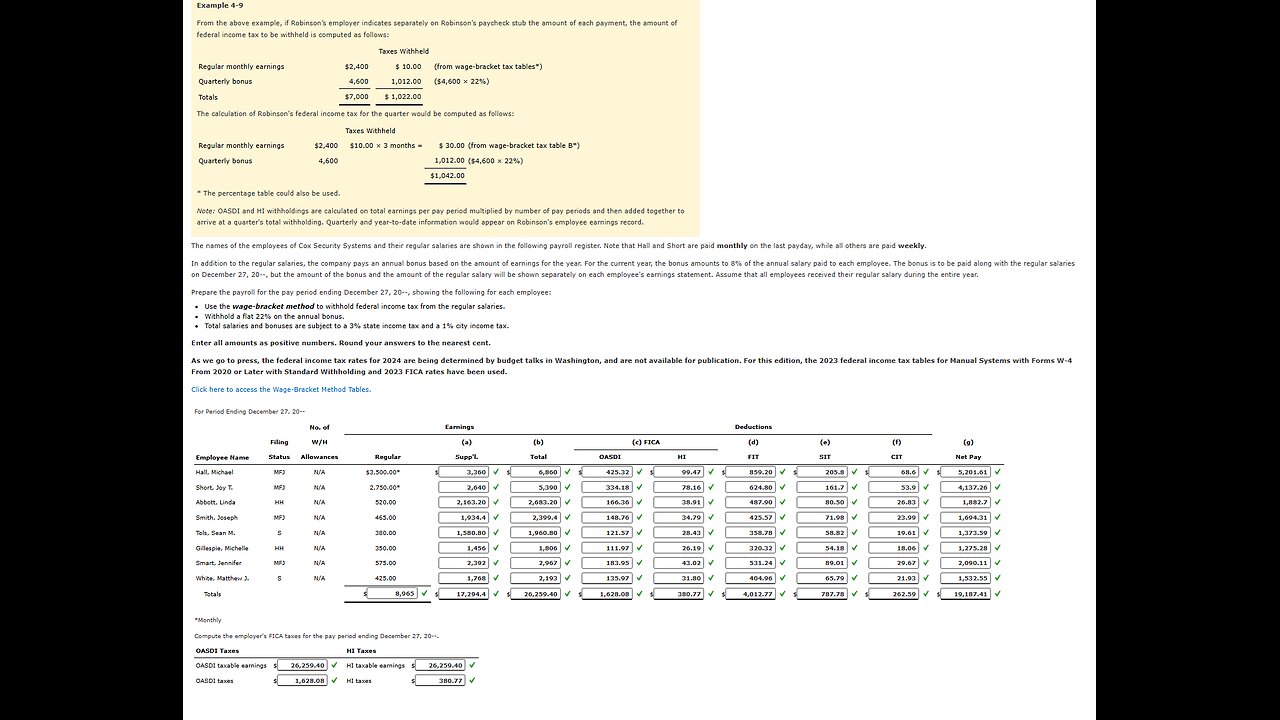

The names of the employees of Cox Security Systems and their regular salaries are shown in the following payroll register. Note that Hall and Short are paid monthly on the last payday, while all others are paid weekly.

In addition to the regular salaries, the company pays an annual bonus based on the amount of earnings for the year. For the current year, the bonus amounts to 8% of the annual salary paid to each employee. The bonus is to be paid along with the regular salaries on December 27, 20--, but the amount of the bonus and the amount of the regular salary will be shown separately on each employee's earnings statement. Assume that all employees received their regular salary during the entire year.

Prepare the payroll for the pay period ending December 27, 20--, showing the following for each employee:

Use the wage-bracket method to withhold federal income tax from the regular salaries.

Withhold a flat 22% on the annual bonus.

Total salaries and bonuses are subject to a 3% state income tax and a 1% city income tax.

Enter all amounts as positive numbers. Round your answers to the nearest cent.

As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.

Click here to access the Wage-Bracket Method Tables.

For Period Ending December 27, 20--

Employee Name No. of Earnings Deductions

Filing W/H (a) (b) (c) FICA (d) (e) (f) (g)

Status Allowances Regular Supp'l. Total OASDI HI FIT SIT CIT Net Pay

Hall, Michael MFJ N/A $3,500.00* fill in the blank 1 of 77$

3,360

fill in the blank 2 of 77$

6,860

fill in the blank 3 of 77$

425.32

fill in the blank 4 of 77$

99.47

fill in the blank 5 of 77$

859.20

fill in the blank 6 of 77$

205.8

fill in the blank 7 of 77$

68.6

fill in the blank 8 of 77$

5,201.61

Short, Joy T. MFJ N/A 2,750.00* fill in the blank 9 of 77

2,640

fill in the blank 10 of 77

5,390

fill in the blank 11 of 77

334.18

fill in the blank 12 of 77

78.16

fill in the blank 13 of 77

624.80

fill in the blank 14 of 77

161.7

fill in the blank 15 of 77

53.9

fill in the blank 16 of 77

4,137.26

Abbott, Linda HH N/A 520.00 fill in the blank 17 of 77

2,163.20

fill in the blank 18 of 77

2,683.20

fill in the blank 19 of 77

166.36

fill in the blank 20 of 77

38.91

fill in the blank 21 of 77

487.90

fill in the blank 22 of 77

80.50

fill in the blank 23 of 77

26.83

fill in the blank 24 of 77

1,882.7

Smith, Joseph MFJ N/A 465.00 fill in the blank 25 of 77

1,934.4

fill in the blank 26 of 77

2,399.4

fill in the blank 27 of 77

148.76

fill in the blank 28 of 77

34.79

fill in the blank 29 of 77

425.57

fill in the blank 30 of 77

71.98

fill in the blank 31 of 77

23.99

fill in the blank 32 of 77

1,694.31

Tols, Sean M. S N/A 380.00 fill in the blank 33 of 77

1,580.80

fill in the blank 34 of 77

1,960.80

fill in the blank 35 of 77

121.57

fill in the blank 36 of 77

28.43

fill in the blank 37 of 77

358.78

fill in the blank 38 of 77

58.82

fill in the blank 39 of 77

19.61

fill in the blank 40 of 77

1,373.59

Gillespie, Michelle HH N/A 350.00 fill in the blank 41 of 77

1,456

fill in the blank 42 of 77

1,806

fill in the blank 43 of 77

111.97

fill in the blank 44 of 77

26.19

fill in the blank 45 of 77

320.32

fill in the blank 46 of 77

54.18

fill in the blank 47 of 77

18.06

fill in the blank 48 of 77

1,275.28

Smart, Jennifer MFJ N/A 575.00 fill in the blank 49 of 77

2,392

fill in the blank 50 of 77

2,967

fill in the blank 51 of 77

183.95

fill in the blank 52 of 77

43.02

fill in the blank 53 of 77

531.24

fill in the blank 54 of 77

89.01

fill in the blank 55 of 77

29.67

fill in the blank 56 of 77

2,090.11

White, Matthew J. S N/A 425.00 fill in the blank 57 of 77

1,768

fill in the blank 58 of 77

2,193

fill in the blank 59 of 77

135.97

fill in the blank 60 of 77

31.80

fill in the blank 61 of 77

404.96

fill in the blank 62 of 77

65.79

fill in the blank 63 of 77

21.93

fill in the blank 64 of 77

1,532.55

Totals fill in the blank 65 of 77$

8,965

fill in the blank 66 of 77$

17,294.4

fill in the blank 67 of 77$

26,259.40

fill in the blank 68 of 77$

1,628.08

fill in the blank 69 of 77$

380.77

fill in the blank 70 of 77$

4,012.77

fill in the blank 71 of 77$

787.78

fill in the blank 72 of 77$

262.59

fill in the blank 73 of 77$

19,187.41

*Monthly

Compute the employer's FICA taxes for the pay period ending December 27, 20--.

OASDI Taxes HI Taxes

OASDI taxable earnings fill in the blank 74 of 77$

26,259.40

HI taxable earnings fill in the blank 75 of 77$

26,259.40

OASDI taxes fill in the blank 76 of 77$

1,628.08

HI taxes fill in the blank 77 of 77$

380.77

-

5:19:50

5:19:50

SLS - Street League Skateboarding

8 days ago2024 SLS Tokyo: Women’s and Men’s Knockout Rounds

552K28 -

2:51:00

2:51:00

Fresh and Fit

11 hours agoWomen Claim To Give Better Dating Advice So We Did THIS...

176K89 -

![[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver](https://1a-1791.com/video/s8/1/c/W/7/1/cW71u.0kob-small-F-EM-UP-Friday-Take-2-Desti.jpg) 5:16:50

5:16:50

CHiLi XDD

13 hours ago[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver

92.2K5 -

5:13:43

5:13:43

ItsMossy

18 hours agoHALO WITH THE RUMBLERS (: #RUMBLETAKEOVER

70.5K2 -

1:54:08

1:54:08

INFILTRATION85

12 hours agoHi, I'm INFILTRATION

57.4K9 -

7:51:03

7:51:03

GuardianRUBY

14 hours agoRumble Takeover! The Rumblings are strong

113K5 -

4:28:45

4:28:45

Etheraeon

21 hours agoWorld of Warcraft: Classic | Fresh Level 1 Druid | 500 Follower Goal

76.5K3 -

3:17:21

3:17:21

VapinGamers

13 hours ago $4.13 earned🎮🔥Scrollin’ and Trollin’: ESO Adventures Unleashed!

53.3K2 -

10:48:40

10:48:40

a12cat34dog

14 hours agoGETTING AFTERLIFE UNLOCKED :: Call of Duty: Black Ops 6 :: ZOMBIES CAMO GRIND w/Bubba {18+}

44.8K2 -

8:23:18

8:23:18

NubesALot

17 hours ago $5.99 earnedDark Souls Remastered and party games

42K