Premium Only Content

The names of the employees of Hogan Thrift Shop are listed on the following

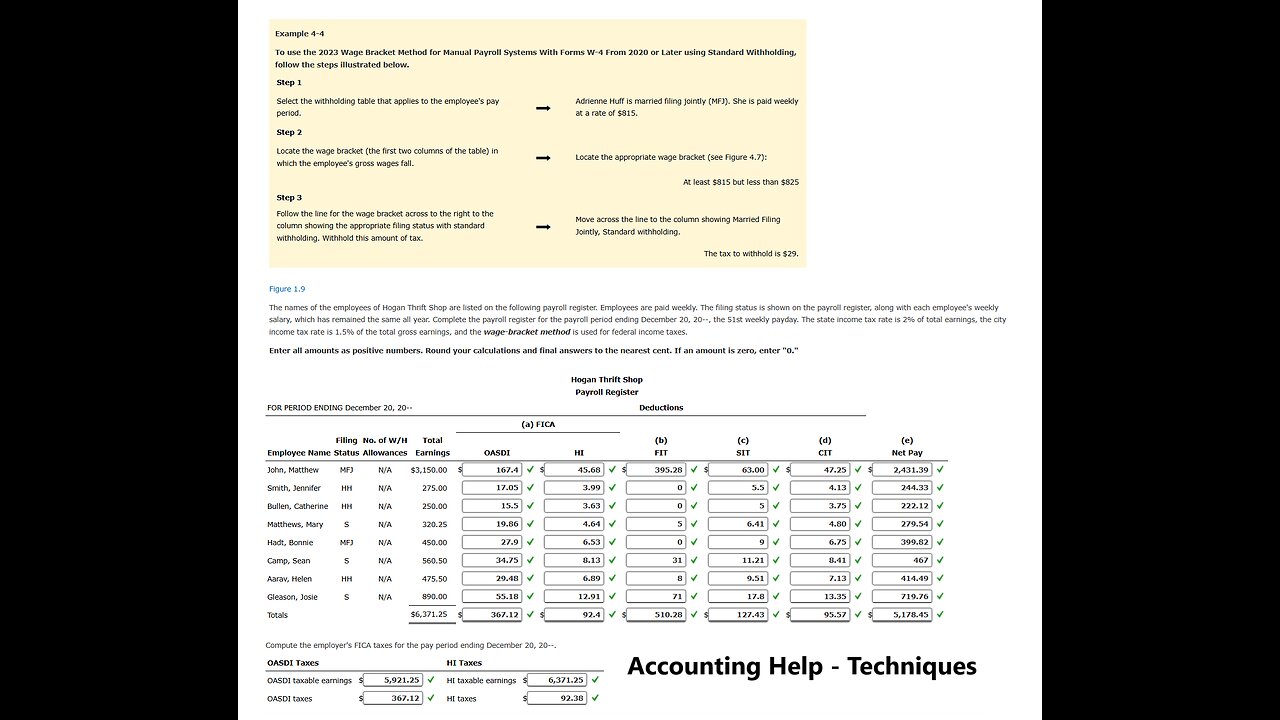

Example 4-4

To use the 2023 Wage Bracket Method for Manual Payroll Systems With Forms W-4 From 2020 or Later using Standard Withholding, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee's pay period. ➡ Adrienne Huff is married filing jointly (MFJ). She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee's gross wages fall. ➡ Locate the appropriate wage bracket (see Figure 4.7):

At least $815 but less than $825

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate filing status with standard withholding. Withhold this amount of tax. ➡ Move across the line to the column showing Married Filing Jointly, Standard withholding.

The tax to withhold is $29.

Figure 1.9

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The filing status is shown on the payroll register, along with each employee's weekly salary, which has remained the same all year. Complete the payroll register for the payroll period ending December 20, 20--, the 51st weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage-bracket method is used for federal income taxes.

Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. If an amount is zero, enter "0."

As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.

Click here to access the Wage-Bracket Method Tables.

Click here to access the Percentage Method Tables.

Hogan Thrift Shop

Payroll Register

FOR PERIOD ENDING December 20, 20-- Deductions

(a) FICA

Employee Name Filing

Status No. of W/H

Allowances Total

Earnings OASDI HI (b)

FIT (c)

SIT (d)

CIT (e)

Net Pay

John, Matthew MFJ N/A $3,150.00 fill in the blank 1 of 58$

167.4

fill in the blank 2 of 58$

45.68

fill in the blank 3 of 58$

395.28

fill in the blank 4 of 58$

63.00

fill in the blank 5 of 58$

47.25

fill in the blank 6 of 58$

2,431.39

Smith, Jennifer HH N/A 275.00 fill in the blank 7 of 58

17.05

fill in the blank 8 of 58

3.99

fill in the blank 9 of 58

0

fill in the blank 10 of 58

5.5

fill in the blank 11 of 58

4.13

fill in the blank 12 of 58

244.33

Bullen, Catherine HH N/A 250.00 fill in the blank 13 of 58

15.5

fill in the blank 14 of 58

3.63

fill in the blank 15 of 58

0

fill in the blank 16 of 58

5

fill in the blank 17 of 58

3.75

fill in the blank 18 of 58

222.12

Matthews, Mary S N/A 320.25 fill in the blank 19 of 58

19.86

fill in the blank 20 of 58

4.64

fill in the blank 21 of 58

5

fill in the blank 22 of 58

6.41

fill in the blank 23 of 58

4.80

fill in the blank 24 of 58

279.54

Hadt, Bonnie MFJ N/A 450.00 fill in the blank 25 of 58

27.9

fill in the blank 26 of 58

6.53

fill in the blank 27 of 58

0

fill in the blank 28 of 58

9

fill in the blank 29 of 58

6.75

fill in the blank 30 of 58

399.82

Camp, Sean S N/A 560.50 fill in the blank 31 of 58

34.75

fill in the blank 32 of 58

8.13

fill in the blank 33 of 58

31

fill in the blank 34 of 58

11.21

fill in the blank 35 of 58

8.41

fill in the blank 36 of 58

467

Aarav, Helen HH N/A 475.50 fill in the blank 37 of 58

29.48

fill in the blank 38 of 58

6.89

fill in the blank 39 of 58

8

fill in the blank 40 of 58

9.51

fill in the blank 41 of 58

7.13

fill in the blank 42 of 58

414.49

Gleason, Josie S N/A 890.00 fill in the blank 43 of 58

55.18

fill in the blank 44 of 58

12.91

fill in the blank 45 of 58

71

fill in the blank 46 of 58

17.8

fill in the blank 47 of 58

13.35

fill in the blank 48 of 58

719.76

Totals $6,371.25 fill in the blank 49 of 58$

367.12

fill in the blank 50 of 58$

92.4

fill in the blank 51 of 58$

510.28

fill in the blank 52 of 58$

127.43

fill in the blank 53 of 58$

95.57

fill in the blank 54 of 58$

5,178.45

Compute the employer's FICA taxes for the pay period ending December 20, 20--.

OASDI Taxes HI Taxes

OASDI taxable earnings fill in the blank 55 of 58$

5,921.25

HI taxable earnings fill in the blank 56 of 58$

6,371.25

OASDI taxes fill in the blank 57 of 58$

367.12

HI taxes fill in the blank 58 of 58$

92.38

-

3:13:17

3:13:17

Boxin

3 hours ago(Rumble push to 50 Followers!) (alerts Working...?) Spoopy Month!!!! Resident Evil 7 Biohazard 4

50.3K2 -

2:26:35

2:26:35

Father Russell

3 hours agoThrone and Liberty | Morning Stream

27.6K1 -

5:59:12

5:59:12

ColdHe4rted

8 hours agoOverwatch = new tank! Lets go!

21.5K -

5:19:50

5:19:50

SLS - Street League Skateboarding

8 days ago2024 SLS Tokyo: Women’s and Men’s Knockout Rounds

552K28 -

2:51:00

2:51:00

Fresh and Fit

12 hours agoWomen Claim To Give Better Dating Advice So We Did THIS...

176K92 -

![[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver](https://1a-1791.com/video/s8/1/c/W/7/1/cW71u.0kob-small-F-EM-UP-Friday-Take-2-Desti.jpg) 5:16:50

5:16:50

CHiLi XDD

13 hours ago[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver

92.2K6 -

5:13:43

5:13:43

ItsMossy

19 hours agoHALO WITH THE RUMBLERS (: #RUMBLETAKEOVER

70.5K2 -

1:54:08

1:54:08

INFILTRATION85

12 hours agoHi, I'm INFILTRATION

57.4K9 -

7:51:03

7:51:03

GuardianRUBY

14 hours agoRumble Takeover! The Rumblings are strong

113K5 -

4:28:45

4:28:45

Etheraeon

21 hours agoWorld of Warcraft: Classic | Fresh Level 1 Druid | 500 Follower Goal

76.5K3