Premium Only Content

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding

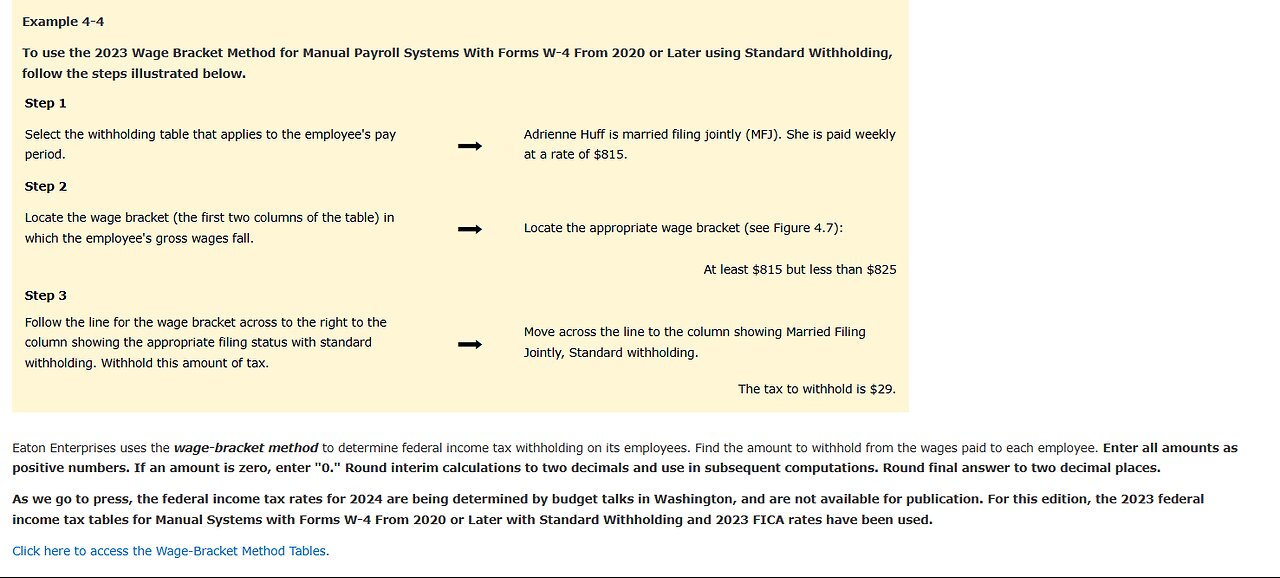

Example 4-4

To use the 2023 Wage Bracket Method for Manual Payroll Systems With Forms W-4 From 2020 or Later using Standard Withholding, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee's pay period. ➡ Adrienne Huff is married filing jointly (MFJ). She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee's gross wages fall. ➡ Locate the appropriate wage bracket (see Figure 4.7):

At least $815 but less than $825

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate filing status with standard withholding. Withhold this amount of tax. ➡ Move across the line to the column showing Married Filing Jointly, Standard withholding.

The tax to withhold is $29.

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid to each employee. Enter all amounts as positive numbers. If an amount is zero, enter "0." Round interim calculations to two decimals and use in subsequent computations. Round final answer to two decimal places.

As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.

Click here to access the Wage-Bracket Method Tables.

Employee

Filing

Status

No. of

Withholding

Allowances Payroll Period

W = Weekly

S = Semimonthly

M = Monthly

D = Daily

Wage

Amount to Be

Withheld

Tarra James HH N/A W $1,350 fill in the blank 1 of 9$

108

Mike Cramden MFJ N/A W 590 fill in the blank 2 of 9

6

Jim Jones HH N/A W 675 fill in the blank 3 of 9

28

Joan Kern MFJ N/A M 3,100 fill in the blank 4 of 9

80

Mary Long S N/A M 2,730 fill in the blank 5 of 9

173

Cathy Luis HH N/A S 955 fill in the blank 6 of 9

10

Josie Martin MFJ N/A D 108 fill in the blank 7 of 9

0.1

Terri Singer HH N/A S 2,500 fill in the blank 8 of 9

184

Shelby Torres HH N/A M 3,215 fill in the blank 9 of 9

153

-

LIVE

LIVE

Vigilant News Network

15 hours agoBombshell Study Reveals Where the COVID Vaccine Deaths Are Hiding | Media Blackout

1,897 watching -

1:17:59

1:17:59

Sarah Westall

11 hours agoDOGE: Crime & Hysteria bringing the Critics & the Fearful - Plus new CDC/Ukraine Crime w/ Dr Fleming

65K5 -

45:39

45:39

Survive History

17 hours ago $9.79 earnedCould You Survive in the Shield Wall at the Battle of Hastings?

69.8K6 -

1:50:28

1:50:28

TheDozenPodcast

15 hours agoViolence, Abuse, Jail, Reform: Michael Maisey

105K4 -

23:01

23:01

Mrgunsngear

1 day ago $6.25 earnedWolfpack Armory AW15 MK5 AR-15 Review 🇺🇸

90.3K12 -

25:59

25:59

TampaAerialMedia

1 day ago $4.01 earnedUpdate ANNA MARIA ISLAND 2025

57.7K4 -

59:31

59:31

Squaring The Circle, A Randall Carlson Podcast

17 hours ago#039: How Politics & War, Art & Science Shape Our World; A Cultural Commentary From Randall Carlson

44K3 -

13:21

13:21

Misha Petrov

17 hours agoThe CRINGIEST Thing I Have Ever Seen…

35.9K63 -

11:45

11:45

BIG NEM

13 hours agoWe Blind Taste Tested the Best Jollof in Toronto 🇳🇬🇬🇭

25.7K1 -

15:40

15:40

Fit'n Fire

17 hours ago $0.57 earnedArsenal SLR106f & LiteRaider AK Handguard from 1791 Industries

22.1K1