Premium Only Content

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding

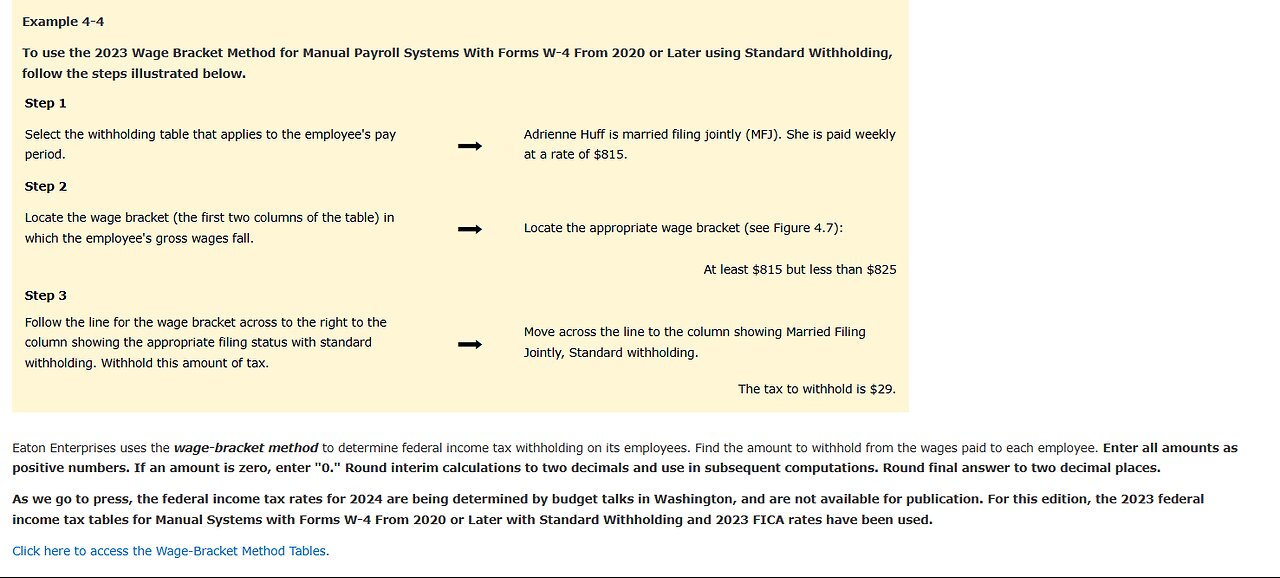

Example 4-4

To use the 2023 Wage Bracket Method for Manual Payroll Systems With Forms W-4 From 2020 or Later using Standard Withholding, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee's pay period. ➡ Adrienne Huff is married filing jointly (MFJ). She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee's gross wages fall. ➡ Locate the appropriate wage bracket (see Figure 4.7):

At least $815 but less than $825

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate filing status with standard withholding. Withhold this amount of tax. ➡ Move across the line to the column showing Married Filing Jointly, Standard withholding.

The tax to withhold is $29.

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid to each employee. Enter all amounts as positive numbers. If an amount is zero, enter "0." Round interim calculations to two decimals and use in subsequent computations. Round final answer to two decimal places.

As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.

Click here to access the Wage-Bracket Method Tables.

Employee

Filing

Status

No. of

Withholding

Allowances Payroll Period

W = Weekly

S = Semimonthly

M = Monthly

D = Daily

Wage

Amount to Be

Withheld

Tarra James HH N/A W $1,350 fill in the blank 1 of 9$

108

Mike Cramden MFJ N/A W 590 fill in the blank 2 of 9

6

Jim Jones HH N/A W 675 fill in the blank 3 of 9

28

Joan Kern MFJ N/A M 3,100 fill in the blank 4 of 9

80

Mary Long S N/A M 2,730 fill in the blank 5 of 9

173

Cathy Luis HH N/A S 955 fill in the blank 6 of 9

10

Josie Martin MFJ N/A D 108 fill in the blank 7 of 9

0.1

Terri Singer HH N/A S 2,500 fill in the blank 8 of 9

184

Shelby Torres HH N/A M 3,215 fill in the blank 9 of 9

153

-

15:49

15:49

Chris From The 740

1 day ago $0.02 earnedThe EAA Girsan Influencer X - Not Your Grandpa's 1911

1.67K3 -

25:38

25:38

Producer Michael

16 hours agoLuxury Souq's MULTI-MILLION DOLLAR Watch Collection!

68K5 -

17:06

17:06

Sleep is CANCELED

20 hours ago10 SCARY Videos To Keep You Up All Night!

44.7K2 -

2:37

2:37

Canadian Crooner

1 year agoPat Coolen | Let It Snow!

27.6K9 -

2:44

2:44

BIG NEM

11 hours agoWhat's Really Behind the Fake Alpha Male Epidemic?

23.5K4 -

57:20

57:20

State of the Second Podcast

7 days agoThe Inventor of Bump Stock Fights Back! (ft. Slide Fire)

15.9K5 -

1:04:12

1:04:12

PMG

1 day ago $11.69 earned"I’ll be DRONED for Christmas!"

58.9K12 -

23:38

23:38

RealitySurvival

1 day agoBest Anti-Drone Rounds For Self Defense

34.7K5 -

57:43

57:43

barstoolsports

19 hours agoBest Shot Wins The Game | Surviving Barstool S4 Ep. 7

221K10 -

1:52:24

1:52:24

Kim Iversen

14 hours agoLuigi Mangione Charged With TERRORISM | Liz Cheney Accused Of WITNESS TAMPERING, Faces 20 YEARS IN JAIL

125K164