Premium Only Content

Gold Backed Hidden Wars, Fall of the Portuguese Empire via the IMF

Several leaders have attempted to reintroduce or establish a gold-backed currency, often as a way to stabilize their national economies, increase sovereignty, or reduce dependence on Western financial systems. Here’s a list of notable leaders who pursued this goal but ultimately faced obstacles, including international opposition, logistical challenges, or political upheaval:

1. Muammar Gaddafi (Libya)

Plan: In the early 2000s, Gaddafi proposed creating a gold-backed African dinar as a pan-African currency. His vision was to replace the CFA franc (used by 14 African countries and pegged to the euro) and to reduce African dependence on Western currency systems.

Outcome: Gaddafi’s plan faced strong opposition from Western countries, which had interests in maintaining the CFA franc and dollar dominance in the region. Following Libya’s civil conflict and Gaddafi’s death in 2011, the plan never materialized.

2. Hugo Chávez (Venezuela)

Plan: In the 2000s, Chávez explored using Venezuela’s gold reserves to back its currency, the bolívar, to protect against inflation and counter U.S. financial influence. Chávez repatriated a significant portion of Venezuela’s gold reserves from European banks to give the country greater control over its assets.

Outcome: Venezuela’s economic crisis worsened due to hyperinflation, economic mismanagement, and sanctions, making a stable gold-backed currency unrealistic. The bolívar continued to depreciate, and the gold-backing plan was shelved.

3. Saddam Hussein (Iraq)

Plan: In the early 2000s, Saddam Hussein proposed moving Iraq away from the U.S. dollar for oil sales, considering gold or the euro as alternatives. His aim was to weaken U.S. economic influence in Iraq and the region.

Outcome: International sanctions, the U.S. invasion of Iraq in 2003, and the fall of Saddam’s government prevented any progress toward a gold-backed or alternative currency system.

4. Augusto Pinochet (Chile)

Plan: Although not widely publicized, Pinochet’s regime considered using Chile’s significant copper and mineral wealth to back its currency, stabilizing the Chilean peso amid hyperinflation and economic instability in the 1970s.

Outcome: Due to global economic pressures, currency instability, and U.S. involvement in Chile’s economic reforms, the plan was not fully implemented. Instead, Chile adopted economic liberalization measures, which contributed to recovery but did not include a gold-backed currency.

5. Charles de Gaulle (France)

Plan: In the 1960s, de Gaulle advocated for a return to the gold standard internationally, criticizing the U.S. for benefiting from dollar hegemony without sufficient gold reserves to back the currency. He also suggested France’s currency reserves be converted to gold to stabilize the franc and reduce dependency on the dollar.

Outcome: De Gaulle’s efforts led to a brief rise in gold purchases by France, but the global move toward fiat currency and the collapse of the Bretton Woods system in 1971 ended his vision for a gold standard.

6. Ron Paul (United States)

Plan: Ron Paul, a U.S. Congressman and presidential candidate, advocated strongly for a return to the gold standard as part of his libertarian economic platform. He believed this would reduce inflation, limit government spending, and ensure a stable currency.

Outcome: Paul’s ideas influenced some Americans but were not adopted into mainstream U.S. economic policy. The U.S. continues to use a fiat currency, and a return to the gold standard remains politically unpopular.

7. Imran Khan (Pakistan)

Plan: During his tenure, Khan discussed reducing dependence on the U.S. dollar and floated the idea of regional economic cooperation that could include commodity-backed trade or currencies to stabilize Pakistan’s economy.

Outcome: Due to Pakistan’s economic challenges, international debt obligations, and reliance on the IMF, a gold-backed or commodity-backed currency was never implemented. Political shifts eventually led to Khan’s removal from office.

8. Robert Mugabe (Zimbabwe)

Plan: After Zimbabwe’s economic crisis and hyperinflation in the 2000s, Mugabe’s government considered using gold to back a new currency to restore stability. Zimbabwe had significant gold resources, which Mugabe hoped could lend credibility to the currency.

Outcome: Due to economic instability, corruption, and the depletion of Zimbabwe’s gold reserves, the plan never took off. Zimbabwe event

gold-backed currency, international finance, Bretton Woods, gold standard, currency stability, global economy, fiat currency, U.S. dollar, African economy, IMF, World Bank, decolonization, gold reserves, Muammar Gaddafi, Libya, Hugo Chávez, Venezuela, Saddam Hussein, Iraq, Augusto Pinochet, Chile, Charles de Gaulle, France, Ron Paul, United States, Imran Khan, Pakistan, Robert Mugabe, Zimbabwe, Joseph Mobutu, Zaire, currency crisis, economic sanctions, financial sovereignty, global monetary system, economic reforms

-

4:48

4:48

Mike Martins Channel

10 days ago $0.15 earnedFalse flag in England to be blamed on Russia, to start world war 3 , all in the name of Ukraine

3622 -

9:20

9:20

Colion Noir

19 hours agoArgentine President Lowers Gun Purchase Age to 18, Why The U.S. Should Do The Same

63.1K39 -

1:49:07

1:49:07

Adam Does Movies

18 hours ago $1.86 earnedKraven Movie Review + The Lord of the Rings: The War of the Rohirrim - LIVE!

31.3K2 -

21:59

21:59

BlackDiamondGunsandGear

12 hours ago $1.08 earned🔴 NEW Ruger RXM / RANGE Review / Plaid Joshie Approved?

20.3K11 -

1:33:50

1:33:50

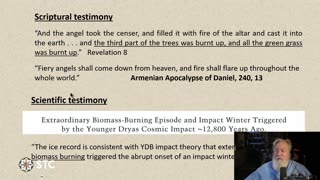

Squaring The Circle, A Randall Carlson Podcast

1 day ago#031 Apocalypse Unsealed - Squaring The Circle: A Randall Carlson Podcast

17.8K7 -

1:01:47

1:01:47

Trumpet Daily

2 days ago $9.94 earnedChris Wray Lied About January 6 - Trumpet Daily | Dec. 13, 2024

19.6K17 -

55:42

55:42

Bek Lover Podcast

14 hours agoDemonic Deception Incoming!

11.1K17 -

37:13

37:13

TampaAerialMedia

1 day ago $0.37 earnedBOSTON Travel Guide - Tours, Tips, Trails, & Transportation

8.86K3 -

52:47

52:47

PMG

1 day ago $1.03 earned"Bye-Bye Chris Wray- Kyle Seraphin, Ashli Babbitt's Murder Should Have Been Fired Years Ago"

8.43K1 -

2:04:24

2:04:24

RG_GerkClan

6 hours agoLIVE Sunday Special: Lets Dominate the Galaxy - Lego Star Wars The Skywalker Sage - Gerk Clan

12.2K2