Premium Only Content

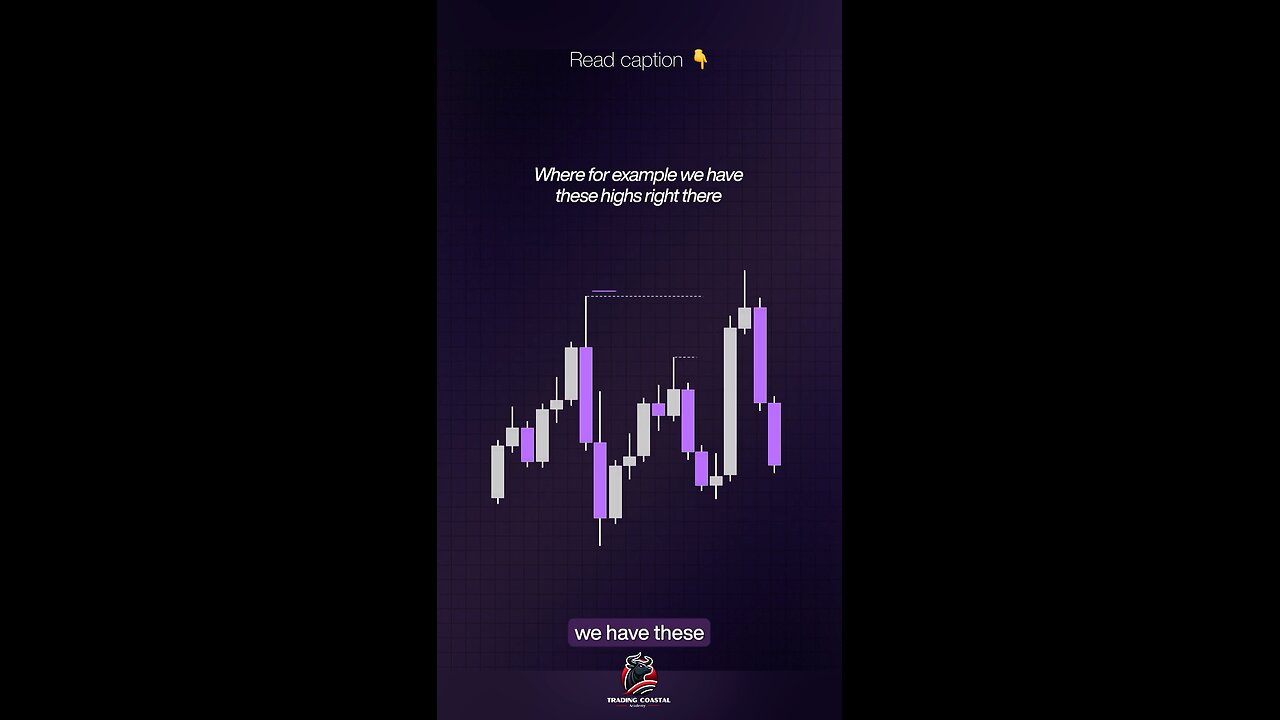

“🔍 Master Liquidity Sweeps! 📈 How to Use Higher Time Frames for Better Entries 🚀

1. Identify Liquidity Sweeps More Accurately: Liquidity sweeps are often confusing on lower time frames because price movements can appear as sudden spikes or “stings.” By zooming out to a higher time frame, you can see if these spikes are actually liquidity sweeps into a Fair Value Gap (FVG), helping you distinguish between real sweeps and temporary fluctuations.

2. Improved Trade Entry and Confirmation: When you use higher time frames, liquidity sweeps become more obvious, allowing for clearer trade entry points. This can help prevent premature entries or exits on lower time frames, as you have a broader context for the price action.

3. Enhances Risk-to-Reward by Avoiding Noise: Trading with the higher time frame context reduces the impact of lower time frame noise, leading to better risk management. This approach helps you set more accurate stops and targets, improving the overall risk-to-reward ratio of your trades.

-

51:58

51:58

PMG

13 hours ago $3.20 earned"Can the Government Learn from Elon Musk’s 70% Labor Cut? A Deep Dive into Inefficient Agencies"

55.5K1 -

6:39:15

6:39:15

Amish Zaku

13 hours agoRumble Spartans #10 - New Year New Maps

47.1K3 -

1:04:58

1:04:58

In The Litter Box w/ Jewels & Catturd

1 day agoNo Tax On Tips! | In the Litter Box w/ Jewels & Catturd – Ep. 722 – 1/17/2025

162K32 -

5:35:39

5:35:39

Dr Disrespect

19 hours ago🔴LIVE - DR DISRESPECT - WARZONE - CRAZY CHALLENGES

180K38 -

1:16:30

1:16:30

Edge of Wonder

15 hours agoLA Fire Updates: Miracles Amidst the Devastation

53.5K15 -

54:54

54:54

LFA TV

19 hours agoBanning Mystery of the Ages | TRUMPET DAILY 1.17.25 7pm

45.3K9 -

1:47:13

1:47:13

2 MIKES LIVE

13 hours ago2 MIKES LIVE #168 Open Mike Friday!

38.2K4 -

1:05:11

1:05:11

Sarah Westall

13 hours agoMysterious Fog and California Wildfires Both Contain Dangerous Elements w/ Dr Robert Young & Hazen

56.4K8 -

1:40:48

1:40:48

Mally_Mouse

13 hours agoLet's Play!! -- Stardew Valley pt. 23!

30.2K1 -

16:21

16:21

China Uncensored

16 hours agoCan Anything Stop the Tiktok Ban?

40.7K14