Premium Only Content

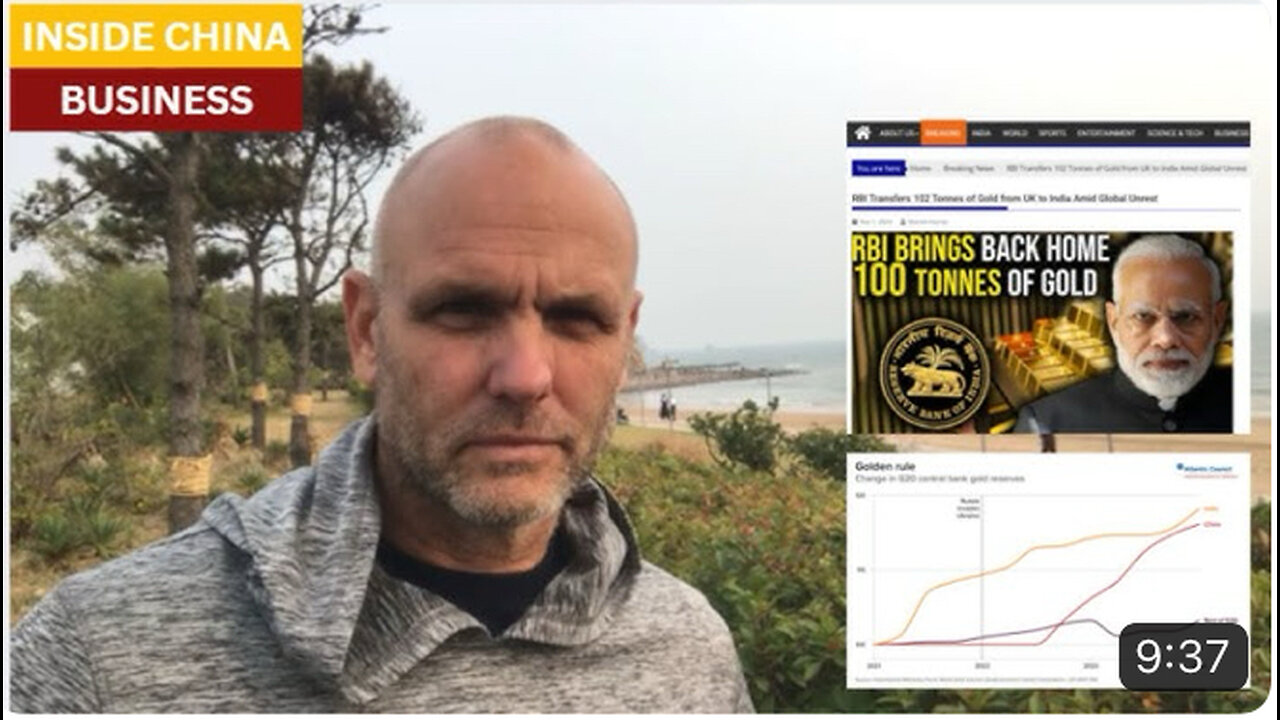

India, China ASEAN, BRICS are push gold to record highs

US-China expert English video: India, China ASEAN, BRICS are push gold to record highs, then pull from Western vaults after Russia sanctions. They don’t trust gold stored in western vaults and institutions. Buying gold is de-risking against US Gov’t and US$. In other words move your US$ assets outside US jurisdiction and covert part of your assets into Gold and stored in countries like Singapore. 印度、中國、東協、金磚國家將金價推至歷史新高,然後在俄羅斯制裁後從西方金庫撤出。他們不信任把黃金儲存在西方金庫. 購買黃金可以降低美國政府和美元的風險. 換句話說,將您的美元資產轉移到美國管轄範圍之外,並將部分資產轉換成黃金並儲存在新加坡等國家.

https://www.bloomberg.com/news/articles/2024-08-20/as-the-rich-snap-up-gold-bars-storage-vaults-brace-for-business

https://thereserve.sg/

https://www.bloomberg.com/news/articles/2024-04-07/the-gold-market-hunts-for-answers-behind-bullion-s-sudden-surge

https://www.reuters.com/markets/commodities/switzerland-sent-524-tonnes-gold-china-last-year-most-since-2018-2023-01-24/

https://www.atlanticcouncil.org/blogs/econographics/india-outpaces-the-rest-of-the-g20-in-gold-purchases/

Gold prices are at historic highs, buoyed by India and China central bank buying in OTC markets. Further, all-time high levels of gold repatriation are underway, to vaults in Asia. Industry insiders and market experts are puzzled at the intensity and the timing of the gold buys, which seem divorced from economic fundamentals.

But these moves are an essential aspect of the BRICS countries' de-risking from Western banking systems. Following the sanctions on Russia, whereby billions of dollars of Russian reserves in US and European banks were seized, China and India were strongly motivated to reduce their exposure to Western regulators. China sold off huge portfolios of US Treasury bonds, and both China and India demanded physical deliveries of gold previously held by European custodians.

受印度和中國央行在場外市場買入的提振,金價處於歷史高點。 此外,黃金正在向亞洲金庫匯回,創歷史新高。業內人士和市場專家對黃金購買的強度和時機感到困惑,這似乎與經濟基本面脫節。

但這些措施是金磚國家降低西方銀行體系風險的重要面向。 在對俄羅斯實施制裁後,俄羅斯在美國和歐洲銀行的數十億美元儲備被沒收,中國和印度強烈希望減少對西方監管機構的曝險。 中國拋售了大量美國國債,中國和印度都要求交付歐洲託管機構先前持有的黃金.

-

25:53

25:53

Stephen Gardner

5 hours ago🔥BREAKING: Trump HATING LAWYER busted in $17 million money laundering scheme!

8.82K72 -

20:10

20:10

CartierFamily

11 hours agoAndrew Schulz DESTROYS Charlamagne’s WOKE Meltdown on DOGE & Elon Musk!

87.7K84 -

33:56

33:56

The Why Files

9 days agoLegend of the 13 Crystal Skulls | From Mars to the Maya

40.6K37 -

2:56:14

2:56:14

TimcastIRL

5 hours agoEPSTEIN Files DROP, FBI GOES ROGUE, AG Says They COVERED UP Epstein Case w/Amber Duke | Timcast IRL

152K76 -

1:39:23

1:39:23

Kim Iversen

6 hours ago"Canada's Trump" Is Trudeau’s Worst Nightmare: Is Maxime Bernier the Future of Canada?

54.2K67 -

DVR

DVR

Bannons War Room

10 days agoWarRoom Live

2.65M446 -

16:06

16:06

The Rubin Report

12 hours agoProof the Islamist Threat in England Can No Longer Be Ignored | Winston Marshall

72.6K75 -

2:07:07

2:07:07

Robert Gouveia

9 hours agoFBI Files Coverup! Bondi FURIOUS; SCOTUS Stops Judge; Special Counsel; FBI Does

94.7K80 -

56:15

56:15

Candace Show Podcast

9 hours agoBREAKING: My FIRST Prison Phone Call With Harvey Weinstein | Candace Ep 153

153K110 -

1:56:39

1:56:39

Flyover Conservatives

8 hours agoROBIN D. BULLOCK | Prophetic Warning: 2030 Is Up for Grabs – If We Don’t Act Now, Disaster Awaits! | FOC SHOW

46K8