Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Tax Accounting: Diane is a single taxpayer who qualifies for the earned income credit. Diane has

3 months ago

24

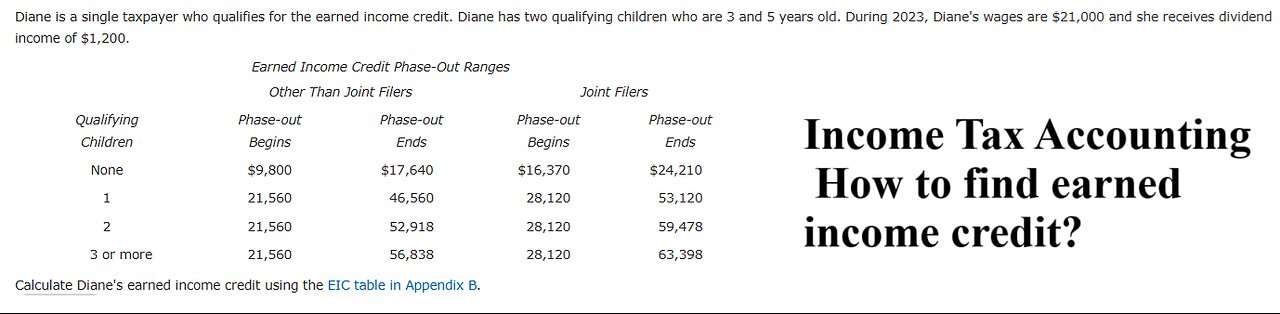

Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2023, Diane's wages are $21,000 and she receives dividend income of $1,200.

Earned Income Credit Phase-Out Ranges

Other Than Joint Filers Joint Filers

Qualifying

Children Phase-out

Begins Phase-out

Ends Phase-out

Begins Phase-out

Ends

None $9,800 $17,640 $16,370 $24,210

1 21,560 46,560 28,120 53,120

2 21,560 52,918 28,120 59,478

3 or more 21,560 56,838 28,120 63,398

Calculate Diane's earned income credit using the EIC table in Appendix B.

#TaxAccounting

#Accounting

#EarnedCredit

Loading comments...

-

LIVE

LIVE

Laura Loomer

1 hour agoEP 97: Trump's Nominees Transform America

1,736 watching -

UPCOMING

UPCOMING

Man in America

9 hours agoThe Helicopter Crash DOESN'T MAKE SENSE... What REALLY Happened???

6.14K3 -

LIVE

LIVE

Flyover Conservatives

20 hours agoParents WIN, Teachers Unions PANIC! 3 Huge Education Bombshells This Week! - Corey DeAngelis | FOC Show

713 watching -

1:40:20

1:40:20

Glenn Greenwald

5 hours agoTulsi's Hearing Exposes Bipartisan Rot of DC Swamp | SYSTEM UPDATE #400

67.6K149 -

1:19:48

1:19:48

Simply Bitcoin

10 hours ago $3.02 earnedJerome Powells MASSIVE Bitcoin Backflip! | EP 1172

25.7K2 -

58:42

58:42

The StoneZONE with Roger Stone

1 hour agoLBJ + CIA + Mob + Texas Oil = JFK Murder | The StoneZONE w/ Roger Stone

14.1K2 -

58:00

58:00

Donald Trump Jr.

9 hours agoBreaking News on Deadly Plane Crash, Plus Hearing on the Hill, Live with Rep Cory Mills & Sen Marsha Blackburn | TRIGGERED Ep.212

148K111 -

52:03

52:03

Kimberly Guilfoyle

7 hours agoLatest Updates on Deadly Air Collision, Plus Major Hearings on Capitol Hill,Live with Marc Beckman & Steve Friend | Ep.192

82.3K28 -

1:17:16

1:17:16

Josh Pate's College Football Show

6 hours ago $0.85 earnedMichigan vs NCAA | ESPN’s ACC Deal | Season Grades: UGA & Miami | Notre Dame Losses

27.3K2 -

1:26:50

1:26:50

Redacted News

6 hours agoWhat happened? Trump DESTROYS the Pete Buttigieg run FAA for tragic airline crash | Redacted News

211K153