Premium Only Content

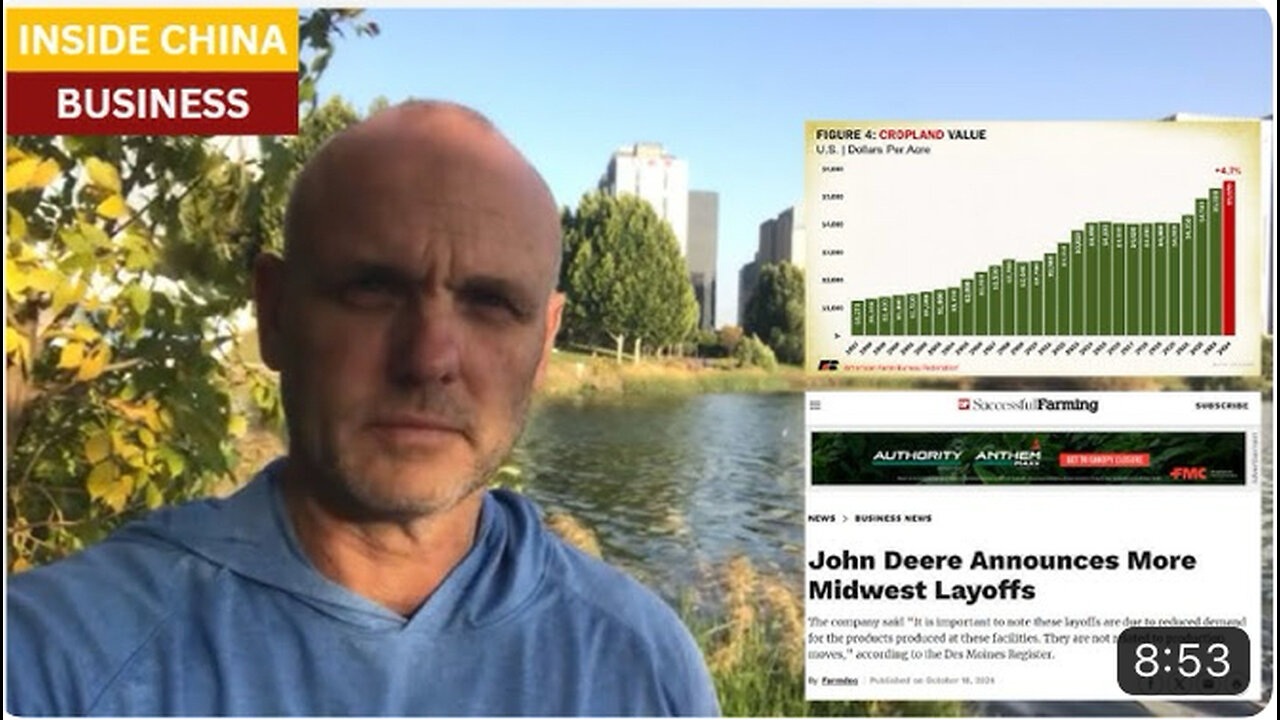

Layoffs at John Deere blow up investment thesis on food shortages

Video: Layoffs at John Deere blow up investment thesis on food shortages; US farmland to see liquidation at huge discounts. Bill Gates is big loser 約翰迪爾的裁員推翻了有關食品短缺的投資論點;美國農地將面臨巨額折扣清算。比爾蓋茲是個大輸家

https://m.made-in-china.com/ (best China sourcing website)

https://www.dtnpf.com/agriculture/web/ag/news/equipment/article/2024/10/17/deere-announces-new-layoffs-amid#

https://www.agriculture.com/john-deere-announces-more-midwest-layoffs-8730278

https://www.desmoinesregister.com/story/money/business/2024/10/16/john-deere-layoffs-announced-in-quad-cities-davenport-iowa-ag-economy/75706525007/

https://www.politico.eu/article/world-food-crisis-ukraine-russia-war-global-warming-united-nations/

https://www.mckinsey.com/industries/agriculture/our-insights/a-reflection-on-global-food-security-challenges-amid-the-war-in-ukraine-and-the-early-impact-of-climate-change

https://www.scmp.com/news/china/science/article/3270808/average-chinese-national-now-eats-more-protein-american-united-nations

Venture Capital and Private Equity firms poured tens of billions of dollars were poured into shares of farm equipment makers, fertilizer companies, and even indoor vertical farms and cropland. Conventional wisdom was that these were very safe investments that would yield outsized returns as the world struggled to feed itself over coming decades.

That investment thesis has now collapsed, amid plunging global food prices and soaring farm productivity. The ag sector of the developing world produced record crops, and did so without the expensive equipment produced by major Western farm equipment makers, such as John Deere and Case New Holland.

As VC and PE firms are now seeing double-digit annual declines in cash flows from their investments into the agriculture theme, we should expect them to sell their positions, and return to tech sector investment. Venture Capital and Private Equity firms poured tens of billions of dollars were poured into shares of farm equipment makers, fertilizer companies, and even indoor vertical farms and cropland. Conventional wisdom was that these were very safe investments that would yield outsized returns as the world struggled to feed itself over coming decades.

That investment thesis has now collapsed, amid plunging global food prices and soaring farm productivity. The ag sector of the developing world produced record crops, and did so without the expensive equipment produced by major Western farm equipment makers, such as John Deere and Case New Holland.

As VC and PE firms are now seeing double-digit annual declines in cash flows from their investments into the agriculture theme, we should expect them to sell their positions, and return to tech sector investment.

創投和私募股權公司投入數百億美元投資農業設備製造商、化肥公司,甚至室內垂直農場和農地的股票。 傳統觀點認為,這些都是非常安全的投資,在未來幾十年世界難以養活自己的情況下,它們會帶來巨額回報。

隨著全球食品價格暴跌和農業生產力飆升,這一投資論點現在已經崩潰。 發展中國家的農業部門生產了創紀錄的農作物,並且沒有使用約翰迪爾和凱斯紐荷蘭等西方主要農業設備製造商生產的昂貴設備。

由於創投和私募股權公司目前投資農業主題的現金流每年出現兩位數下降,我們應該預期他們會出售頭寸,回歸科技業投資.

-

11:49

11:49

Reforge Gaming

2 hours agoXbox - Next Game on PlayStation?

4.13K3 -

27:46

27:46

ArturRehi

1 day agoSurprise Counter-Attack in Kursk Advanced 3 Miles | French Jets Arrive | Ukraine Update

3.95K3 -

11:51

11:51

Alabama Arsenal

14 hours ago $1.23 earnedThe Silent Sledgehammer | GQ Armory 8.6BLK Paladin

18.6K1 -

2:21:11

2:21:11

Nerdrotic

17 hours ago $37.04 earnedDown the Rabbit Hole with Kurt Metzger | Forbidden Frontier #090

168K35 -

2:41:13

2:41:13

vivafrei

22 hours agoEp. 251: Bogus Social Security Payments? DOGE Lawsduit W's! Maddow Defamation! & MORE! Viva & Barnes

281K306 -

1:19:23

1:19:23

Josh Pate's College Football Show

15 hours ago $5.35 earnedBig Ten Program Rankings | What Is College Football? | Clemson Rage| Stadiums I Haven’t Experienced

81.9K1 -

13:22:09

13:22:09

Vigilant News Network

21 hours agoBombshell Study Reveals Where the COVID Vaccine Deaths Are Hiding | Media Blackout

130K69 -

1:17:59

1:17:59

Sarah Westall

17 hours agoDOGE: Crime & Hysteria bringing the Critics & the Fearful - Plus new CDC/Ukraine Crime w/ Dr Fleming

123K16 -

45:39

45:39

Survive History

22 hours ago $12.12 earnedCould You Survive in the Shield Wall at the Battle of Hastings?

101K7 -

1:50:28

1:50:28

TheDozenPodcast

21 hours agoViolence, Abuse, Jail, Reform: Michael Maisey

129K7