Premium Only Content

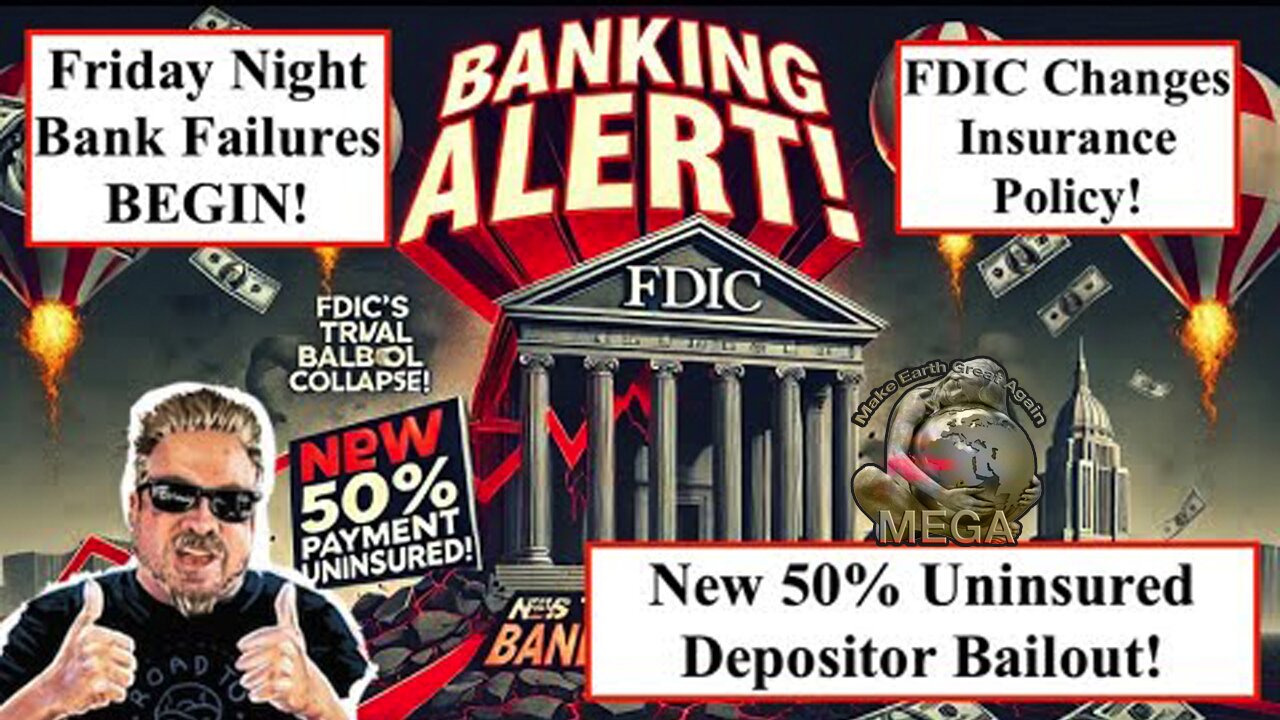

ALERT! FDIC's Friday Night Bank Failures BEGIN! New 50% Payment for Uninsured Depositors! (Bix Weir)

The "Unspoken" bailout policy of the FDIC was no bailouts for uninsured depositors. That was until Silicon Valley Bank & Signature Bank failed and they issued 100% bailouts to their friends and family. A small bank in Oklahoma named The First National Bank of Lindsay was closed with $7.1M in uninsured depositors. Legally, the $7.1M should have been a writeoff for the depositor but the FDIC didn't want to cause a panic so they partially bailed the uninsured depositors out! Here's the statement from the FDIC: "For uninsured deposits, the FDIC has announced it will make 50 percent of those funds available to depositors starting Monday, October 21, 2024, with the possibility of increasing that amount as assets from the failed bank are sold."

This opens up a huge can of worms for the Future of Banks bailouts by the FDIC. Will they stick with this new 50% rule, uphold the legal language of No Uninsured Bailouts or offer FULL BAILOUTS to all banks like they did with Silicon Valley & Signature Banks? My take... this small 50% bailout was a trial balloon to see how the public reacts...I bet those that got only a 50% bailout will be suing the FDIC for discrimination!!

-

1:24:40

1:24:40

Kim Iversen

16 hours agoJeffrey Sachs Just Exposed the Truth They Don’t Want You to Hear

86.8K111 -

2:11:32

2:11:32

Glenn Greenwald

14 hours agoGlenn From Moscow: Russia Reacts to Trump; Michael Tracey Debates Ukraine War | SYSTEM UPDATE #413

208K113 -

2:19:23

2:19:23

Slightly Offensive

14 hours ago $16.57 earnedGOV. RAMASWAMY? Vivek to import 1 BILLION INDIANS to OHIO | Nightly Offensive

107K69 -

4:51:08

4:51:08

Wahzdee

17 hours agoSniper Elite Then Extraction Games—No Rage Challenge! 🎮🔥 - Tuesday Solos

117K6 -

2:12:58

2:12:58

Robert Gouveia

17 hours agoSenator's Wife EXPOSED! Special Counsel ATTACKS; AP News BLOWN OUT

124K81 -

55:07

55:07

LFA TV

1 day agoDefending the Indefensible | TRUMPET DAILY 2.25.25 7PM

70.4K22 -

6:09:26

6:09:26

Barry Cunningham

23 hours agoTRUMP DAILY BRIEFING - WATCH WHITE HOUSE PRESS CONFERENCE LIVE! EXECUTIVE ORDERS AND MORE!

221K78 -

1:46:37

1:46:37

Game On!

18 hours ago $7.63 earnedPUMP THE BRAKES! Checking Today's Sports Betting Lines!

118K4 -

1:27:21

1:27:21

Redacted News

17 hours agoBREAKING! SOMETHING BIG IS HAPPENING AT THE CIA AND FBI RIGHT NOW, AS KASH PATEL CLEANS HOUSE

258K347 -

1:08:28

1:08:28

In The Litter Box w/ Jewels & Catturd

1 day agoCrenshaw Threatens Tucker | In the Litter Box w/ Jewels & Catturd – Ep. 749 – 2/25/2025

153K69