Premium Only Content

Mastering ISF: Your Ultimate Guide to Smooth Imports for Plus-Size Coats!

ISF Customs Broker

800-710-1559

isf@isfcustomsbroker.com

https://isfcustomsbroker.com

For upcoming videos → SUBSCRIBE → https://www.youtube.com/@isfcustomsbroker1856?sub_confirmation=1

In today's video, we're tackling the essential topic of avoiding ISF penalties when importing those stylish plus-size men's coats. Navigating through the complex world of customs regulations may seem daunting, but fear not, we've got you covered!

Importing goods like these coats requires meticulous attention to detail, especially when it comes to filing your Importer Security Filing (ISF) correctly. Missteps in this process could land you in a sea of penalties faster than you can say haute couture!

By understanding the significance of ISF compliance and the potential consequences of errors, you can safeguard your shipments and keep your importing endeavors smooth sailing. Remember, a well-informed importer is a successful importer!

To truly ace the art of customs brokerage, don't hesitate to seek assistance from experienced customs brokers who can steer you in the right direction. Their expertise can be your best ally in avoiding costly penalties and ensuring your business thrives in the global market.

So, whether you're a seasoned importer or just dipping your toes into international trade, mastering the ins and outs of ISF requirements is paramount. Stay tuned for more insightful content on customs brokerage to elevate your importing game. Hit that subscribe button and join us on this educational journey!

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is for educational purposes only and we are not affiliated with any US government agencies/companies/individual/etc.

00:22 - File ISF Accurately and Timely: Make sure to submit your Importer Security Filing (ISF) at least 24 hours before shipment departure, including all essential details such as sellers, buyers, and product descriptions, to prevent customs delays and penalties.

01:57 - Use a Customs Broker and Double-Check Information: Engage a knowledgeable customs broker to ensure accurate ISF filings and verify all data, including the correct Harmonized Tariff Schedule (HTS) codes, to avoid costly mistakes and potential fines.

03:14 - Stay Informed and Request Clarifications: Keep up with evolving ISF regulations and consider seeking advance binding rulings from U.S. Customs and Border Protection (CBP) for clarity on filing requirements, which can help mitigate the risk of penalties.

-

6:00:08

6:00:08

SpartakusLIVE

10 hours agoYoung Spartan STUD teams with old gamers for ultimate BANTER with a SMATTERING of TOXICITY

31.9K -

1:50:39

1:50:39

Kim Iversen

11 hours agoShocking Proposal: Elon Musk for Speaker of the House?! | IDF Soldiers Reveal Atrocities—'Everyone Is a Terrorist'

77.9K174 -

43:27

43:27

barstoolsports

14 hours agoOld Dog Bites Back | Surviving Barstool S4 Ep. 9

134K4 -

5:13:04

5:13:04

Right Side Broadcasting Network

7 days agoLIVE REPLAY: TPUSA's America Fest Conference: Day One - 12/19/24

185K28 -

1:06:01

1:06:01

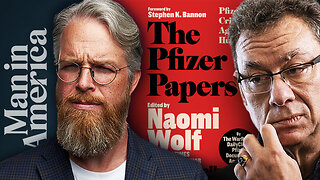

Man in America

1 day agoPfizer Has Been Caught RED HANDED w/ Dr. Chris Flowers

62.1K19 -

2:24:15

2:24:15

Slightly Offensive

12 hours ago $18.44 earnedAttempted ASSASSINATION of Nick J Fuentes LEAVES 1 DEAD! | Guest: Mel K & Breanna Morello

51.9K48 -

1:43:08

1:43:08

Roseanne Barr

11 hours ago $28.85 earned"Ain't Nobody Good" with Jesse Lee Peterson | The Roseanne Barr Podcast #79

85.2K49 -

The StoneZONE with Roger Stone

8 hours agoTrump Should Sue Billionaire Governor JB Pritzker for Calling Him a Rapist | The StoneZONE

53.8K6 -

1:36:58

1:36:58

Flyover Conservatives

1 day agoAmerica’s Psychiatrist Speaks Out: Are We Greenlighting Violence? - Dr. Carole Lieberman | FOC Show

36.5K6 -

6:44:54

6:44:54

LittleSaltyBear

10 hours ago $3.20 earnedNecromancing Path of Exile 2 4K

31.3K4