Premium Only Content

This Couple Has $84k in Debt So I OVERHAULED Their Budget | Budget Reno E1

Go to our partner https://trymintmobile.com/calebbale to get premium wireless for as low as $15 a month. Special offer: New customers can get any plan for $15/month. New activation and upfront payment of $45 for 3 mo. service required. Restrictions apply.

⚡️BE A PART OF THE NEXT BUDGET RENOVATION⚡️

To begin, fill out this form and I’ll contact you! https://forms.gle/TKALX5Tfj7jqy4uQ6

⚡️GET 1 ON 1 BUDGET HELP⚡️

Sign up for a variety of sessions with me and we'll get your budget in order! https://tidycal.com/calebbale

⚡️Download the Buddy app from the App Store!⚡️

For one of my all-time favorite budgeting apps, check out Buddy Budgets! https://apps.apple.com/us/app/buddy-budget-expense-app/id936422955

Disclaimer: I am not a financial advisor. This advice is VERY specific to Adam and Destinee. Do your own research before making serious financial decisions!

Adam and Destinee's financial journey started off on the wrong foot, with credit card sign-up bonuses leading to a mountain of debt and a lack of budgeting. Living paycheck to paycheck, they felt trapped. Join us as we dive deep into their finances and embark on a Budget Reno mission to transform their financial future. From dissecting their spending habits to crafting a practical plan, you'll learn valuable lessons to apply to your own finances. Plus, find out how Adam and Destinee can break free from debt and achieve financial freedom.

In this video, I go through Adam and Destinee’s whole budget. I critique their spending habits, help them cut expenses, then help them find ways they can be more intensional with the money they have. This means cutting up their credit cards and focusing all their attention on paying off their $84k in debt as quickly as they can.

I also walk them through the Ramsey baby steps to help them in their financial journey. This means saving an initial starter emergency fund before paying off all their debt with gazelle intensity. Then saving enough for a 3-6 month emergency, saving 15% of their income towards retirement, saving for kid’s college, and paying off their home early. I made a lot of tough suggestions. But I know they can accomplish this feet!

Timestamps:

0:00 - Intro

0:49 - Adam and Destinee’s Spending Problem

2:08 - Full Breakdown of Debts

4:14 - The Total Monthly Expenses and Income

5:44 - Their Initial Debt Payoff Timeline

7:00 - The MASSIVE Credit Card Problem

11:00 - Stop the Investing

13:00 - EXACTLY Which Expenses to Cut

17:41 - Going Through the Baby Steps

19:33 - How to Increase Income and What Items to Sell

23:36 - Sell the House??

26:07 - The Remaining Baby Steps

26:31 - They HAVE to Get on The SAME Page

28:06 - Adam’s Reaction to My Budget Renovation

29:24 - Sign Up for a Budget Reno!

#budgetrenovation #calebbale #debtpayoff

📒 Notes and Resources 📒

⚡️MY FAVORITE DEBIT CARDS⚡️

🎬Discover Cashback Debit Card Review: https://youtu.be/4hSAiFkXXp8

⚡️BEST FINTECH REVIEWS⚡️

🎬Best Budget Apps! https://youtu.be/i8rxcO0TC5w

🎬Best Cashback Debit Cards! https://youtu.be/ACSQ8Zzdss4

🎬Best Bank Accounts to Fight Inflation: https://youtu.be/k9YI3WKvk5E

⚡️GET FINANCIAL COACHING⚡️

If you need some help with getting your debt worked out, set up a session with me. I legitimately want to help. www.balefinancialcoaching.com

⚡️FOR INQUIRIES⚡️

For business and coaching inquiries, hit me up:

balefinancialcoaching@gmail.com

⚡️CHECK OUT THE BLOG⚡️

http://balefinancialcoaching.com/blog/

⚡️DISCLAIMER⚡️

Do your own research. My content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional financial advisor when considering your retirement options. Though I teach financial principals, I am not an investment advisor and none of my advice constitutes legal, tax, or investment as a professional. Everything I share is based on my own research and is intended for your benefit. Any financial technology reviews are intended for your benefit. Research each product yourself to determine if they are right for you.

⚡️DOWNLOAD MY FREE KINDLE BOOK⚡️

Graduated and Clueless: How to live like an adult when life is confusing

https://www.amazon.com/Graduated-Clueless-live-adult-confusing-ebook/dp/B07GH1XTRW/ref=sr_1_1?dchild=1&keywords=caleb+bale&qid=1609779396&sr=8-1

⚡️EQUIPMENT I USE⚡️

This is the equipment I use with Amazon affiliate links. If you choose to purchase anything using these links, you will not be charged anything financially, but will be able to support my channel in a small way!

Sony A7S II: https://amzn.to/38PM8Sl

Neewer 660 LED bicolor lights: https://amzn.to/3o4KB1a

Rokinon 12 mm lens: https://amzn.to/38Qpauy

Magnus VT 4000 tripod: https://amzn.to/3aXmNsj

Rode Video Mic: https://amzn.to/3b0nfWI

-

4:51:08

4:51:08

Wahzdee

14 hours agoSniper Elite Then Extraction Games—No Rage Challenge! 🎮🔥 - Tuesday Solos

64.5K3 -

2:12:58

2:12:58

Robert Gouveia

14 hours agoSenator's Wife EXPOSED! Special Counsel ATTACKS; AP News BLOWN OUT

108K41 -

55:07

55:07

LFA TV

1 day agoDefending the Indefensible | TRUMPET DAILY 2.25.25 7PM

33.7K14 -

6:09:26

6:09:26

Barry Cunningham

20 hours agoTRUMP DAILY BRIEFING - WATCH WHITE HOUSE PRESS CONFERENCE LIVE! EXECUTIVE ORDERS AND MORE!

174K50 -

1:46:37

1:46:37

Game On!

15 hours ago $0.51 earnedPUMP THE BRAKES! Checking Today's Sports Betting Lines!

96.8K3 -

1:27:21

1:27:21

Redacted News

14 hours agoBREAKING! SOMETHING BIG IS HAPPENING AT THE CIA AND FBI RIGHT NOW, AS KASH PATEL CLEANS HOUSE

198K247 -

1:08:28

1:08:28

In The Litter Box w/ Jewels & Catturd

1 day agoCrenshaw Threatens Tucker | In the Litter Box w/ Jewels & Catturd – Ep. 749 – 2/25/2025

116K57 -

44:57

44:57

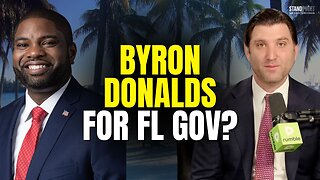

Standpoint with Gabe Groisman

1 day agoWill Byron Donalds Run for Florida Governor? With Congressman Byron Donalds

60.8K9 -

1:06:25

1:06:25

Savanah Hernandez

14 hours agoEXPOSED: FBI destroys evidence as NSA’s LGBTQ sex chats get leaked?!

81.9K38 -

1:59:58

1:59:58

Revenge of the Cis

16 hours agoEpisode 1452: Hindsight

79.8K11