Premium Only Content

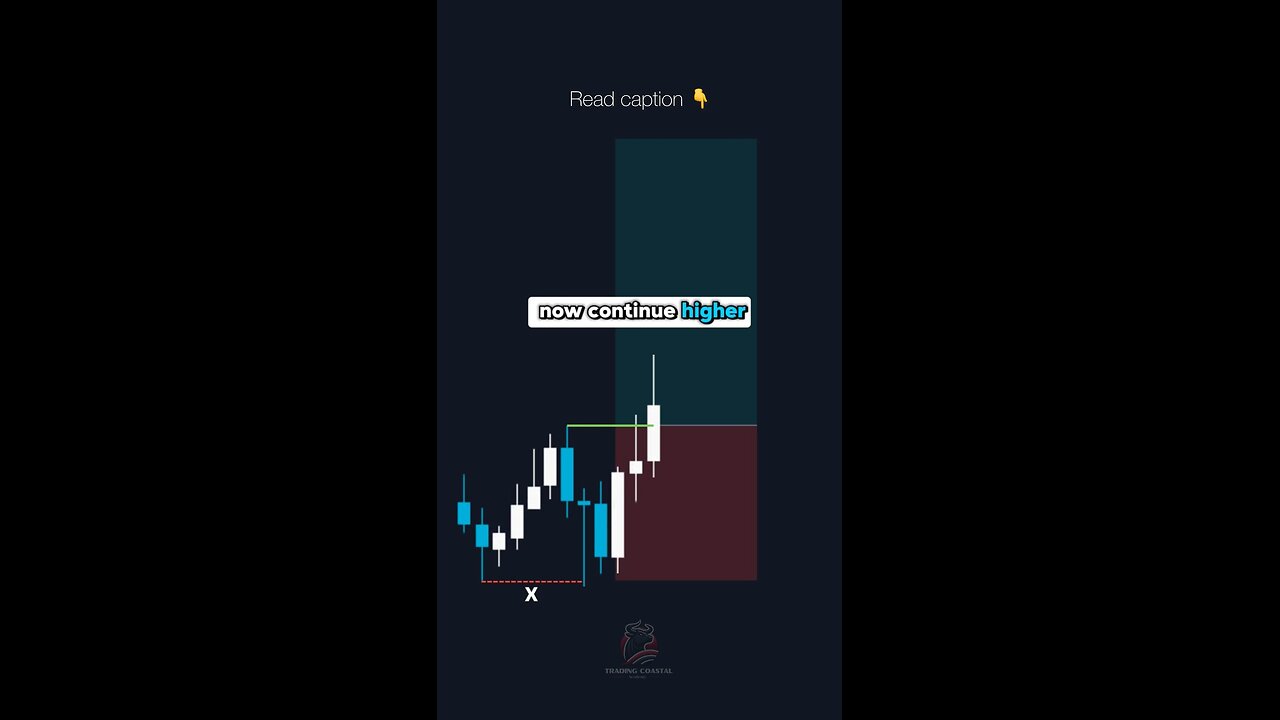

“How to Avoid Stop Hunts in Trading! 🛑📉 | Master Liquidity Sweeps 🚀 #TradingTips #Forex

1. Higher Timeframe Analysis: Always analyze higher timeframes (e.g., 1H, 4H, Daily) before entering trades on lower timeframes. This helps identify key market structure levels, liquidity zones, and where large institutional orders may lie. A strong setup on higher timeframes is more reliable and can reduce false signals on lower timeframes.

2. Wait for Liquidity Sweep: Before entering a trade, be patient and wait for a liquidity sweep on a lower timeframe (e.g., 5M, 15M). A liquidity sweep occurs when the price takes out stop-losses from weak hands or hits support/resistance levels, leading to a reversal. Reacting to this sweep helps reduce the risk of getting stopped out prematurely.

3. Target Nearest Liquidity Zones: After the liquidity sweep, target the nearest liquidity zone for your take profit. These are areas where orders are likely to accumulate (e.g., previous highs/lows). This increases the likelihood that the market will push in your favor after your entry, improving the risk-to-reward ratio.

-

LIVE

LIVE

Right Side Broadcasting Network

8 hours ago🎅 LIVE: Tracking Santa on Christmas Eve 2024 NORAD Santa Tracker 🎅

2,109 watching -

2:48

2:48

Steven Crowder

10 hours agoCROWDER CLASSICS: What’s This? | Nightmare Before Kwanzaa (Nightmare Before Christmas Parody)

182K12 -

LIVE

LIVE

LFA TV

12 hours agoLFA TV CHRISTMAS EVE REPLAY

856 watching -

![ROSEANNE BARR - Her Journey, TRUMP, and the MAGA GOLDEN AGE! [INTERVIEW]](https://1a-1791.com/video/s8/1/M/m/B/2/MmB2v.0kob.1-small-ROSEANNE-BARR-Her-Journey-T.jpg) 51:35

51:35

Dr Steve Turley

1 day ago $13.12 earnedROSEANNE BARR - Her Journey, TRUMP, and the MAGA GOLDEN AGE! [INTERVIEW]

31.9K47 -

57:38

57:38

The Tom Renz Show

5 hours agoMerry Christmas - The Tom Renz Show Christmas

60.4K11 -

2:59:10

2:59:10

Wendy Bell Radio

16 hours agoThe Bridge Too Far

145K251 -

1:03:45

1:03:45

Donald Trump Jr.

1 day agoHappy Festivus: Airing Our Grievances and Stopping The Swamp w/Sean Davis | TRIGGERED Ep.201

410K535 -

1:30:30

1:30:30

Game On!

19 hours ago $7.59 earnedTop 5 things you need to know for Sports Christmas!

63.9K5 -

1:58:10

1:58:10

Robert Gouveia

1 day agoMatt Gaetz REJECTS Report, Sues Committee; Luigi Fan Club Arrives; Biden Commutes; Festivus Waste

288K227 -

1:31:40

1:31:40

Adam Does Movies

1 day ago $15.83 earnedThe Best & Worst Christmas Movies! - LIVE!

112K8