Premium Only Content

Central Banks Desperate Action to Avoid Currency Collapse with Matthew Piepenburg

Interview recorded - 27th of September, 2024

On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG and critic of current monetary policy actions of central banks.

During this conversation we spoke about his thoughts on the economy, why there is a debt trap, no expectation of real growth in the future, private vs public debt, calculating US Dollar devaluation, precious metals and more. I hope you enjoy!

0:00 - Introduction

1:42 - Current thoughts on the economy?

7:16 - Concentration of growth

12:38 - Private vs public debt crisis

26:31 - Calculating US Dollar devaluation?

32:26 - Can they decrease the deficit?

40:16 - Why nothing about gold or silver?

50:10 - One message to takeaway?

Matt began his finance career as a transactional attorney before launching his first hedge fund during the NASDAQ bubble of 1999-2001

Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, Matt is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). Along with Egon von Greyerz, Matthew is the co-author of Gold Matters, which offers an extensive examination of gold as an historically-confirmed wealth-preservation asset.

Matthew Piepenburg -

LinkedIn - https://linkedin.com/in/matthewpiepenburg

Website - https://vongreyerz.gold/

WTFinance -

Instagram - https://www.instagram.com/wtfinancee/

Spotify - https://open.spotify.com/show/67rpmjG92PNBW0doLyPvfn

iTunes - https://podcasts.apple.com/us/podcast/wtfinance/id1554934665?uo=4

Twitter - https://twitter.com/AnthonyFatseas

-

LIVE

LIVE

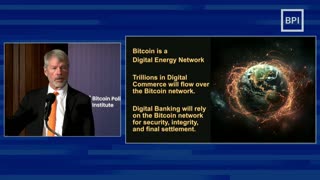

Bitcoin Policy Institute

35 minutes agoLive March 03

483 watching -

34:43

34:43

Degenerate Jay

22 hours ago $1.02 earnedAssassin's Creed Was Always Anti-Religion?

6.64K4 -

6:41

6:41

Silver Dragons

18 hours agoCanadian Silver Maple Leaf Coins - Dealer Reveals Everything You NEED to Know

3.73K2 -

8:42

8:42

Dangerous Freedom

16 hours ago $0.85 earnedThe M&P Competitor SHREDS—But Did Smith & Wesson Screw It Up?

6.69K2 -

1:12:50

1:12:50

MTNTOUGH Fitness Lab

16 hours agoSTOP Living in Fear: Why Some People Rise From Tragedy AND OTHERS DON'T | Ryan Manion

4.32K -

8:03

8:03

Alabama Arsenal

1 day ago $0.34 earnedWoox Bravado | Modern Features Meet Timeless Style

8.11K1 -

2:49:10

2:49:10

TimcastIRL

13 hours agoElon Musk Says X Hit By MASSIVE Cyberattack From Ukraine, Rumble Hit Too w/Ben Davidson| Timcast IRL

246K132 -

2:05:10

2:05:10

Kim Iversen

15 hours agoFree Speech for Me, But Not for Thee: Trump Admin’s Protester Crackdown Sounds MAJOR Alarms

94.9K493 -

1:29:26

1:29:26

Glenn Greenwald

16 hours agoICE Detains Permanent Resident for Protesting Israel; European Leaders Make Maniacal Rearmament Vows They Cannot Keep | SYSTEM UPDATE #421

168K294 -

1:02:56

1:02:56

Donald Trump Jr.

18 hours agoUSAID Slush Fund Slashed, X Cyberattack, Plus Interview with Nate Morris | Triggered Ep.223

156K197