Premium Only Content

VITL - Stocks to trade - Break Out Alert

## Stock Strategy Circle: Analyzing Vital Farms, Inc. Stock

1. Introduction to the stock update on Vital Farms, Inc. (V-I-T-L) by John from Stock Strategy Circle.

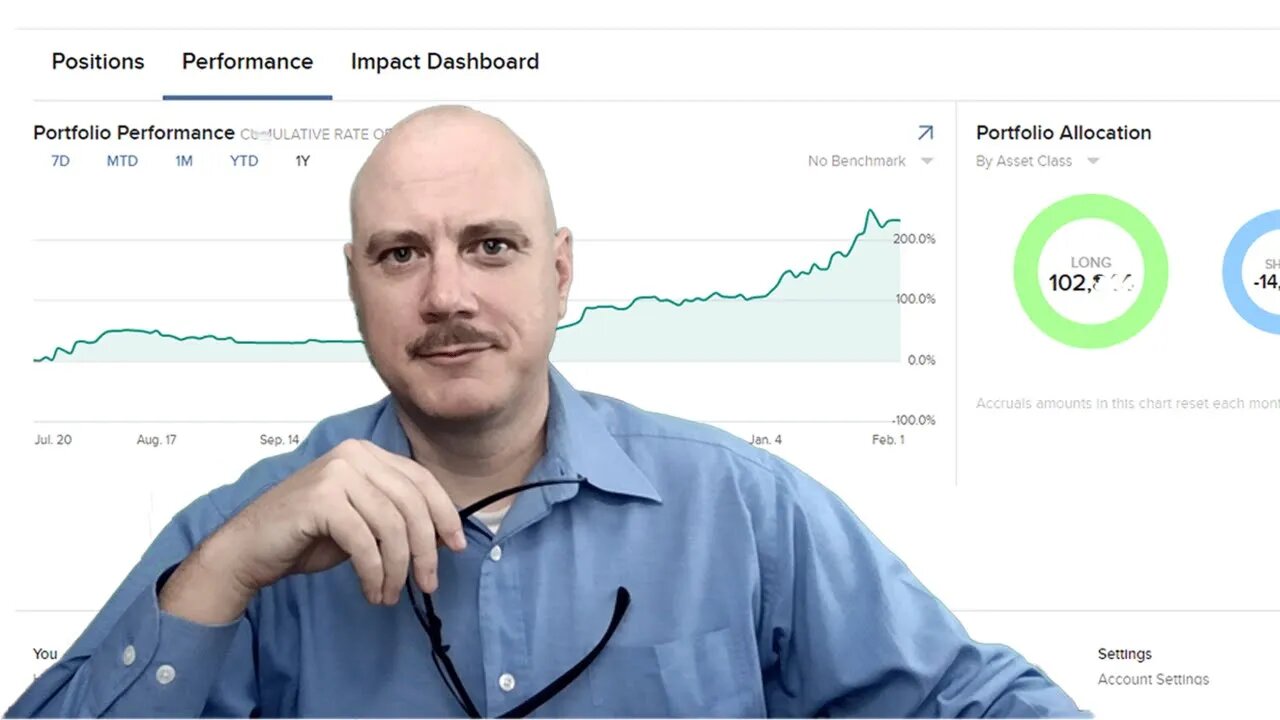

2. Use of TC2000 for stock analysis:

- Preference for TC2000 despite using Trader's View.

- Limitations of TC2000's volume profile layout.

3. Importance of volatility stop indicator in trading:

- Position sizing based on stock volatility, not just account size.

- Example of how volatility affects risk-reward ratios.

4. Analysis of Vital Farms, Inc. stock:

- Identification of uptrend and volatility stop.

- Explanation of position sizing based on volatility stop and risk tolerance.

5. Risk management strategies for swing traders:

- Limiting risk to a small percentage of account size.

- Using poker player strategy to maximize returns.

6. Analysis of trading volume spikes in Vital Farms, Inc. stock:

- Impact of volume spikes on stock price movements.

- Importance of subsequent trading days after volume spikes.

7. Technical analysis of stock chart:

- Identification of base formation after volume spikes.

- Breakout from downtrend and bullish saucer formation.

8. Fundamental analysis of Vital Farms, Inc. stock:

- Growth in earnings, sales, common stock equity, and book value per share.

- Consideration of operating income before expenses.

9. Conclusion and trade alert:

- Stock update posted for members of Stock Strategy Circle.

- Link to Traders View for further analysis.

- Identification of overhead resistance at $41.35 for Vital Farms, Inc.

Link to Loom

-

1:11:26

1:11:26

PMG

1 day ago $0.12 earnedTRANTIFA BORDER PATROL ASSASSINS!

8991 -

2:15:15

2:15:15

vivafrei

21 hours agoEp. 249: Confirmation Hearings RECAP! Canada-U.S. TRADE WAR? Bureaucrats Sue Trump! Viva Barnes Live

166K423 -

4:51:59

4:51:59

MyronGainesX

14 hours agoIRS Auctions Off Tekashi 69's Possessions

173K28 -

LIVE

LIVE

Vigilant News Network

1 day agoRFK Jr. Hearing EXPOSES Corrupt Politicians in Humiliating Scandal | Media Blackout

3,327 watching -

1:11:40

1:11:40

Josh Pate's College Football Show

13 hours ago $5.68 earnedPerfect CFB Conferences | Big Ohio State Changes | Canceling Spring Games | SEC 2025 Thoughts

61.7K2 -

1:08:07

1:08:07

Bek Lover Podcast

10 hours agoInteresting Times with Bek Lover Podcast

33.7K -

1:51:12

1:51:12

Tate Speech by Andrew Tate

14 hours agoEMERGENCY MEETING EPISODE 105 - UNBURDENED

206K105 -

1:01:18

1:01:18

Tactical Advisor

16 hours agoBuilding a 308 AR10 Live! | Vault Room Live Stream 016

184K20 -

2:17:02

2:17:02

Tundra Tactical

1 day ago $29.55 earnedTundra Nation Live : Shawn Of S2 Armament Joins The Boys

273K29 -

23:22

23:22

MYLUNCHBREAK CHANNEL PAGE

2 days agoUnder The Necropolis - Pt 5

214K71