Premium Only Content

The Essential Guide to Customs Bonds: Choosing the Right Option for Your Imports!

ISF Depot // 661-246-8217 // customs@isfdepot.com // www.isfdepot.com

In today's video, we discussed the Importer Security Filing (ISF) and its significance in the import process. We emphasized the importance for importers to understand the ISF timeline and submission requirements in order to ensure a smooth and efficient import process. The ISF must be filed at least 24 hours before the goods are loaded onto a vessel bound for the US, allowing Customs and Border Protection (CBP) to assess potential risks and inspect cargo if necessary.

We then discussed the basic submission requirements for the ISF, highlighting the key pieces of information that need to be included. These include buyer and seller information, manufacturer or supplier information, container stuffing location, consolidator or stuffer information, HTSUS number, and container and seal number. By providing accurate and complete information, importers can facilitate the clearance of their goods through customs.

Moving on, we touched on the crucial aspect of the customs bond. A customs bond is a financial guarantee between the CBP and the importer or customs broker, ensuring the payment of duties, taxes, and other fees to the government. Importers have two options for securing a customs bond: a single entry bond for specific import transactions and a continuous bond that remains in effect for one year and covers all import transactions within that period. Continuous bonds are recommended for frequent importers as they streamline the process and minimize the need for multiple bond filings.

We then shifted our focus to the role of a customs broker in the import process. A customs broker is a licensed professional who assists importers in clearing their goods through customs. Their deep understanding of complex regulations allows them to ensure compliance and facilitate a smooth import process. One of their key responsibilities is to ensure the accuracy and completeness of the ISF. They work closely with importers, gathering necessary information and submitting the ISF on their behalf.

Lastly, we mentioned the consequences of non-compliance with the ISF requirements. Failure to file an accurate and timely ISF can result in penalties, cargo holds, or even refusal of shipment. It is crucial for importers to understand and adhere to the ISF guidelines to avoid these potential issues.

In summary, understanding the ISF timeline and submission requirements, as well as securing a customs bond, are key aspects of the import process. Working with a knowledgeable customs broker can greatly facilitate compliance and ensure a smooth import process. Thank you for watching, and don't forget to subscribe to our channel for more valuable information on customs brokerage and international trade.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This tutorial is independent and not affiliated with any US governmental entities.

-

56:28

56:28

Glenn Greenwald

12 hours agoDocumentary Exposing Repression in West Bank Wins at Oscars; Free Speech Lawyer Jenin Younes on Double Standards for Israel's Critics | SYSTEM UPDATE #416

121K95 -

1:03:34

1:03:34

Donald Trump Jr.

14 hours agoZelensky Overplays His Hand, More Trump Wins, Plus Interview with Joe Bastardi | Triggered Ep.221

190K143 -

1:13:16

1:13:16

We Like Shooting

23 hours ago $7.41 earnedDouble Tap 399 (Gun Podcast)

69.7K2 -

1:00:20

1:00:20

The Tom Renz Show

1 day agoTrump Schools Zelensky, The Epstein Files FAIL, & What RFK Will Mean for Cancer

80.9K22 -

42:47

42:47

Kimberly Guilfoyle

16 hours agoThe Trump effect: More Major Investment, Plus America First at Home & Abroad. Live w/Ned Ryun & Brett Tolman | Ep. 201

155K40 -

1:29:23

1:29:23

Redacted News

15 hours agoWW3 ALERT! Europe pushes for war against Russia as Trump pushes peace and cutting off Zelensky

186K305 -

57:56

57:56

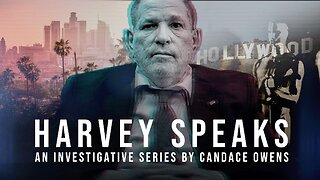

Candace Show Podcast

18 hours agoHarvey Speaks: The Project Runway Production | Ep 1

174K108 -

56:31

56:31

LFA TV

1 day agoEurope’s Relationship With America Is Over | TRUMPET DAILY 3.3.25 7PM

56.4K11 -

2:04:45

2:04:45

Quite Frankly

16 hours ago"European Deth Pact, Blackout Data Breach, Epstein" ft. Jason Bermas 3/3/25

54.9K24 -

1:32:46

1:32:46

2 MIKES LIVE

13 hours ago2 MIKES LIVE #187 Deep Dive Monday!

31.8K1