Premium Only Content

Understanding Customs Clearance: Can You Prepay Duties and Taxes?

ISF Template | 562-453-7357 | isf@isftemplate.com | www.isftemplate.com

In this video, we discuss the question of whether it is possible to prepay customs duties and taxes during the clearance process. We explain the customs clearance process, including document submission and customs inspection. We then address the main question and state that in many cases, it is not possible to prepay duties and taxes before the assessment by customs authorities. We mention the option of using a customs bond as a way to expedite the payment process once duties and taxes have been assessed. We also briefly touch on the Importer Security Filing (ISF) requirements and their importance in the customs clearance process. Overall, the video provides information and insights into the topic of prepaying customs duties and taxes in customs brokerage.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is designed for education and is unaffiliated with US government bodies.

00:22 - Customs clearance process involves submitting necessary documents for customs inspection, with duties and taxes assessed based on goods' value and classification.

00:51 - Prepaying customs duties and taxes before clearance process is not typically possible, as assessment is needed at port of entry to avoid incorrect payment amounts.

01:10 - Importers can expedite payment process by obtaining a customs bond, which acts as a financial guarantee for duties and taxes owed to customs authorities.

02:12 - Importer Security Filing (ISF) requirements must also be complied with to enhance security and enable risk assessment by customs officials for a smooth customs clearance experience.

-

34:32

34:32

Standpoint with Gabe Groisman

18 hours agoGovt. Workers AREN’T Working Says DOGE Chair Sen. Joni Ernst

313 -

LIVE

LIVE

Savanah Hernandez

2 hours agoMASS DEPORTATIONS ARE HERE AND THEY ARE GLORIOUS

884 watching -

21:12

21:12

Clownfish TV

14 hours agoThe Video Game Industry LITERALLY Wants You Dead?!

7144 -

1:35:44

1:35:44

Right Side Broadcasting Network

4 hours agoLIVE REPLAY: First Press Briefing by White House Press Secretary Karoline Leavitt - 1/28/25

79.9K66 -

DVR

DVR

vivafrei

5 hours agoJan. 6 Injustices! Jeremy Brown STILL IN JAIL! Untold Story of Ashli Babbitt Killer Michael Byrd!

43K12 -

3:09:52

3:09:52

Benny Johnson

4 hours ago🚨 First Trump White House Press Briefing LIVE Right Now! New Press Secretary With the FLAMETHROWER

121K149 -

44:12

44:12

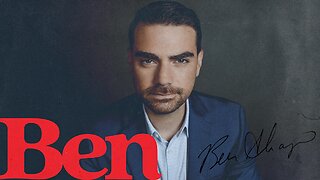

Ben Shapiro

3 hours agoEp. 2126 - Did China Just DRINK OUR MILKSHAKE?!

40.1K18 -

1:11:08

1:11:08

Russell Brand

3 hours agoTrump’s Deportation Wave Begins – SF527

66.2K119 -

The Charlie Kirk Show

3 hours agoThe Big Pause + ICE in Chicago + The Birthright Citizenship Scam | Glenn, Hammer, Eastman | 1.28.25

99.7K21 -

LIVE

LIVE

Scammer Payback

2 hours agoCalling Scammers Live

410 watching