Premium Only Content

Best Dividend ETF for 2024 ( The Top Three ETFs to BUY Now)

Podcast Episode Synopsis: Exploring Dividend ETFs

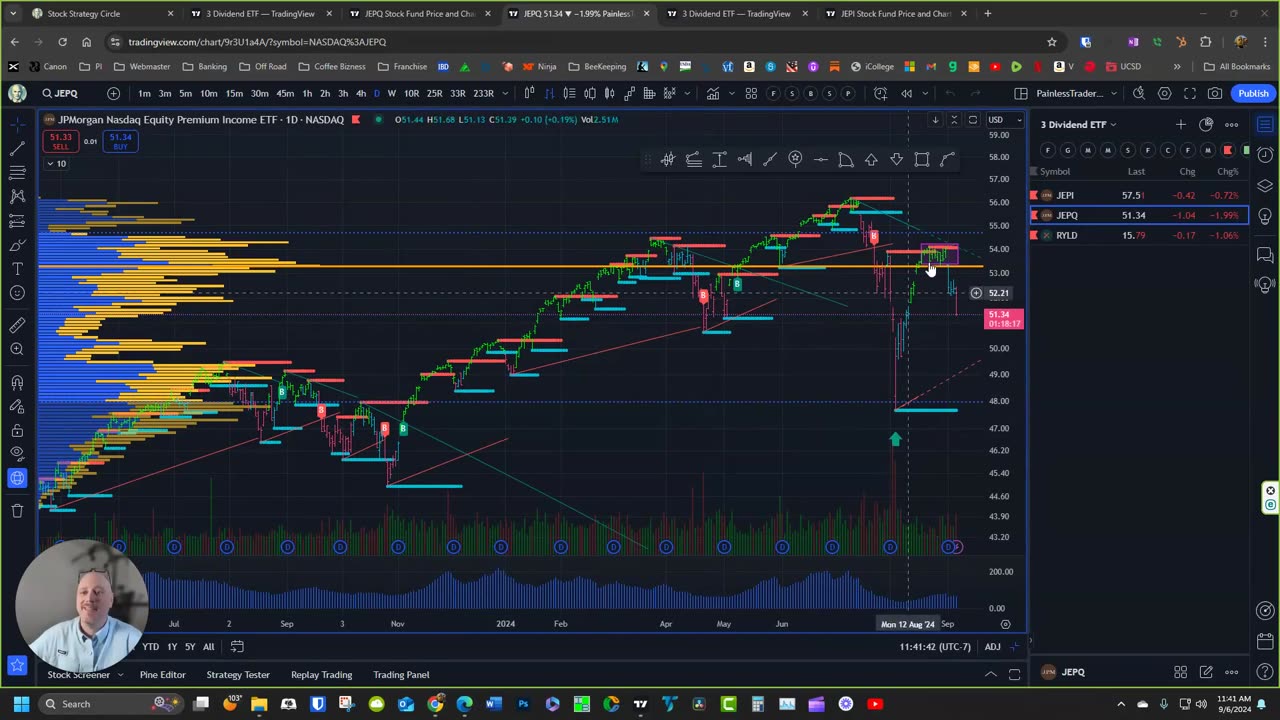

Welcome to another episode of StockStrategyCircle.com! In today's episode, I dive into three dividend-paying ETFs that I believe are worth your consideration: JEPI, JEPQ, and RYLD. These funds not only provide regular income through dividends but also offer a strategic way to navigate the current volatile market.

I start by introducing the concept of a watch list that I've created for our listeners, allowing for quick access to these ETFs. Each of these funds generates income by selling options, which is a key feature that supports their ability to pay consistent dividends.

JEPI: JP Morgan Equity Premium Income ETF

First up is JEPI, the JP Morgan Equity Premium Income ETF. I explain how this fund selects value stocks from the S&P 500 and employs a covered call strategy to generate income. I highlight its impressive track record of monthly dividends, which have ranged from $0.30 to $0.42 per share. I emphasize the benefits of reinvesting dividends through a Dividend Reinvestment Plan (DRIP), allowing investors to dollar-cost average into their positions, especially during market downturns.

JEPQ: JP Morgan Nasdaq Equity Premium Income ETF

Next, I discuss JEPQ, which focuses on the Nasdaq. This ETF has shown more volatility but also offers substantial monthly dividends, with recent payouts of $0.55 and $0.42. I compare the experience of investing in JEPQ to being a landlord, noting the advantages of not having to deal with tenant issues while still enjoying high dividend income. I also analyze its current market position and potential for future growth, reiterating the importance of reinvesting dividends to build a stronger position over time.

RYLD: The Sleepiest of the Three

Finally, I introduce RYLD, which I describe as the "sleepiest" of the three ETFs. With a consistent monthly dividend of $0.16, RYLD offers a 1% monthly return, translating to a 12% annual yield. I explain how this ETF tracks the Russell 2000, providing a more stable investment option compared to the more volatile Nasdaq and S&P 500. I illustrate how reinvesting dividends can lead to compounding returns, allowing investors to gradually increase their holdings without additional capital outlay.

Conclusion

In conclusion, I encourage listeners to consider these three dividend ETFs—JEPI, JEPQ, and RYLD—as viable options for generating income and building wealth in a liquid and manageable way. I believe these funds present a compelling alternative to traditional real estate investments, offering consistent income without the headaches of property management.

Thank you for tuning in to Stock Strategy Circle! I hope this episode provides valuable insights into dividend investing and helps you make informed decisions in your investment journey. Until next time, this is Painless Trader signing off!

00:00:00 - Introduction to Dividend ETFs

00:00:10 - Creating a Watch List

00:00:43 - Overview of JEPI ETF

00:01:49 - Dividend Payments and Dollar Cost Averaging

00:03:36 - Exploring JEPQ ETF

00:05:31 - Introduction to RYLD ETF

00:06:20 - Compounding Returns with RYLD

00:07:34 - Conclusion: Recommended Dividend ETFs

"They're worth taking a look at." - 00:00:10

"All of these ETFs pay regular dividends that they create by generating income on the sale of options." - 00:00:43

"What does that mean? Well, it means that if you own 100 shares of it and you get 40 cents, that's 40 bucks, 40 bucks for doing nothing." - 00:02:29

"As the price goes up and you're buying $0.40 additional on every share every month, you get a smaller portion of shares, but you're still buying." - 00:03:12

"If you're just looking for the income, okay, don't reinvest the dividends and you're going to consistently get whatever it is they decide to pay." - 00:03:43

"It would be very hard to even do that in real estate. I mean, it's almost better than being a landlord." - 00:05:10

"This one tends to follow the NASDAQ. But again, the point of this is to get the dividend income." - 00:05:31

"At 1% a month, your underlying holdings are going to go up by 1% every month." - 00:06:31

"Assuming the price remains more or less equal to what the dividend is, you're going to end up with 112 shares." - 00:07:02

"In conclusion, the three dividend ETFs that you really ought to consider getting a position in, JEPI, JEPQ, RYLD." - 00:08:05

-

LIVE

LIVE

Robert Gouveia

2 hours agoLiberals EXPLODE over Elon's Email; Lawsuits FLY; Sanctions?? Congrats Dan!

1,984 watching -

1:33:36

1:33:36

Redacted News

3 hours agoBREAKING! PUTIN LAUNCHES MASSIVE OFFENSIVE IN UKRAINE AS EUROPEAN LEADERS PUSH FOR MORE WAR

71.9K131 -

44:39

44:39

Kimberly Guilfoyle

3 hours agoBetter Days Ahead for the FBI, Live with Asm Bill Essayli & John Koufos | Ep.199

33.3K14 -

1:40:29

1:40:29

In The Litter Box w/ Jewels & Catturd

23 hours agoWhat Did You Do Last Week? | In the Litter Box w/ Jewels & Catturd – Ep. 748 – 2/24/2025

76.6K25 -

23:34

23:34

Stephen Gardner

3 hours ago🔥CNN PANICS over $5000 DOGE Dividend | Trump Orders bigger Audits

35.7K86 -

1:53:54

1:53:54

The White House

5 hours agoPresident Trump Holds a Press Conference with President Emmanuel Macron of France

60.5K39 -

1:48:31

1:48:31

The Officer Tatum

5 hours agoLIVE MSNBC DROPS HAMMER On Joy Reid as STAFFERS PANIC! + More Ep 67

94.6K61 -

59:36

59:36

Chad Prather

4 hours agoTRUMP TAPS DAN BONGINO TO HELP LEAD FBI - IT’S OVER FOR THE DEEP STATE!

70.1K32 -

4:18:28

4:18:28

Barry Cunningham

10 hours agoTRUMP DAILY BRIEFING: DAN BONGINO TO FBI | LIVE PRESS CONFERENCE WITH MACRON | DOGE MELTDOWN!

61.6K18 -

2:08:16

2:08:16

Mike Rowe

3 days agoTim Allen Loves The Ballet | The Way I Heard It with Mike Rowe

58.3K19