Premium Only Content

Mastering ISF and Tariff Codes: A Guide for Importers and Customs Brokers

ISF Depot // 661-246-8217 // customs@isfdepot.com // www.isfdepot.com

In this video, we explore the concepts of ISF 10+2 and Customs Harmonized Tariff Codes in the context of customs brokerage. ISF, or Importer Security Filing, is a crucial requirement by US Customs and Border Protection (CBP) for importers to provide security-related information prior to vessel departure. ISF is important as it helps CBP assess risks and enhance supply chain security. Filing ISF correctly is essential to avoid delays, penalties, or shipment refusal. Customs Harmonized Tariff Codes play a pivotal role in classifying imported or exported goods and determining duties, taxes, and trade regulations. Customs brokers act as intermediaries, ensuring compliance, accurate tariff code classification, and smooth customs clearance. The benefits of hiring a customs broker include expert knowledge, avoiding penalties or delays, and reducing the risk of overpayment or trade disputes. ISF Depot offers comprehensive services in ISF and customs brokerage, ensuring accurate filings, proper tariff code classification, and efficient customs clearance. Stay tuned for more informative videos on customs brokerage and international trade.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This tutorial is independent and not affiliated with any US governmental entities.

-

1:19:23

1:19:23

Mike Rowe

2 days agoSSG Romesha Recounts One Of The Most Harrowing Battles In Afghanistan | The Way I Heard It

24.4K23 -

2:01:11

2:01:11

TimcastIRL

5 hours agoTaylor Swift BOOED At Super Bowl, Trump CHEERED, Liberals SHOCKED w/Milo Yiannopoulos

68.9K165 -

29:27

29:27

The White House

10 hours agoPresident Trump Signs Proclamation Regarding Gulf of America Day

32.6K82 -

1:06:48

1:06:48

Tucker Carlson

16 hours agoUkraine Is Selling American Weapons to Mexican Drug Cartels. Col. Daniel Davis on How to Stop It.

135K249 -

29:52

29:52

The Why Files

8 days agoThe Disappearance of Peter Williamson | Lightning Pants from Another Dimension

40.5K69 -

8:24

8:24

Russell Brand

12 hours agoWhat They Accusing Elon of Now Is OUTRAGEOUS

53.8K76 -

1:34:55

1:34:55

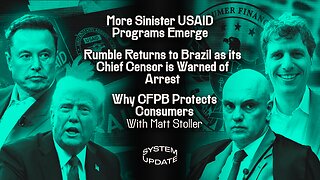

Glenn Greenwald

12 hours agoMore Sinister USAID Programs Emerge; Rumble Returns to Brazil as its Chief Censor is Warned of Arrest; Why CFPB Protects Consumers With Matt Stoller | SYSTEM UPDATE #404

142K172 -

2:49:19

2:49:19

Danny Polishchuk

12 hours agoAmerica Is No Longer The World's Piggy Bank + Guest Richard Grove | Low Value Mail Live Call In Show

91.2K5 -

50:28

50:28

Donald Trump Jr.

13 hours agoCutting Gov’t Waste, One Penny at a Time. Interview with Author Lee Smith | Triggered Ep. 215

173K129 -

1:44:35

1:44:35

Flyover Conservatives

1 day agoThe Shocking Truth About Modern Medicine & The Ultimate Health Hack - Part 1 - Deep Dive: Drs. Mark and Michele Sherwood | FOC Show

54.2K4