Premium Only Content

LIC Insurance Policy Vs LIC SIP Mutual Fund For Long Time Money Making Wealth Gain 36.76% Return

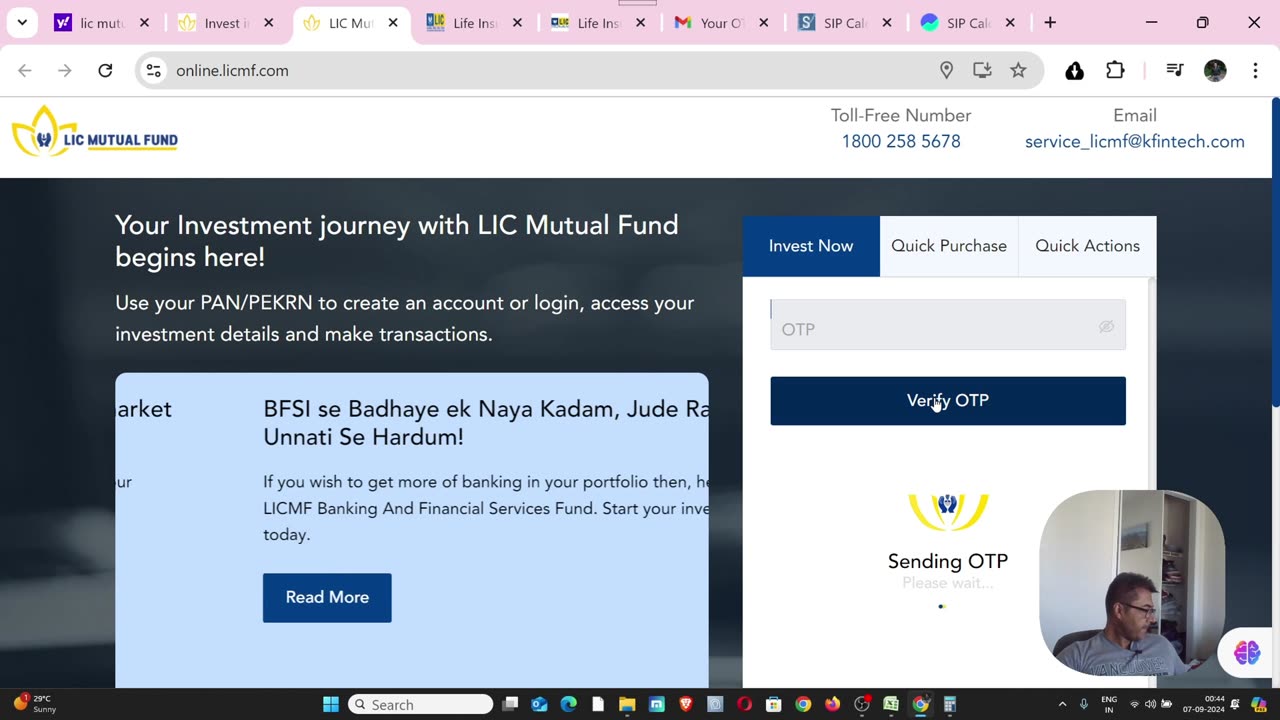

here in this video i am going to show you step by step all results , and can see and think which is better LIC Insurance ( Life Insurance Policy ) Or LIC SIP Mutual Fund investing for wealth gain and money making

I myself invested in both money making tools to earn money from my investment i brought 700000 lic policy Jeevan Annand and another 100000 lumpsum endowment policy for 21 years terms and my yearly premium 34809/- and 5156 /- Rs. i paid yearly premium but i divided my combined premium to monthly which is 3330 ,

now on other side i am contumely investing 500 rs. monthly in LIC Mutual FUND ELSS Fund as SIP , you can see i am getting 36.76% Returns on that

so if i did not invested in LIC insurance and same amount i invested in LIC mutual fund or any other equity mutual fund and almost same yearly gain i got and then my invested amount after 21 years around 9.85 Crores ,

So India growth story day by day gaining now the time is where China was around

#licinsurance

#licmutualfund

#mutualfundsindia

#howtoinvestinmutualfund

#bestwaystoinvestinmutualfund

#sipinvestment

#bestmoneymakingtips

#howtoinvestinmutualfund

#longtimemutualfundinvesting

so you can see how you can invest and gain money in SIP as long time investor

how to earn monthly income from sip , how to invest 500 rupees per month , money investment tips , how to increase saving money, how to grow financially in life , best lumpsum investment for monthly income , this week in money , bestversionus- finances bestversionus , my lead gen secret, grow your money by investing in long terms SIPs and stock investment, see stock analysis

-

1:25:29

1:25:29

Sarah Westall

4 hours agoX-Files True History, Project Blue Beam, Cabal Faction War w/ Former FBI Agent John DeSouza

41.4K3 -

7:03:49

7:03:49

Dr Disrespect

11 hours ago🔴LIVE - DR DISRESPECT - NEW PC VS. DELTA FORCE - MAX SETTINGS

129K26 -

49:04

49:04

Lights, Camera, Barstool

1 day agoIs The Monkey The Worst Movie Of The Year?? + Amazon Gets Bond

52.6K4 -

24:19

24:19

Adam Carolla

23 hours agoDiddy’s Legal Drama Escalates, Smuggler Caught Hiding WHAT? + Philly Eagles & The White House #news

49.2K8 -

10:12

10:12

Mike Rowe

2 days agoClint Hill: What A Man. What A Life. | The Way I Heard It with Mike Rowe

87K10 -

1:31:52

1:31:52

Redacted News

6 hours agoBOMBSHELL! This is war! FBI whistleblowers reveal Epstein files being destroyed? | Redacted News

144K333 -

48:55

48:55

Candace Show Podcast

7 hours agoSTOP EVERYTHING. They FINALLY Mentioned ME In The Blake Lively Lawsuit! | Candace Ep 152

129K120 -

1:02:51

1:02:51

In The Litter Box w/ Jewels & Catturd

1 day agoWhere are the Epstein Files? | In the Litter Box w/ Jewels & Catturd – Ep. 750 – 2/26/2025

101K86 -

1:59:06

1:59:06

Revenge of the Cis

8 hours agoLocals Episode 198: Suits

80.2K12 -

1:38:56

1:38:56

SLS - Street League Skateboarding

1 day agoTop Moments from the Second Half of the 2024 SLS Championship Tour! All The 9’s 🔥

55.1K2