Premium Only Content

Navigating the ISF Process for Fishing Masks: Timely Filing is Key!

ISF Filer || isf@isffiler.com || 858-280-9374 || www.isffiler.com

In today's video, we discussed the topic of when to file an Importer Security Filing (ISF) for fishing masks in the context of customs brokerage. We first highlighted the importance of understanding the ISF process as a necessary step for smooth entry into the United States. Next, we emphasized the significance of correctly identifying fishing masks, as they can be classified as either accessories or apparel based on their purpose.

Moving on, we addressed the timing of ISF filing for fishing masks. While the general rule is to file the ISF no later than 24 hours before the vessel's departure, we mentioned that exceptions and variations may apply. We specifically noted that if fishing masks are part of a consolidated shipment, the responsibility for ISF filing falls on the party consolidating the goods. However, if the fishing masks are imported by an individual or company directly, the importer themselves must file the ISF within the required timeframe.

Lastly, we highlighted the consequences of late or inaccurate ISF filing, including potential penalties, delayed goods release, and additional costs. We emphasized the importance of working with a knowledgeable customs broker who can guide importers through the ISF filing process and help them avoid any compliance issues.

We hope this video has provided you with valuable insights into the ISF filing requirements for fishing masks. If you have any further queries or require assistance with customs brokerage, feel free to reach out to our experienced team. Stay tuned for more informative videos in the future. Thank you for watching!

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is intended for educational purposes and has no affiliation with US government entities.

0:51 - ISF Process Overview: Complying with customs regulations is crucial for importing goods into the U.S., which includes filing an Importer Security Filing (ISF) to provide advance information to U.S. Customs and Border Protection (CBP) about the goods.

1:26 - Product Classification: Customs authorities may classify the same product differently based on its characteristics, making it important to consult with a customs broker for accurate classification.

2:03 - Exceptions for Fishing Masks: The 24-hour ISF filing rule applies to fishing masks, but exceptions exist, such as when they are part of a consolidated shipment, in which case the consolidator must file the ISF.

2:41 - Penalties for Non-Compliance: Failure to comply with customs regulations can result in penalties, delays in releasing goods, and extra costs, emphasizing the need for guidance from a knowledgeable customs broker.

3:12 - Assistance Available: For any questions or customs brokerage needs, assistance is available, and viewers are encouraged to stay tuned for more informative content.

-

36:28

36:28

TheTapeLibrary

14 hours ago $7.86 earnedThe Disturbing True Horror of the Hexham Heads

57.8K5 -

DVR

DVR

JdaDelete

1 day ago $1.22 earnedHalo MCC with the Rumble Spartans 💥

37.3K6 -

3:52:22

3:52:22

Edge of Wonder

9 hours agoChristmas Mandela Effects, UFO Drone Updates & Holiday Government Shake-Ups

33.8K8 -

1:37:36

1:37:36

Mally_Mouse

8 hours agoLet's Play!! -- Friends Friday!

39.3K1 -

57:45

57:45

LFA TV

1 day agoObama’s Fake World Comes Crashing Down | Trumpet Daily 12.20.24 7PM EST

35K15 -

1:27:17

1:27:17

2 MIKES LIVE

7 hours ago2 MIKES LIVE #158 Government Shutdown Looms and Games!

30.9K10 -

1:07:34

1:07:34

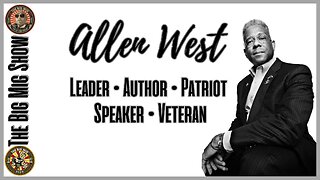

The Big Mig™

11 hours agoVeteran, Patriot, Leader, Author Allen West joins The Big Mig Show

30.3K8 -

1:06:47

1:06:47

The Amber May Show

1 day ago $1.18 earnedBloated CR Failed | What Did The View Say Now? | Who Kept Their Job At ABC| Isaac Hayes

18.5K2 -

59:29

59:29

State of the Second Podcast

4 days agoAre We Losing the Fight for Gun Rights? (ft. XTech)

32.8K3 -

1:00:10

1:00:10

The Nima Yamini Show

8 hours agoTragedy in Germany 🇩🇪 Suspected Terror Attack at Christmas Market – LIVE Updates from Germany

34.4K46