Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Secure Your Retirement: Maximize Your Investments and Beat Social Security

3 months ago

174

Finance

ewr

kevin freeman

economic war room

retirement savings

regulations

inflation

minimum wage

government programs

war on poverty

open borders

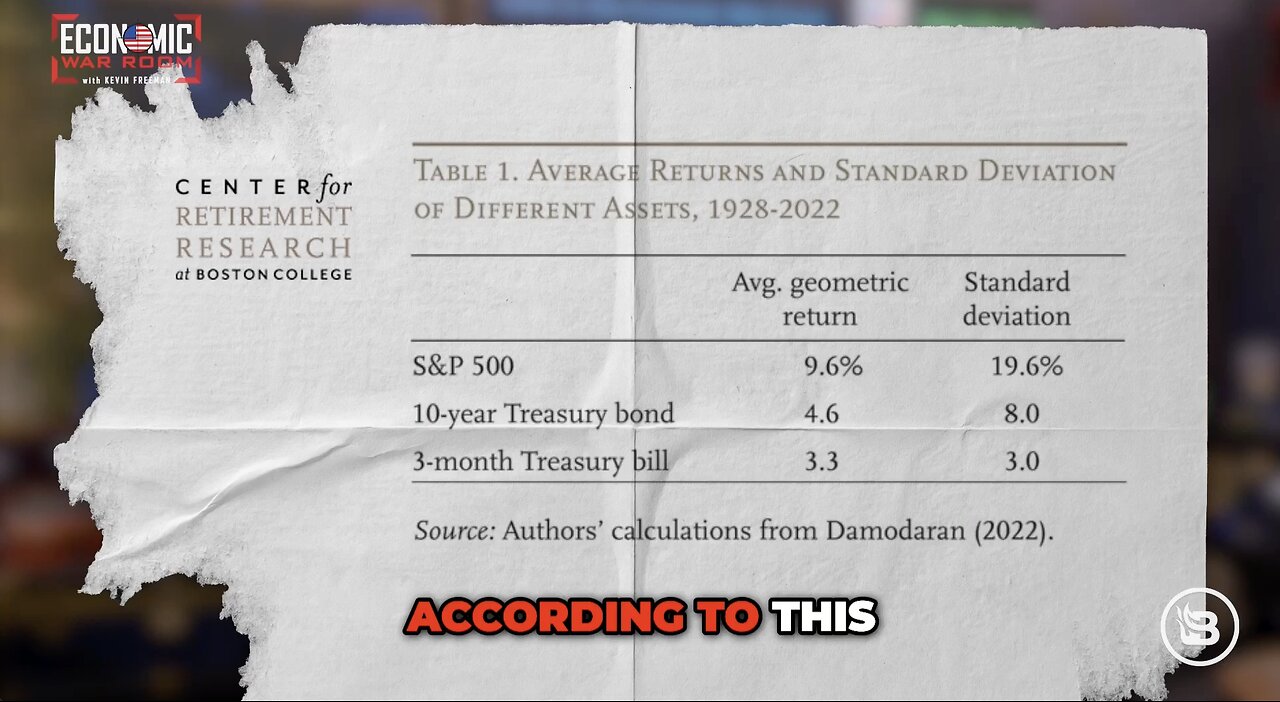

According to this, the S&P 500 from 1928 to 2022 returned almost ten percent a year versus three percent for three-month Treasury bills. If you held a standard 60 40 portfolio 60 percent stocks 40 percent bonds over a typical 40-year work career and you got the average returns and you would have grown your investment at a 7.6% annual rate with private investments as compared to 3.3% annual return provided by Treasury bills which is what the Social Security system is supposed to hold. Would that make a difference in your retirement?

@EconomicWarRoom

Loading 1 comment...

-

6:01

6:01

Economic War Room

8 days agoThe Genesis of "The Pfizer Papers"

221 -

39:47

39:47

Brewzle

1 day agoPennsylvania Wouldn’t Let Me Film…So I Went Bourbon Hunting in NY

26.9K7 -

10:12

10:12

Space Ice

22 hours agoBallistic: Ecks vs Sever - Underrated Masterpiece Or Incoherent Mess?

20.6K9 -

2:43:07

2:43:07

RG_GerkClan

5 hours agoLIVE: Lets Get to 500 FOLLOWS! - Escape From Tarkov - Gerk Clan

14.7K3 -

LIVE

LIVE

Vigilant News Network

19 hours agoHillary Clinton EXPOSED In Another Massive Hoax | The Daily Dose

1,753 watching -

1:00:17

1:00:17

Trumpet Daily

1 day ago $6.55 earnedRINOs Are Trump’s Biggest Enemy Now - Trumpet Daily | Nov. 22, 2024

12.4K19 -

17:47

17:47

RealReaper

14 hours ago $0.19 earnedGladiator 2 Another Pointless Sequel

7K2 -

45:45

45:45

PMG

12 hours ago"Hannah Faulkner and Stephanie Nash | No Farms No Food"

5.78K -

27:11

27:11

Degenerate Plays

1 day ago $0.12 earnedReturn Of The Online Girlfriends - Stellar Blade : Part 30

4.82K -

7:16

7:16

SeasonofMist

2 days agoSOLSTAFIR - Fjara (Official Music Video)

3.87K2