Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Secure Your Retirement: Maximize Your Investments and Beat Social Security

5 months ago

180

Finance

ewr

kevin freeman

economic war room

retirement savings

regulations

inflation

minimum wage

government programs

war on poverty

open borders

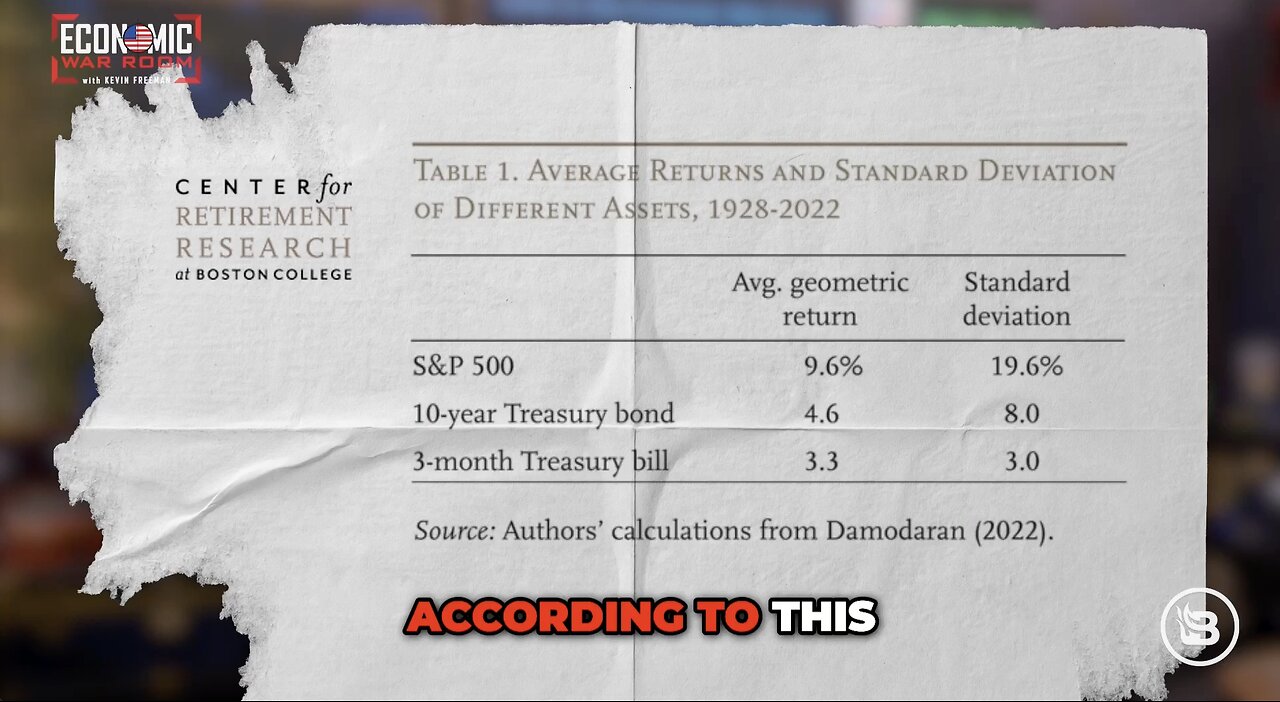

According to this, the S&P 500 from 1928 to 2022 returned almost ten percent a year versus three percent for three-month Treasury bills. If you held a standard 60 40 portfolio 60 percent stocks 40 percent bonds over a typical 40-year work career and you got the average returns and you would have grown your investment at a 7.6% annual rate with private investments as compared to 3.3% annual return provided by Treasury bills which is what the Social Security system is supposed to hold. Would that make a difference in your retirement?

@EconomicWarRoom

Loading 1 comment...

-

1:51

1:51

Economic War Room

5 days ago2024 Highlights: Celebrating Our Wins Against the Odds

1131 -

21:33

21:33

Degenerate Jay

2 days ago $1.30 earnedThe Best Video Game Movie Ever Made? Sonic The Hedgehog 3 Movie Review

25.2K -

19:57

19:57

BlackDiamondGunsandGear

3 days agoIS 22LR ENOUGH?

15.7K8 -

1:59:47

1:59:47

Anthony Rogers

19 hours agoLIVE Comedy @ Cusumano's Pizza (Upstairs)

14.4K1 -

5:02:46

5:02:46

MoFio23!

16 hours agoNintendo Switch It UP Saturdays with The Fellas: LIVE - Episode #1

99K14 -

4:26:49

4:26:49

BLoobsGaming

16 hours agoCan I get an Enhance Crystal Weapon Seed please!? MORE Corrupted Gauntlet

147K42 -

7:35:05

7:35:05

BSparksGaming

1 day agoDynamic Duo! Marvel Rivals w/ Chili XDD

93.8K -

7:00:42

7:00:42

NellieBean

18 hours ago🔴 LIVE - trying some COD maybe Pals later

92.4K1 -

1:47:46

1:47:46

SpartakusLIVE

16 hours agoThe Master RIZZLER has entered the building, the 95% REJOICE

43.7K3 -

29:53

29:53

MYLUNCHBREAK CHANNEL PAGE

1 day agoOff Limits to the Public - Pt 1

105K187