Premium Only Content

How To Manage Your Money So You Never Go Broke

Take control of your finances and learn how to manage your money effectively in this informative video.

1. Know Where Your Money Goes: Track your spending for a month to see where your money disappears. Use a budgeting app like MoneyTrack to reveal hidden spending patterns and identify areas for improvement.

2. Craft a Realistic Budget: Ditch the drastic cuts and create a budget that fits your lifestyle. Use your spending awareness to set achievable goals, like cooking at home more often instead of eliminating takeout completely.

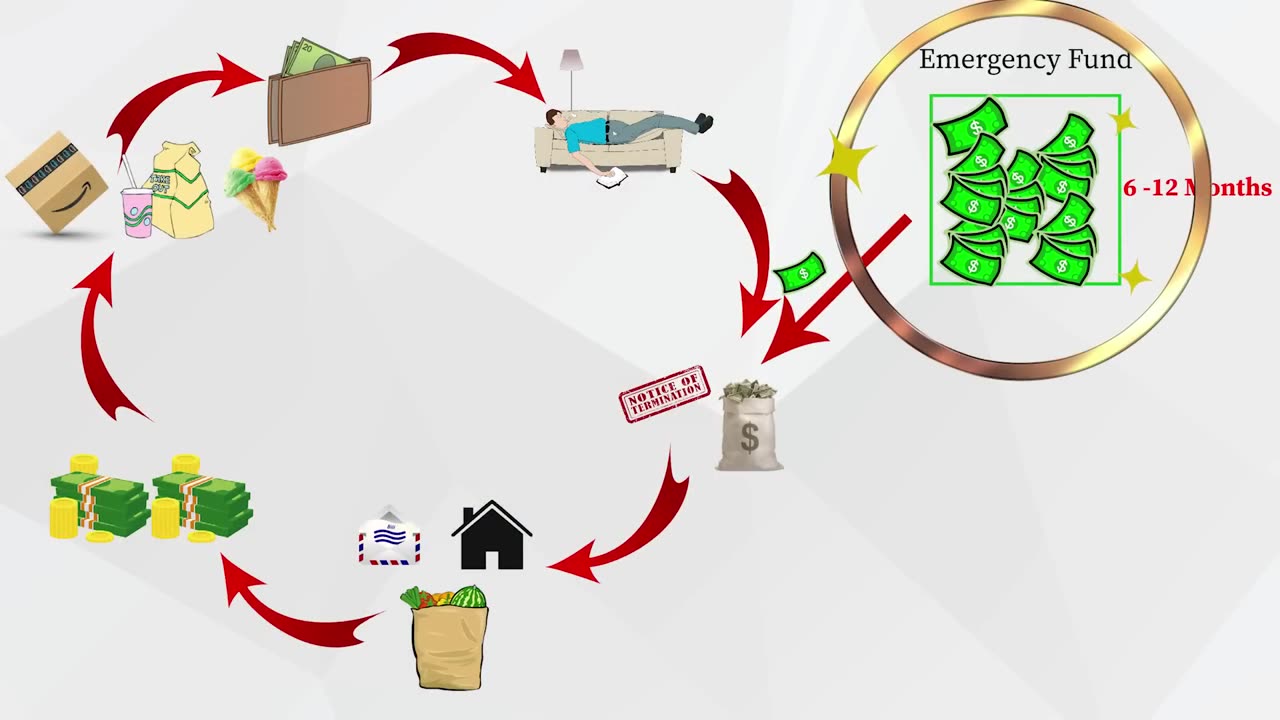

3. Build Your Safety Net: Start an emergency fund, even with small contributions. This cushion will protect you from unexpected expenses and keep you from high-interest loans.

4. Be a Bill-Paying Pro: Pay your bills on time, every time. Avoid late fees and prioritize essential spending. On-time payments also boost your credit score, leading to better interest rates.

5. Unsubscribe from the Money Drain: Review your bank statements for recurring charges you don't use. Ditch those unnecessary subscriptions and put that extra money back in your pocket.

6. Save for Big Dreams: Avoid unnecessary debt for major purchases. Prioritize saving cash to buy items like a car or furniture outright. You'll skip the interest payments and enjoy the satisfaction of debt-free ownership.

7. Grow Your Money: Start investing, even if it's a small amount. Utilize employer 401(k) matchings and consider opening a retirement or investment account. Let your money work for you and build a brighter financial future.

Remember, the key to financial well-being is consistent effort and smart habits. Commit to these 7 steps, and you'll be well on your way to taking control of your money and achieving your financial goals.

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.

-

2:38:54

2:38:54

TimcastIRL

9 hours agoElon Secret Child Scandal ERUPTS, Ashley St. Clair Story Goes Viral w/Bethany Mandel | Timcast IRL

149K100 -

2:04:52

2:04:52

Kim Iversen

11 hours agoElon's Pumping Out Babies Like They're Tesla Model 3's | EU Panics Over Peace Talks, Wants More War

140K127 -

1:05:35

1:05:35

Man in America

14 hours agoFort Knox & Trump’s Secret Gold Move—The Financial Reset NO ONE Is Ready For?

87.2K77 -

2:21:20

2:21:20

Robert Gouveia

11 hours agoTrump Goes to SCOTUS! Judge CAVES on DOGE? Fani Willis Not Happy!

108K30 -

20:41

20:41

Stephen Gardner

11 hours ago🔥You Won't BELIEVE What JUST Happened To Don Trump Jr.!!

112K196 -

58:00

58:00

The StoneZONE with Roger Stone

9 hours agoEuropean Leaders Resist Trump Peace Overtures To Their Own Demise | The StoneZONE w/ Roger Stone

77.6K12 -

9:29

9:29

AlaskanBallistics

11 hours ago $8.77 earnedWyoming Suppressors and Rifles at Shot Show 2025

90.5K4 -

1:06:40

1:06:40

Donald Trump Jr.

14 hours agoThe Left is Taking one L After Another, Live with Michael Knowles | Triggered Ep. 217

181K118 -

47:17

47:17

Kimberly Guilfoyle

14 hours agoWoke Gets DOGE’d, Live with AJ Rice & Jarrett Stepman | Ep. 197

133K43 -

20:11

20:11

Candace Show Podcast

13 hours agoBecoming Brigitte: Candace Owens x Xavier Poussard | Ep 6

200K335