Premium Only Content

Navigating Tax Forms: 1099-OID, 1096, and 1040V Demystified

Learn how to understand and file 1099-OID, 1096, and 1040V tax forms with our comprehensive guide. Tips and step-by-step instructions included .Step-by-Step Process

Step 1: Understanding the 1099-OID

What is it?: The 1099-OID form is used to report original issue discount income, which is the excess of the stated redemption price at maturity over the issue price.

When to use it: Typically, this form is issued for bonds and other forms of debt securities.

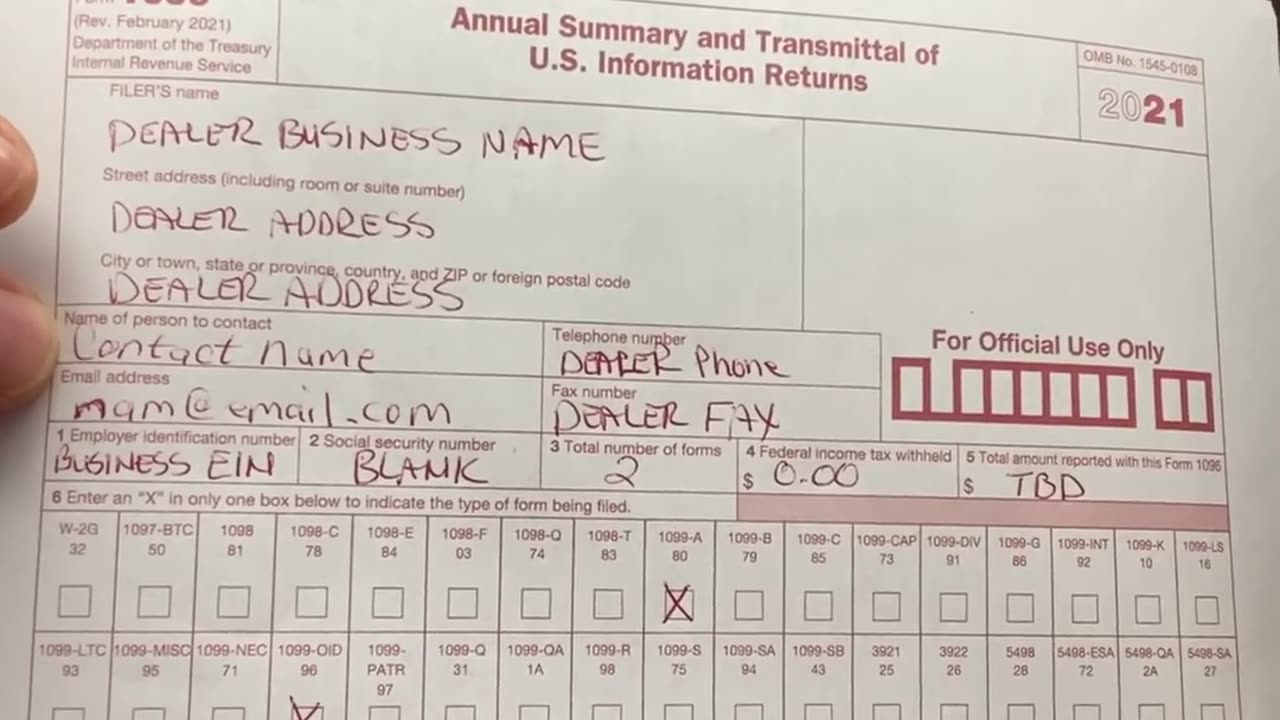

Step 2: Filling Out Form 1096

Purpose: Form 1096 is used to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS.

Process:

Collect all the necessary forms to be transmitted.

Fill out Form 1096 with your total figures.

Ensure accuracy to avoid penalties.

Step 3: Submitting Payments with Form 1040V

What is it?: Form 1040V is a payment voucher used when sending a check or money order for a balance due on a Form 1040, 1040A, 1040EZ, or 1040X.

Steps:

Complete your tax return.

Detach Form 1040V from the instructions.

Write your Social Security Number and tax year on your payment.

Mail the form and payment to the specified IRS address.

-

LIVE

LIVE

The Dana Show with Dana Loesch

2 hours agoTRUMP IMPOSES TARIFFS ON IMPORTS FROM CANADA, CHINA & MEXICO | The Dana Show LIVE On Rumble!

1,020 watching -

LIVE

LIVE

Major League Fishing

5 days agoLIVE! - Bass Pro Tour: Stage 1 - Day 4

139 watching -

59:38

59:38

The Dan Bongino Show

6 hours agoTrump Is Setting The Old World Order Ablaze (Ep. 2414) - 02/03/2025

620K993 -

1:02:10

1:02:10

The Rubin Report

3 hours agoJD Vance Makes Host Go Quiet with This Brutal Warning for These Major Countries

82.1K57 -

2:00:51

2:00:51

Steven Crowder

5 hours agoWhy Trump & America Will Dominate the Global Trade War

407K230 -

1:06:15

1:06:15

vivafrei

17 hours agoLive with "Bitcoin Jesus" Roger Ver - the Indictment, Law-Fare and the War on Crypto

93.4K18 -

DVR

DVR

Bannons War Room

1 year agoWarRoom Live

111M -

1:30:18

1:30:18

Caleb Hammer

3 hours agoProfessional Redditor Treats His Wife Like A Pet | Financial Audit

30.7K3 -

36:07

36:07

Rethinking the Dollar

3 hours agoTit-for-Tat Trade Wars: Why Gold Is Still Winning (Trade Wars Hurt Your Money!)

19.6K1 -

56:02

56:02

Randi Hipper

4 hours agoBITCOIN AT CRITICAL LEVELS AS MARKET CRASHES! LATEST PRICE UPDATE HERE

32.7K2