Premium Only Content

The *PIIGS, China, and Vietnam: Private investors chase higher yields and risk

The *PIIGS, China, and Vietnam: Private investors chase higher yields and risk, send USD back to US *葡萄牙、義大利、愛爾蘭、希臘和西班牙五國、中國和越南:私人投資者追逐更高的收益率和風險,將美元送回美國 (*Portugal, Italy, Ireland, Greece, and Spain)

https://www.bloomberg.com/news/articles/2024-05-14/foreign-private-investors-set-to-top-central-bank-bond-buying

https://www.worldgovernmentbonds.com/country/china/

https://wolfstreet.com/2024/06/19/the-foreign-holders-of-the-ballooning-us-debt/

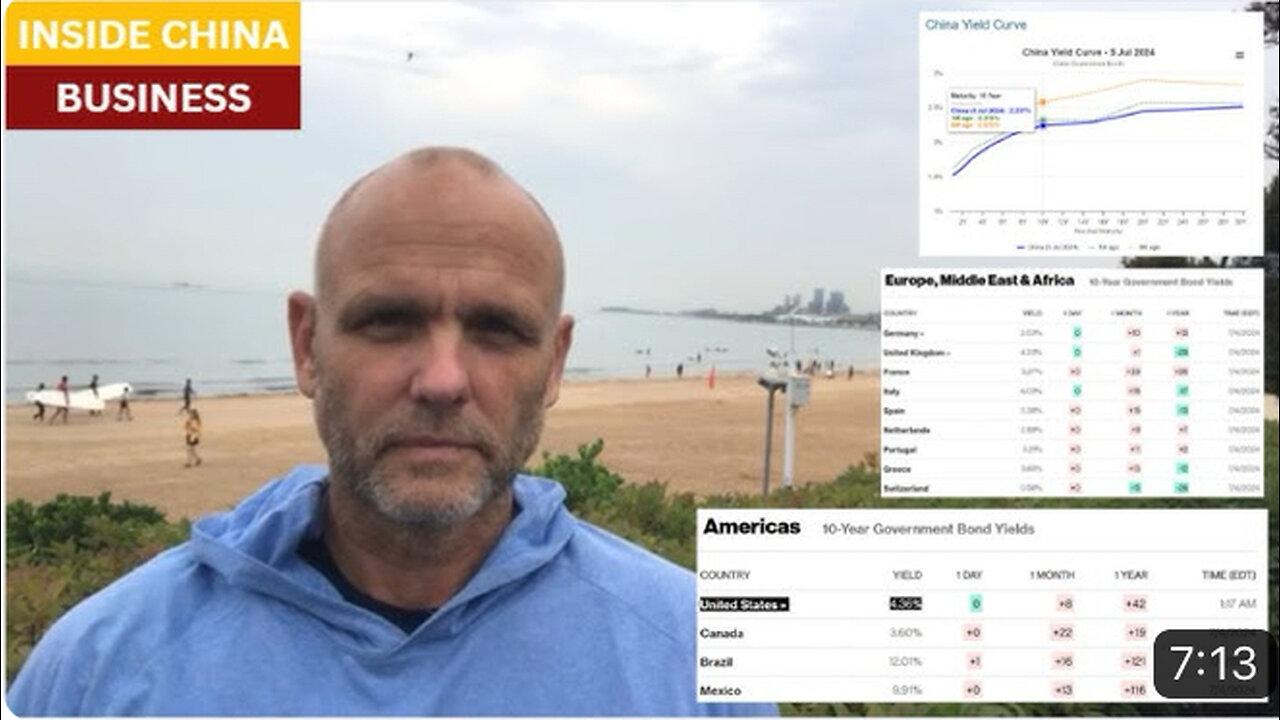

The United States Treasury now borrows at rates far higher than most other world governments. Compared to countries in Asia, the US borrows at almost double the rate of China, Singapore, and Japan, but also Malaysia and Vietnam. In Europe, even the governments of the historically badly managed PIIGS countries can borrow for lower rates than can the United States.

Skyrocketing US government deficit spending is sucking in hundreds of billions of dollars a year from banking systems around the world, worsening inflation in the US and, ironically, making USD more scarce and valuable outside the US.

American political and banking officials boast of strong economic growth and US dollar demand, but can only secure new lenders by paying some of the highest borrowing rates in the world.

美國財政部目前的借款利率遠高於世界上大多數其他政府。 與亞洲國家相比,美國的借款利率幾乎是中國、新加坡和日本的兩倍,也是馬來西亞和越南的兩倍。 在歐洲,即使是歷史上管理不善的PIIGS國家的政府也能以比美國更低的利率借款。

美國政府赤字支出的飆升每年從世界各地的銀行系統吸走數千億美元,加劇美國的通貨膨脹,諷刺的是,這使得美元在美國以外的地區變得更加稀缺和更有價值。

美國政治和銀行官員吹噓強勁的經濟成長和美元需求,但只能透過支付世界上最高的借款利率來獲得新的貸款人.

-

2:15:08

2:15:08

megimu32

6 hours agoON THE SUBJECT: IRL Streamers Attacked & Nostalgic Animal Movies That Made Us Cry

39.3K6 -

1:00:54

1:00:54

The Tom Renz Show

10 hours agoMore Epstein/FBI, a Scary Trade War, & the Dem Echo Chamber

36.4K11 -

40:43

40:43

Kimberly Guilfoyle

11 hours agoDems Double Down on Delusion-Why? Live with Tony Kinnett & Bo French | Ep.202

107K40 -

1:28:42

1:28:42

Redacted News

9 hours agoBREAKING! SOMETHING BIG IS HAPPENING IN EUROPE ALL OUT WAR IS COMING AGAINST RUSSIA, TRUMP FURIOUS

158K326 -

47:50

47:50

Candace Show Podcast

9 hours agoBREAKING: Judge Makes Statement Regarding Taylor Swift's Text Messages. | Candace Ep 155

147K128 -

1:14:23

1:14:23

Josh Pate's College Football Show

6 hours ago $1.10 earnedCFB’s Most Hated Teams | FSU & Clemson Future | Big Ten Win Totals | Star Rankings Overrated?

33K -

1:33:47

1:33:47

CatfishedOnline

8 hours agoGoing Live With Robert - Weekly Recap

42.5K1 -

55:18

55:18

LFA TV

1 day agoEurope’s Sudden Turn Against America | TRUMPET DAILY 3.6.25 7PM

44.4K3 -

4:21

4:21

Tundra Tactical

7 hours ago $3.19 earnedPam Bondi MUST Enforce Due Process NOW!

32.7K1 -

56:42

56:42

VSiNLive

8 hours agoFollow the Money with Mitch Moss & Pauly Howard | Hour 1

55.1K1