Premium Only Content

40-Year Mortgages: A Trap or a Solution? Unpacking Long-Term Home Loans

In today's video, we dive into the controversial topic of 40-year mortgages. Are they a practical solution for those struggling to afford a home, or are they a financial trap that could cost you more in the long run? We'll explore the mechanics of extending mortgage terms, the minimal savings on monthly payments, and the overall impact on your financial health. Whether you're a first-time homebuyer or considering refinancing, this video is essential to understand the long-term consequences of such decisions.

🏠 Key Points Covered:

An overview of 40-year mortgages and how they compare to traditional 30-year loans.

The financial implications of extending your mortgage term by a decade.

Practical advice on whether a longer mortgage term could be right for your financial situation.

Insights into how banks profit from longer mortgages and what that means for you.

💸 Why Watch?

Learn about the pros and cons of opting for a 40-year mortgage.

Understand how minimal monthly savings could lead to higher overall costs.

Get expert tips on making informed decisions about home financing in today's market.

💬 Join the Conversation:

Would you consider a 40-year mortgage to make homeownership more accessible, or do you think it prolongs financial burden? Share your views and experiences in the comments below!

👉 Subscribe for more financial insights, real estate trends, and personal finance tips to navigate the complexities of buying a home.

-

2:21:35

2:21:35

Price of Reason

12 hours agoThe Establishment WORRIES about Elon Musk AGAIN! Superman Trailer Discussion! Sonic 3 Review!

42.5K3 -

1:14:54

1:14:54

Steve-O's Wild Ride! Podcast

15 hours ago $17.65 earnedZac Brown Reveals The Secrets To HIs Success - Wild Ride #247

65.9K13 -

4:16:43

4:16:43

JdaDelete

9 hours ago $12.23 earnedProject Zomboid with the Boys | The Great Boner Jam of 2025

41.3K -

6:00:08

6:00:08

SpartakusLIVE

10 hours agoYoung Spartan STUD teams with old gamers for ultimate BANTER with a SMATTERING of TOXICITY

31.9K -

1:50:39

1:50:39

Kim Iversen

11 hours agoShocking Proposal: Elon Musk for Speaker of the House?! | IDF Soldiers Reveal Atrocities—'Everyone Is a Terrorist'

77.9K172 -

43:27

43:27

barstoolsports

14 hours agoOld Dog Bites Back | Surviving Barstool S4 Ep. 9

134K4 -

5:13:04

5:13:04

Right Side Broadcasting Network

7 days agoLIVE REPLAY: TPUSA's America Fest Conference: Day One - 12/19/24

185K28 -

1:06:01

1:06:01

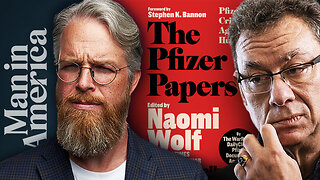

Man in America

1 day agoPfizer Has Been Caught RED HANDED w/ Dr. Chris Flowers

62.1K19 -

2:24:15

2:24:15

Slightly Offensive

12 hours ago $18.44 earnedAttempted ASSASSINATION of Nick J Fuentes LEAVES 1 DEAD! | Guest: Mel K & Breanna Morello

51.9K48 -

1:43:08

1:43:08

Roseanne Barr

11 hours ago $28.85 earned"Ain't Nobody Good" with Jesse Lee Peterson | The Roseanne Barr Podcast #79

85.2K49