Premium Only Content

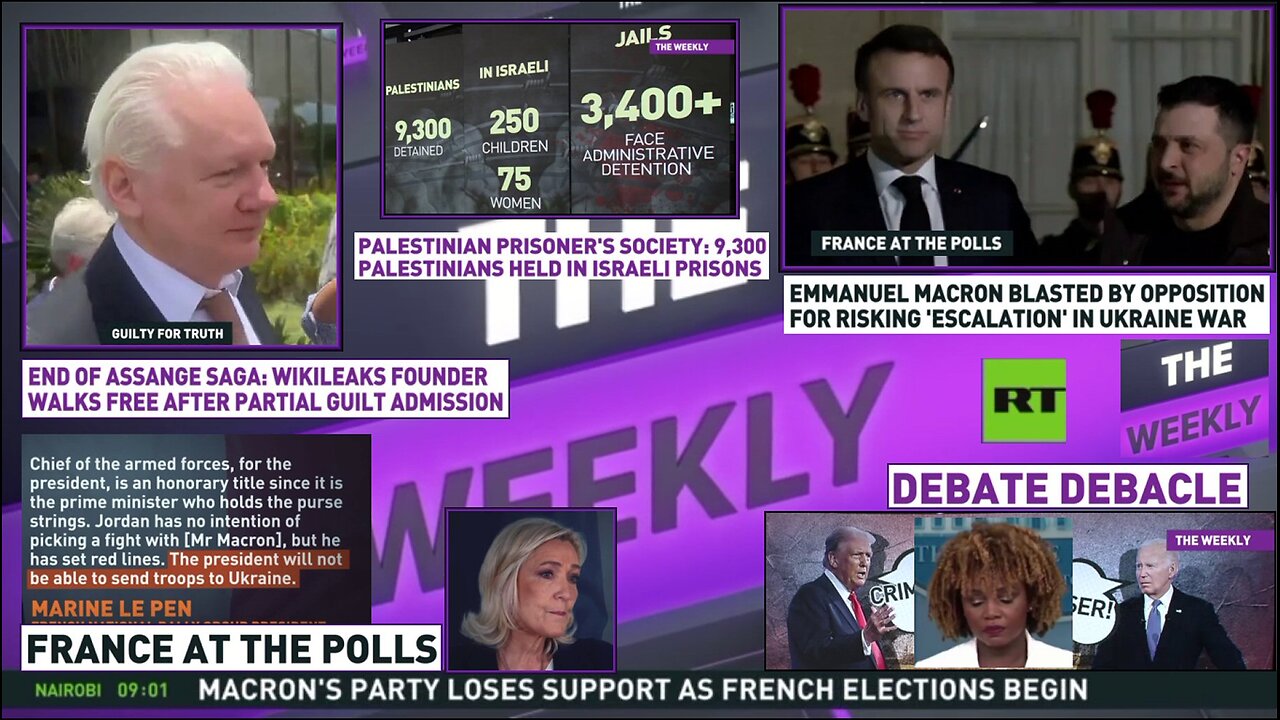

RT News - June 30th 2024 - The Weekly

France goes to the polls after Emmanuel Macron called for a snap election when his alliance party suffered massive defeat at the EU elections held on 9th June 2024.

Rachel Marsden talks us through the background.

The French people are voting to elect 577 members of the country’s National Assembly. Some analysts have called Macron’s decision a gamble which could backfire (which WILL backfire if the elections isn't rigged, in my opinion). Polls close between 16:00 in most of the country and in Paris and other major cities, they stay open until 18:00. A second round of voting could take place on July 7th

Even if Macron's party loses, he could still stay in place until 2027 (awkward) as the last vote gave him that mandate. (me - or there could be a coup, or riots or anything might happen with the mood of the citizens in France at the moment ! - think "Gilets Jaunes on steroids)

---

Rachel Ruble talks about the conditions that Palestinians detained in Israeli prisons face each day. They are facing US-style tortue against them. She talks through the case of Asadullah Haroon who spent 15 years wrongfully imprisoned in Guantanamo Bay (GITMO). Aziz Dweik from the Palestinian Legislative Council says the conditions in Israeli prisons are even worse than GITMO and Abu Ghraib. There are 9,300 Palestinian detainees in Israel prisons, some being women and children, some simply under "administrative detention"

-----

The Israel/Gaza conflict could lead to regional war. Exclusive RT interview with Ramzy Ezzeldin Ramzy. Could nuclear war be triggered?

-------------------------

Short take: WikiLeaks founder Julian Assange takes his first steps on Australian soil, reunited with his family after a gruelling 14 year-long legal battle. That’s after a judge accepted a plea deal struck with the US government with which Assange had little choice but to agree. Australian lawmaker, Andrew Wilkie, slammed Washington for setting an alarming precedent. Joe Biden’s shaky debate performance against Donald Trump turns into a name-calling match, with both candidates hurling insults at the other. Round up of the weekly news.

-------------

Below : 1) Russia should bring back death penalty – top investigator

2) The death of the petrodollar: What really happened between the US and Saudis? FEATURE

2a) Abuse only gets worse with time: How the US increasingly mistreats its closest allies FEATURE

2b) Schizophrenic world order: The West is willing to destroy its financial system to punish Russia FEATURE

======================================

1) Russia should bring back death penalty – top investigator 30 Jun, 2024 00:42

The courts must be allowed to sentence terrorists and child predators to capital punishment, a senior official in Moscow has said

Capital punishment should be reinstated for certain violent crimes, the head of Russia’s Investigative Committee Aleskandr Bastrykin has argued.

Moscow effectively suspended the death penalty in the late 1990s as a condition for joining the Council of Europe. However, in 2022 Russia quit the organization, accusing the West of weaponizing it to exert pressure on Moscow and attempt to impose “its own political agenda and ‘progressive’ values.”

Speaking at a legal conference in St. Petersburg on Friday, Bastrykin said that “the cruelty of the crimes” that are being committed in Russia has increased compared to the Soviet era. He argued courts should be allowed to sentence violent criminals, such as terrorists, serial killers, and those who commit crimes against children, to execution.

“I am a proponent of the death penalty,” the chief investigator said. “Why don’t we lift the moratorium and bring back the death penalty into the law, given that the number of violent crimes is rising?”

As an example, Bastrykin cited the March attack on a concert hall in Moscow by Islamic State-linked terrorists, which left 145 people dead. Police have detained several suspects, including all four gunmen who stormed the venue and set it on fire.

“In Soviet times, a person could be sentenced to death for murdering two or three people. As for today, the suspects can be given a maximum sentence of life imprisonment,” Bastrykin said.

According to the head of the Investigative Committee, last year alone, law enforcement investigated 23,700 offenses against children, including 246 murders, 1,870 cases of rape, and more than 6,800 other sex crimes.

Bastrykin is not the first Russian official to propose the reinstatement of the death penalty for especially grave crimes. President Vladimir Putin, however, has so far refused to publicly endorse this idea.

https://www.rt.com/russia/600205-russia-reinstate-death-penalty/

==============================================

2) The death of the petrodollar: What really happened between the US and Saudis? FEATURE 23 Jun, 2024 14:40

News about the expiration of a Washington-Riyadh deal may be fake, but an arrangement that is key to the dollar’s success has eroded

It is said that works of fiction can often convey certain truths better than a newswire. That is perhaps the light in which to view reports circulating around the internet recently about the expiration of a 50-year ‘petrodollar’ treaty between the US and Saudi Arabia.

The agreement is a piece of fiction. The spurious reports appear to have originated in India or in the murky tangle of websites aimed at crypto investors. There was an official agreement between the US and Saudi Arabia signed in June of 1974 and another, secret one reached later that year according to which the Saudis were promised military aid in exchange for recycling their oil proceeds into US Treasuries. The deal whereby Riyadh would sell its oil in dollars was informal, and there was no expiration date. The petrodollar system as we have come to known largely grew organically.

However, this fiction points to an underlying truth: the petrodollar has entered a long twilight from which there will be no return. No other economic arrangement has done more to ensure American preeminence over the last half-century. Yet in its essence it represented an implicit oil backing to the dollar that would be maintained. To borrow an idea originally expressed by financial analyst Luke Gromen, it is ultimately America’s inability and unwillingness to maintain this backing that is gradually dooming the system.

Origins of the petrodollar

When the US abandoned the dollar’s gold peg in 1971, thus ending the Bretton Woods arrangement, the international financial system was thrown into chaos. What ensued was a turbulent period of high inflation and major adjustments to the new reality of free-floating currencies. Untethered from even the pretense of a gold backing, the dollar unsurprisingly devalued and inflation ran rampant. By the summer of 1973, it had lost a fifth of its value against other major currencies. https://www.grant-williams.com/podcast/0028-luke-gromen/

This should have marked the end of the two and a half decades of post-war dollar primacy. And yet quite a peculiar thing happened: the dollar’s role as reserve currency and primary instrument of trade only expanded. The reason is that the Americans managed to steer the oil trade into dollars, starting with the Saudis in 1974 and soon thereafter extending to all of OPEC. This established a de facto commodity backing for the dollar. Since the oil market is much larger than the gold market, it actually gave the dollar even greater scope.

In exchange for agreeing to sell their oil in dollars, Saudi Arabia became a protectorate of the US military. Many have seen this deal as a Godfather-like “offer you can’t refuse” for the Saudis. After all, Secretary of State Henry Kissinger and Defense Secretary James Schlesinger attracted considerable attention in early 1975 by refusing to rule out the possibility of taking over foreign oil fields using military force in the event of a “strangulation” of the West by oil-producing countries. Although the US-Saudi oil deal predates these remarks, it’s not a stretch to imagine that the Kingdom regarded coming under the US tent as a safer move than waiting around to find out how the word “strangulation” would be defined.

It probably was a good bet. Many things have transpired in Saudi Arabia in the intervening half century, but one thing that has resolutely not happened is a color revolution or US regime-change operation.

The de facto oil backing and the exception that proved the rule

The dollar thus went from being pegged to gold under Bretton Woods to being unofficially backed by oil. And indeed, after the shock in 1973-74, oil traded in a remarkably stable range of roughly $15-30/per barrel for the next 30 years. This remarkable stability lies at the heart of the success of the petrodollar arrangement. There was one important exception to this stability, but even it ended up only buttressing the system.

That exception is the oil shock of 1978-79, sparked by the Iranian Revolution, when oil surged well above the upper end of this range. This coincided with (and partly caused) a deep crisis in the dollar and raging inflation in the US. It was at this time that Fed chairman Paul Volcker embarked on his famous series of aggressive rate hikes.

Volcker’s tough medicine was aimed at breaking the back of the worst US inflation in history, but no less important was the effect it had on bolstering the frayed credibility of the dollar. A New York Times article from the time complained that the Fed chairman’s moves “make clear that international considerations, and specifically the defense of the dollar, are now influencing American economic policy to a degree unparalleled in the postwar period.” In other words, Volcker was being accused of prioritizing the functioning of the dollar system over domestic considerations.

It’s important not to get too bogged down in untangling cause and effect here, or in seeking in Volcker’s actions an explicit petrodollar angle. The oil market during those years was responding to a host of factors, and it was by no means within the power of the Fed to manage it. Nor was Volcker explicitly trying to do so. But he was very aware of the pain high crude prices caused oil importers and the threat to the stability of the system it posed.

Volcker’s decisive action restored the dollar as the world’s most preferred currency, and the stronger greenback did help keep oil cheaper in the greenback than in other currencies. Most importantly, however, the perception was created that the US was willing to subject its own economy to pain (Volcker put the US through two punishing recessions) in order to preserve the value of the dollar for all global players holding or transacting in dollars.

Oil prices came down in the early ‘80s and basically stayed within the $15-30 range for the next twenty or so years. A lot of this had to do with major new sources of oil coming online, such as the North Sea, Alaska, and Mexico. However, the bottom line is that the dollar preserved its value against oil. It doesn’t even really matter how much of this is an actual achievement of US policy and how much is just a confluence of favorable circumstances. What matters is that the dollar was seen as equivalent to oil, and the Volcker years had created the impression that the US would actually defend it in a time of crisis and manage it fairly. That made holding dollars (or US Treasuries) a reasonable proposition for all.

A 30-year range breaks and the rest is history

Fast forward to 2003, and the oil price began a long and steady ascent. This is largely attributable to rising Chinese demand and the geological realities that many of the world’s major legacy fields were peaking and starting to turn over, meaning the easy-to-extract oil was becoming scarce (It’s more accurate to think about peak ‘cheap’ oil than the actual geological peak.) The dollar also weakened substantially against other major currencies over 2003-2008, a circumstance economist Steve Hanke believes caused 50% of the oil price surge during that period.

Importantly, when oil moved to the top of its 30-year range, it didn’t stop. Over the next couple of years, oil prices would rise steadily before peaking at $145 per barrel in July 2008. Again, another way to think about this is a drop in the value of the dollar against oil, an ominous development for those holding dollars and buying oil.

This is the moment when a fatal crack appeared in the foundation of the petrodollar edifice. With oil surging and the dollar weak, where was a new swashbuckling Paul Volcker to come in and tighten policy, strengthen the dollar at whatever cost, and preserve its implicit oil backing? The answer: nowhere to be found. In fact, quite the opposite happened. During the crucial period when crude was rising in 2007 and early 2008, the US actually cut interest rates in response to a weakening economy, thus exacerbating the problem.

Luke Gromen sees this episode as causing an important epiphany for many nations who had been aggregating foreign currency reserves with a belief that the dollar would continue to be managed to be as good as gold for oil, and that the US would not pursue policies that would have the effect of impoverishing energy importers.

Making matters worse was the deluge of bailouts and trillions in quantitative easing in the aftermath of the 2008-09 financial crisis, which contributed to the sense that the US would spare no effort to stabilize its own faulty banking system – the dollar be damned. It had also become apparent that the US economy was now too financialized and too leveraged to endure Volcker-like treatment.

Now it should be noted that oil prices did plummet in 2009, and the dollar did (perversely) strengthen amid the global financial crisis. But this owed directly to the economic carnage caused by the meltdown itself and the ensuing recession. Nobody confused Ben Bernanke for Paul Volcker.

Oil prices also plummeted in 2014-2016 amid the shale boom, which made the US the de facto marginal cost producer globally. It can even be argued that for much of the decade of 2010-2020, the dollar fell into a new (albeit higher) range against oil, thus reinstating a pale reflection of the previous dollar-energy tie. But the system was already malfunctioning by then; the short-lived shale miracle only delayed and obscured the consequences.

It's important not to seek in any fluctuation of the dollar or crude an affirmation or refutation of the idea of an oil backing to the greenback. What is key to grasp is that starting in the mid-2000s with the run-up in oil described above, the implicit promise of the petrodollar system began to break down. This break-down has been playing out ever since.

China wants to print yuan for oil; the US inadvertently obliges

One country that took early notice of the declining credibility of the dollar is China. Merely days after Fed chairman Ben Bernanke announced the largest money-printing escapade in history, in March 2009, the head of the People’s Bank of China issued a boldly titled white paper called ‘Reform the International Monetary System’, calling for a neutral reserve asset to replace the dollar-centric system. https://www.bis.org/review/r090402c.pdf

In the ensuing years, China, the world’s largest importer of oil, made clear its desire to be able to purchase oil using its own currency. It has also cut back on buying US Treasuries and been acquiring gold at a blistering pace, both clear votes of no-confidence in the dollar.

Many interpret these moves in overly geopolitical terms, as Beijing’s desire to flex its muscles and undermine the US-led unipolar world for its own sake. However, it’s important to understand that for the Chinese, who are short oil and long US Treasuries, this is a matter of national security. Relying on a currency which is being debased by the day and overseen by an increasingly belligerent fading hegemon for buying the modern economy’s most critical commodity – whose overall price trajectory is upward – is no solution.

China introduced yuan-priced oil contracts in 2018 as part of an effort to make its currency tradable globally. Although this initially didn’t make much of a dent in the dollar’s dominance of the oil market, it showed where Beijing was headed. What got the needle moving was the Ukraine conflict – or rather Washington’s unhinged reaction to it. And here we arrive at the meeting point of a deep-seated economic trend and a geopolitical flashpoint.

With Moscow limited by sanctions in where it could market its oil, China significantly ramped up purchases of discounted Russian crude, with settlement in yuan. Legendary analyst Zoltan Pozsar called this development “dusk for the petrodollar… and dawn for the petroyuan.”

It goes beyond China. The BRICS group as a whole has, as a stated objective, increasing trade in local currencies, an objective that has gained urgency in light of Washington's capricious and overbearing use of sanctions. India, the world’s third-biggest oil importer and consumer, has become the biggest buyer of seaborne Russian crude since 2022, paying for Russian crude in rupees, dirhams, and yuan. As the BRICS group consolidates and new financial infrastructure and trade networks coalesce, the non-dollar oil trade will only grow.

In January 2023, Saudi Arabia even openly stated that it was willing to sell oil in currencies other than the dollar, the first public acknowledgement of what had been a source of speculation for years. In November of that year, the Kingdom sealed a currency swap deal with China, a surefire precursor of plans to do future business in local currencies.

The petrodollar arrangement has been very good for the Saudis and historically they have not shown a strong eagerness to give it up. No doubt contributing to this is a certain hesitancy about breaking with the Americans. Things do not tend to end well for the leadership of oil-producing countries who stop doing the bidding of the US. Yet the times are changing and Riyadh seems to sense that.

Washington wants all the benefits but none of the responsibility

We are now accustomed to the proliferation of unbacked currencies, so it’s hard to appreciate just how unusual the petrodollar arrangement was for a world long used to dealing with some form of gold standard. It’s one thing for a government to insist that a currency be accepted within its own borders, but to propose that another country part with real goods – such as oil – for money backed by absolutely nothing would have been a tough sell in past eras. Yet the US managed to do that and more.

But such an arrangement would never have been sustainable for so long – longer than the gold-backed Bretton Woods lasted – based on military power and backroom dealings by cabals of diplomats alone.

While Washington has always acted with a certain sense of impunity, believing there to be no viable alternative to the dollar, for the several-decade-long golden age of the petrodollar there was at least an economic justification for it. It worked well enough for the rest of the world that, until recently, no major bloc emerged to oppose it. There also was the long shadow of Paul Volcker to give it credibility.

However, just as the US reneged in 1971 on its obligation to convert dollars into gold, it later reneged on its implicit obligation to maintain the value of the dollar against oil. Since then, Washington has shed all semblances of fiscal restraint and any pretense of managing the dollar in the best interests of everyone. Instead, it now wields the greenback as a weapon in a desperate bid to roll back the very events it helped set in motion by not preserving the integrity of the currency in the first place.

The US is now fighting to maintain all the benefits of this broken system, the responsibility for which it is neither equipped nor willing to take any longer. If the dollar isn’t pegged to gold and isn’t even implicitly backed by oil, and Washington won’t preserve its integrity, then it is hardly up to the task of facilitating trade in critical resources. A system as deeply entrenched as the petrodollar won't disappear overnight, but when its economic foundation has eroded, it can only be maintained for so long by bluster and smoke and mirrors.

By Henry Johnston, a Moscow-based RT editor who worked in finance for over a decade

https://www.rt.com/business/599637-us-dollar-oil-deal/

===========

Interesting, related, from the same analyst : from 12 Dec, 2023

2a) Abuse only gets worse with time: How the US increasingly mistreats its closest allies

A mainstay of Washington’s policy since even before the end of World War II has been to make economic dependencies of its friends

At a recent investment forum in Moscow, Russian President Vladimir Putin remarked on the ill-treatment the US subjects others to. At first glance, this is hardly news. Washington has an extensive toolkit that includes all types of sanctions, economic coercion, and regime-change operations to deal with its real or perceived adversaries. But in this case, Putin was commenting on Washington's treatment of its very own allies.

“In fact, the US… exploited its allies just like any other actor of the global economy,” the Russian president said.

Recent events have laid bare a strategy that has been central to US policy for decades, and now the world is increasingly taking notice.

The early seeds of exploitation ("Now, the advantage is ours here, and I personally think we should take it....” )

It is July 1944, and these are the words of US Treasury Secretary Henry Morgenthau. World War II had turned decisively in the Allies’ favor, and delegates from 44 countries had convened in the New Hampshire resort town of Bretton Woods to hash out a post-war economic order.

Morgenthau was instructing the American delegation to the conference, which was led by Harry Dexter White, a senior Treasury official. White fully agreed with his boss, replying: “If the advantage was theirs, they would take it.”

If the Americans clearly did hold the advantage, one might wonder which American adversary White had in mind in his reply: Who was the “theirs?” The Axis powers, presumably? No. He meant Great Britain, a close ally whose troops had stormed the beaches of Normandy side-by-side with the Americans just a few short weeks earlier – but by this time was in dire economic straits and nearly bankrupt.

It is rare to see the American approach articulated so clearly and unabashedly. Since even before World War II ended, a central feature of US policy has been to bring allies into its economic orbit – not as equals, of course, but as dependencies – and to keep them there.

If, in the initial postwar period, there was at least some legitimate benefit to adopting US-centric trade and monetary policies, as the US economy has become an increasingly indebted and financialized shell of its former self, Washington has had little to offer allies except threats and coercion.

However, maintaining discipline through a whole lot of stick and not much carrot can’t work forever, especially as a new, multipolar world forms that promises opportunities for new partnerships. The US risks, as historian Michael Hudson put it, suffering the fate of the protagonist of a Greek tragedy, who brings about precisely the outcome that he had sought to avoid.

Multilateral collaboration – the American way

Bretton Woods has long occupied a cherished place in the creation myth of the American-led ‘rules-based order’ as a shining example of collaboration among enlightened states to usher in a prosperous new world and avoid the mistakes of the [1919-1939] interwar period that gave rise to economic nationalism and protectionism – policies seen as helping the nascent Nazi regime germinate.

But the US saw the conference and the initial post-war era as a geopolitical struggle and an opportunity to dismantle the fading British Empire and roll out a new economic system that would cement the primacy of the dollar and spawn institutions such as the IMF and World Bank, which would serve American interests.

In fact, economist Benn Steil, author of the book ‘Battle For Bretton Woods,’ argues convincingly that even as the war was ongoing, the Roosevelt administration was already examining how it could turn Britain’s impending bankruptcy to its geopolitical benefit. The US, Steil maintains, was managing its financial aid to Britain carefully to get it through the war but, at the same time, limiting its room for maneuver in the postwar world. Incidentally, the US providing an ally with just enough aid to muddle through a war while turning it into a client state might ring familiar to observers of the current conflict in Ukraine.

Meanwhile, at Bretton Woods, the Americans made good on Morgenthau’s exhortation to press their advantage. They pushed through their proposal for the dollar to be pegged to gold at $35/oz and all other currencies pegged to the dollar over the British proposal, as articulated by the renowned economist John Maynard Keynes, for the creation of a neutral reserve asset called bancor that would be used to settle trade between nations.

Geoffrey Crowther, then the editor of The Economist magazine, called the bancor proposal a much better idea and warned that “Lord Keynes was right ... the world will bitterly regret the fact that his arguments were rejected.” As the US increasingly abuses the privilege the dollar grants it while the BRICS group seeks to create a neutral supranational currency that will, in some key ways, resemble the discarded bancor, Crowther seems prophetic.

What had gotten Britain through the war was the Lend-Lease program launched by the US in 1941, which provided London with crucial financial aid. But, much to the surprise of the British, the program was abruptly stopped when the war ended. By late 1945, the country’s economy was in tatters.

British Prime Minister Clement Attlee dispatched an ailing Keynes – less than a year from death – to Washington seeking financial assistance. The eminent economist and his countrymen were expecting a generous offer from the Americans – grant aid or an interest-free loan – in recognition of the tremendous sacrifices of the British war effort, which predated the US becoming involved.

Keynes would be in for a rude awakening. Far from receiving a subsidy as a show of gratitude, what was offered after months of hard wrangling – called the Anglo-American Loan Agreement – was a very commercially oriented $4.4 billion loan laden with terms that essentially economically subjugated Britain to its former colony. It was in those onerous conditions that the true demonstration of American superiority lay.

First of all, the Brits had to liberalize trade and open up the Commonwealth to US exporters, who proceeded to displace British companies. But even more devastating was the stipulation that the pound be made convertible to the dollar at a fixed rate. This would allow Britain’s colonies and dominions to unload sterling for dollars, a longstanding demand of US exporters, but it would also further drain London’s already meager reserves.

Indeed, in July 1947, when the measure took effect, the pound succumbed to overwhelming selling pressure as capital flowed out, and the UK essentially went bankrupt. Shortly thereafter, the free convertibility of the currency was suspended. It was an event entirely scripted by the US Treasury.

The loan agreement was, to put it mildly, not well received in the UK. MP Robert Boothby called it “our economic Munich.” Labour MP Norman Smith complained that the country was being treated as the defeated party in the war.

British politician Leopold Amery argued that the convertibility clause caused the country to lose control of its own currency, which furthered American control over Britain’s monetary policy.

However, fearing the alternative to accepting the loan was worse, Attlee and the Labour government relented and agreed.

Great Britain eventually recovered economically and paid off the loan, making the final payment in 2006 to some fanfare, and the circumstances surrounding the agreement were largely forgotten in the UK. But what is incontrovertible is that from this point on Britain would be firmly entrenched in the dollar system and entirely in the US orbit.

Ushering in Japan’s lost decade

If Great Britain was an empire already in terminal decline whose departure from the stage of superpowers was only hastened by Washington, Japan was quite the opposite. Having recovered remarkably quickly from the destruction of World War II, by the late 1970s, it had established itself as the world’s second-largest economy and had emerged as an innovation and technology hub every bit the equal of the US. It had also become a staunch ally of Washington during the Cold War.

The US, meanwhile, had just emerged from a recession and a long bout of inflation only quelled by the draconian efforts of Fed Chair Paul Volcker. Ronald Reagan was in office, and it was full-steam ahead with a set of policies – tax cuts on the rich in tandem with interest rate cuts – that would lead to skyrocketing budget deficits and a massive increase in foreign debt.

Japan, meanwhile, was running huge trade surpluses as a result of selling the world everything from cars to video cameras. As Reagan ran up huge deficits – in no small part to boost military spending in an effort to drive the Soviet Union to bankruptcy while trying to keep up – Japan plowed huge sums into US Treasuries, thus helping to finance the deficit spending.

It was certainly a fantastically convenient arrangement for the US and one that by no means emerged by chance. One of the great achievements – if you want to call it that – of the US-engineered financial system is that it managed to make its own debt an indispensable part of the undergirding of the entire system.

To look at this in a larger context, when Great Britain was the world’s largest debtor and the US the largest creditor at the end of World War II, this state of affairs was seen as an insurmountable weakness on the part of the British that rendered them entirely beholden to their creditor. But when the US assumed that exact same role as the world’s largest debtor – with Japan and subsequently China in the role of largest creditor – there was no sense that it put the US in a position of fealty. That is because the US was issuing its debt in its own currency and had managed to leverage its economic and military strength to ensure the global prominence of that currency.

For the Japanese at the time, though, it’s hard to imagine what else they could have done with the huge surplus balances they were accumulating. The US was just about the only game in town.

But with pro-growth policies running on all cylinders in the US, Washington began to see the dollar as overvalued. In September 1985, the G5 delegates met at the Plaza Hotel in New York and reached an agreement at the behest of the US whereby the main current account surplus countries – Japan and Germany – would strengthen their currencies, ostensibly to boost domestic demand.

The result was a sudden appreciation in the Japanese yen – it was up 46% against the US dollar by the end of 1986. Accordingly, Japanese exports essentially collapsed, having been made too expensive. In order to compensate for this, the Japanese authorities introduced a number of stimulus measures that essentially created a bubble in the economy – most notably in the real estate sector.

What ensued, albeit not immediately, was Japan’s so-called ‘Lost Decade,’ the direct cause of which was interest-rate hikes by the Bank of Japan to cool down the overheated real estate market. However, the overheating was a direct consequence of the measures taken to soften the blow of the US-initiated Plaza Accord. As Michael Hudson points out, what essentially happened was that it was actually the US that triggered the bubble in the first place – via cutting rates and increasing spending. But through the Plaza Accord, it managed to export the consequences of that bubble to its allies – namely Japan.

There is another angle to the US assault on its ally Japan’s economy. By the 1980s, the Japanese were at the absolute cutting edge in innovation. This resulted in a clash with the US over something that would sound familiar to contemporary observers: the semiconductor trade. Japanese firms had begun to produce chips of arguably higher quality than the American ones but at a significantly lower cost.

This, of course, did not sit well with the Americans, who feared that Japan might not only gain the upper hand economically but also militarily, since advanced technology was a cornerstone of US military dominance.

None too pleased with the rise of an ally, the Reagan administration took action. In 1986, the US pressured the Japanese into agreeing to set a price floor for chips sold abroad and promising that its companies would buy more chips from the US. Dissatisfied with Japan’s tepid compliance with these conditions, the following year the US went further and imposed 100% tariffs on a range of Japanese goods, including computers, televisions, and a number of hand tools.

It was the most stringent economic measures taken against Japan since World War II and, coming on top of the Plaza Accord, played no small role in Japan’s economic decline from which the country has still not fully emerged to this day.

A bigger stick and a much-diminished carrot

However manipulative US policy towards its allies was in the early postwar period, there is no doubt that being economically aligned with the US – while certainly doing nothing for national sovereignty – did provide benefits, sometimes even considerable ones.

The US emerged from World War II with roughly three-quarters of the world’s monetary gold stock and was responsible for around 50% of GDP. It was by far the globe’s leading industrial power and was able to disburse aid and provide the manufacturing and financial muscle to rebuild war-torn economies. It is hard to argue that the Marshall Plan didn’t help a devastated Germany get back on its feet – even if it did cement Germany as an ally that, as we have learned recently, is willing to severely compromise its own interests for the sake of US policy aims.

Even the dollar system, as self-serving for the US as it has been, did serve the purpose of providing liquidity and ease of trade in a rapidly globalizing postwar world. Many economists argue that such rapid growth in international trade would have been unfeasible under any sort of gold-based system. There were complaints about the primacy of the dollar as far back as the 1960s, especially from the French, but it is telling that until recently there were no real steps taken to fundamentally change the system.

Of course, there were instances of egregious abuse by the US – such as when President Richard Nixon unilaterally pulled the US out of Bretton Woods by removing the gold backing to the dollar in 1974 without even so much as consulting with allies.

But there was also some attempt to acknowledge the responsibility for managing the global currency in the best interests of everybody. When Volcker traveled to Belgrade for the IMF meeting in early October 1979, the dollar was in the midst of a full-blown crisis due to rampant US inflation. In Belgrade, he met with key American creditors, namely the German and French, who, by all accounts, told him sternly that he must do something to stem the dollar weakness that was eroding the value of their holdings with each passing day.

Volcker spent less than 24 hours in Belgrade and did not even stick around until the end of the conference. He departed back for Washington, by the Fed’s own account, with his ears ringing from the admonishments of America’s trading partners.

Just days later, he unveiled a set of measures, dubbed the October Reform, aimed at reining in inflation – and, by extension, protecting the dollar and the value of the holdings of American trade partners.

But what has transpired since has been a steady hollowing-out and financialization of the US economy – meaning an increase in leverage on a decreasing sliver of actual economic activity. America’s industry was largely offshored and replaced with a growth model based on inflating real estate and securities prices, boosting corporate profits through offshoring production and endless stock buybacks, and taking advantage of the fact that the US could still raise almost endless debt in dollars without suffering the usual consequences.

The US is rapidly losing its billing as the only game in town and, in its current state, has very little to offer allies. It is not difficult to see that the likes of China, Russia, and many others can now offer superior trade and investment opportunities. And now Washington is well on its way to debauching the value of the only thing keeping it afloat – the dollar – not only by weaponizing it but also through unprecedented fiscal profligacy.

Bringing the story up to the present day, when the US was pressuring Germany to abandon the Nord Stream 2 pipeline project with Russia, even before the conflict in Ukraine began, it was almost a crude parody of the sophisticated paternalism previously practiced by the US. Not only was it an utterly brazen attempt to interfere with an ally’s own affairs – as if the Germans themselves couldn’t weigh the risks of doing business with Russia – but it so blatantly contradicted Berlin’s own interests that it can’t be seen as anything other than an act of desperation.

So, when US President Donald Trump stood side-by-side with Russian President Vladimir Putin at their press conference in Helsinki in July 2018 and announced with his usual bluster that the US was planning on “competing” for the European gas market, it was a mix of disingenuousness and fantasy thinking – disingenuous because the US had no intention to compete on a level playing field and fantastical because the US, with its LNG priced some 30-40% above Russian piped gas, couldn’t compete anyway.

The US did end up displacing Russian gas in Europe, but hardly because it ‘outcompeted’ Moscow. The wreckage of the Nord Stream pipeline at the bottom of the Baltic Sea is not a display of American strength.

The Nord Stream episode, the sanctions on Russia, the attempts to coerce Europe to decouple from China – these can be thought of not so much as attempts to keep Russia and China ‘out’ but to keep the allies ‘in.’ A new Iron Curtain is descending, not on the opposing bloc but on America’s own allies, who are to be perpetually locked inside an increasingly desiccated system.

By Henry Johnston, an RT editor. He worked for over a decade in finance and is a FINRA Series 7 and Series 24 license holder.

https://www.rt.com/business/587983-us-allies-abusive-relationship/

======= Interesting, related, from the same analyst from 1st March 2024

2b) Schizophrenic world order: The West is willing to destroy its financial system to punish Russia

Today’s Western leaders exhibit a strange mix of self-assuredness and anxiety that’s characteristic of those defending the status quo during times of sweeping change

US Treasury Secretary Janet Yellen has become the latest to add her voice to the growing chorus of Western officials calling for the seizure of Russia’s $300 billion in frozen foreign-exchange reserves for the benefit of Ukraine. This comes after UK Prime Minister Rishi Sunak penned an op-ed over the weekend in which he called for the West to be “bolder” in moving toward confiscating the assets.

Notwithstanding the reticence being displayed in some quarters of Europe and various admonitions that such an action would be both blatantly illegal and also detrimental to the integrity of the financial system, the idea seems to be taking on a momentum of its own, particularly in Washington and London.

What we are seeing is a vivid example of the type of thinking that places perceived short-term gains ahead of a commitment to preserve the integrity of an institution that derives its potency precisely from widespread confidence in that integrity. It is also, as we will see, a manifestation of a particular type of paradoxical impulse that arises during times of momentous change.

In this case, the institution in question is the Western-led global financial system, at the very heart of which is the US dollar. Outright confiscation of the Russian central bank reserves that have been immobilized since shortly after the Ukraine conflict began in February 2022 would deliver another jolting blow to the credibility of this system. Even as most of the assets are actually held in Europe, there would be no confusion about who was calling the shots and whose credibility is on the line.

Of course, views differ about how much integrity the dollar-centric system ever had, and certainly the entire Bretton Woods framework established in the waning days of World War II very much served the interests of the victorious Americans. But it cannot be disputed that for decades the dollar was widely viewed across the geopolitical spectrum as not just a market-determined reference point and currency for trade but as a safe store of value. As trade became increasingly liberalized, assumptions about a safe and dependable dollar system were built into all manner of economic and trade policies. Such assumptions became part of the very fabric of the global financial system.

Where risks related to the dollar were understood to exist, they were largely seen as lying in the realm of interest-rate policy – in other words, these were market risks rather than risks inherent to the system itself. A series of emerging-market crises in the 1980s and ‘90s left many countries chastened about the perils of excessive dollar debt and the dangers that US interest-rate hikes can unleash.

But one of the conclusions that many countries drew from these episodes was the necessity of holding greater dollar reserves as a bulwark against shocks. Between 2000 and 2005, right on the heels of two decades of crises often triggered by rising dollar interest rates, emerging markets actually accumulated dollar reserves at a record pace of about $250 billion per annum, or 3.5% of GDP – a level five times higher than in the early 1990s.

In other words, countries responded to shocks emanating from the dollar realm by increasing holdings of dollars. This only underscores the nature of how dollar-related risk was perceived at the time. It simply didn’t occur to anybody that greater exposure to the dollar was itself a risk. The idea that hundreds of billions of dollars’ worth of reserves could simply be confiscated if a country found itself at odds with the overseers of the system didn’t factor into any of the equations.

The weaponization of the dollar in recent years has introduced a heretofore unimagined source of risk. That there is now a political risk premium to using the dollar is already a serious deviation from how the currency was viewed for decades. The consequences of this are already apparent for all to see – the widespread de-dollarization trend – although many in the halls of Western power remain dismissive about what is happening.

But perhaps even more insidious is that those advocating for the seizure of Russia’s reserves have turned on its head a fundamental principle of the entire liberal idea. This is best thought of as a conflation of outcomes and processes. A liberal society or rule-of-law-based system – call it what you want – is held together not because all agree on outcomes and policies, but because there is a consensus on the set of processes and rules by which those outcomes and policies are implemented. The processes and rules do not exist to ensure particular outcomes and, in fact, may produce outcomes that are at odds with the interests of those who preside over those rules.

With the plan to confiscate the Russian assets, what we are seeing is a desired outcome being trumpeted as an act done in defense of the liberal order (punish the liberal-values-stomping Russia and support the liberal-democracy aspirant Ukraine), whereas the integrity of the processes is now entirely secondary. Since the desired outcome does not emerge from any reasonable application of existing processes, what is being sought is a radically different interpretation of those processes. When Western officials call for finding “a legal way” to confiscate the assets, what they really mean is that the outcome is paramount and that any legal fig leaf will do.

To put it plainly, the liberal order is no longer being defended by an appeal to its deeper principles but by efforts to advocate outcomes that superficially seem to advance its interests – even if those outcomes emerge from a distinctly illiberal approach.

When this extremely critical distinction undergoes corrosion – as is happening now – the challenge is to see the deeper change not in terms of a different outcome but in terms of a transformation of the processes that produce the outcome. For quant geeks, think of it in terms of statistical process control, where one tries to determine whether or not a process has remained within specs or has undergone some sort of shift.

The 20th century Spanish philosopher Jose Ortega y Gasset described the rise to prominence in Western civilization of a certain type of person who takes for granted the institutions he has inherited and presides over, enjoying their benefits while giving scarce thought to how these institutions arose and what must be done to maintain them. Ortega likened such a person to a spoiled child or a hereditary aristocrat. Ignorant of the fragility of his inheritance and supremely confident in himself, he inevitably ushers in a degradation of the very institutions he has been entrusted with.

Such is the essence of the current crop of Western leaders, particularly those in Washington. Born mostly in the decades immediately following World War II, they take as a given the supremacy of the liberal, rules-based order and its economic wing – the dollar-based financial system. They speak of this world order not with reverence and a deep understanding of its roots but in emotionally laded yet vacuous cliches. While benefitting themselves greatly from the liberal order, they show little interest in the actual principles that purport to underpin it. They invoke it constantly, but mostly in order to bludgeon various foes and adversaries.

A recent op-ed in the New York Times by Bret Stephens titled ‘How Biden Can Avenge Navalny’s Death’ listed seizing Russia’s $300 billion in frozen funds as a potential avenue for making good on a warning Biden gave to Russian President Vladimir Putin in 2021 of “devastating” consequences should the opposition leader die in prison.

Stephens does mention concerns that such a move could trigger flight from the dollar, but concludes that such an argument “might otherwise be persuasive if the need to save Ukraine and punish Russia weren’t more urgent.” In other words, the very dollar system that the US relies on for what’s left of its prosperity can be sacrificed at the altar of the symbolic gesture of, as Stephens puts it, pursuing “the strategic imperative of demonstrating to a dictator that American threats aren’t hollow.”

Janet Yellen, a paladin of the liberal global order if there ever was one, was dismissive in recent comments of the threats that seizing Russia’s reserves would pose to the system itself. It is “extremely unlikely” that tapping the funds would harm the dollar’s standing because “realistically there are no alternatives,” she believes. For Yellen, her support marks an about-face from her earlier view that such a move was “not legally permissible in the United States.” But the winds have now changed and the legal case is apparently looking more promising.

Such is the prevailing insouciance among the ruling class. Like a soon-to-be-deposed king who takes for granted the permanence of the monarchy, today’s leaders simply cannot contemplate at any depth what constitutes the true foundation of the system they preside over.

But there is something else at play. It bears recalling what has animated the discussion of seizing Russia’s assets in recent weeks in the first place: it is the panic setting in over the drying up of funding for the clearly failing Ukraine proxy war against Russia. In other words, notwithstanding the self-assured tones from the likes of Yellen, the plan has not emerged from a place of strength. The willingness to take such a dangerous step for very short-term aims (putting aside the question of whether $300 billion can even save the West’s Ukraine project) can be seen as akin to burning the furniture as a last resort to stay warm – it reeks of desperation.

Thus we can say that the type of thinking driving the push to seize the Russian assets derives from the self-assuredness about which Ortega speaks but also from a burgeoning anxiety. The former is due to Western leaders’ apparent belief in the indestructability of the institutions that they are actually undermining; the latter because they are facing a cascade of crises and are increasingly frantic in seeking stopgap solutions at whatever long-term cost.

The inversion of outcomes and processes that we spoke of earlier is another manifestation of this essentially schizophrenic mindset. There is a belief that the system can withstand such blows to its integrity: assets can be stolen and rules subverted but the dollar will always be on top. And yet the act of subordinating processes to outcomes is itself a reflection of a fear that the system is too fragile to withstand undesirable outcomes. If Russia retaining possession of its $300 billion in reserves is an outcome too dangerous for the liberal order to survive, then things are in bad shape.

These two seemingly irreconcilable traits – self-assuredness and deep anxiety – are often found coexisting among those in positions of power who are trying to cling on to the status quo during times of epochal change. It is what drove the arrogant and clueless Romanian leader Nicolae Ceausescu to call a large rally in Bucharest in 1989 that would prove to be his final undoing. Historians may very well look back at the arrogant and clueless Janet Yellens and Rishi Sunaks as caught up in historical processes that they could neither comprehend nor control.

" ........ The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT. "

https://www.rt.com/business/593324-russia-frozen-assets-confiscation/

=======================================

These articles plus many more can be found on RT.com website, if you are lucky enough to live in a country where Russia's media isn't banned

-

5:13:43

5:13:43

ItsMossy

13 hours agoHALO WITH THE RUMBLERS (: #RUMBLETAKEOVER

29.7K1 -

1:54:08

1:54:08

INFILTRATION85

6 hours agoHi, I'm INFILTRATION

31.7K9 -

7:51:03

7:51:03

GuardianRUBY

8 hours agoRumble Takeover! The Rumblings are strong

61.8K2 -

4:28:45

4:28:45

Etheraeon

15 hours agoWorld of Warcraft: Classic | Fresh Level 1 Druid | 500 Follower Goal

45.5K -

3:17:21

3:17:21

VapinGamers

7 hours ago $3.60 earned🎮🔥Scrollin’ and Trollin’: ESO Adventures Unleashed!

31.2K2 -

LIVE

LIVE

a12cat34dog

9 hours agoGETTING AFTERMATH COMPLETED :: Call of Duty: Black Ops 6 :: ZOMBIES CAMO GRIND w/Bubba {18+}

320 watching -

8:23:18

8:23:18

NubesALot

11 hours ago $5.12 earnedDark Souls Remastered and party games

27.9K -

3:03:42

3:03:42

GamersErr0r

23 hours ago $2.14 earnedits not what you think

22.9K1 -

7:15:50

7:15:50

Phyxicx

9 hours agoRocket League with Friends! - 11/22/2024

17.1K1 -

7:54:29

7:54:29

STARM1X16

9 hours agoFriday Night Fortnite

14.3K