Premium Only Content

Checking in with Richard Laterman, Ep #55

Richard Laterman is a Portfolio Manager at ReSolve Asset Management, Inc. with 18 years of investment experience in capital markets. He has the unique ability to take complex information and boil it down into something concise and understandable.

In his role, he provides us with invaluable information about geopolitical events, economic events, and the markets.

In this conversation, we get Richard’s opinion on the world, the drive to embrace alternative strategies, and the necessity of leaning into discomfort.

================================

LISTEN IF YOU ARE INTERESTED IN…

[2:39] The typical day in the life of Richard Laterman

[6:58] Richard’s current view of the world

[18:55] Living to work instead of working to live

[22:51] The drive to embrace alternative strategies

[32:26] Let’s get comfortable being uncomfortable

[39:10] What will accelerate change?

Richard’s current view of the world

We are coming into a paradigm shift. Things like the YOLO mentality, meme stock craze, and financial nihilism are striking a chord with the younger generation. From a macro perspective, we all know that the current system isn’t sustainable.

There’s a lived reality that inflation and the cost of living are far higher than the CPI tells us. People around the world are suffering because of it. Yet the powers that be excel at finessing the numbers to serve their narrative, to kick the debt can down the road.

Honestly, most people don’t have the time or energy to cess out the facts from the opinions that are reported to us. Many of Amy’s well-educated hard-working friends don’t own homes because they can’t, not because they don’t want to. Yet we’re reading that the US is “flourishing.”

Living to work instead of working to live

Iain McGilchrist, in his book “The Master and His Emissary,” dissects the differences between the left and right hemispheres of the brain. He espouses the idea that the right hemisphere should be the “master” because it specializes in decision-making. The left brain is reductionist; it should be the analyst. It brings the information and findings back to the right brain for integration.

Iain believes that society has shifted more toward reductionist left-brained thinking. It emphasizes gamification and rewarding sociopathic behavior. Society has embraced a narrow focus on goals and maximizing one’s utility without accounting for the downstream effects of one’s actions.

As increasing numbers of people embrace this mindset, they cease to be productive members of society. That’s when the potential for violence and extremism creeps in. If society at large can't provide for their families or live a fulfilled life, they become disenfranchised—easy targets for radicalization.

The drive to embrace alternative strategies

People are seeing that the traditional 60/40 portfolio allocation isn’t cutting it. They want to expand into alternative strategies. Why? Because we all have this perception that things are heading towards an unsustainable situation.

Everyone is feeling some sense of disconnect. We’re willing to address it in the way we feel is best, despite it being uncomfortable. It’s our job to explain what’s happening and why we’re making the decisions we’re making with our client’s portfolios.

When you embrace diversification, you will be uncomfortable in the beginning. But in the long-term, we’re building a resilient portfolio that you can stick with long-term. One that can ride the waves of the geopolitical climate.

What will accelerate change? Listen to our whole conversation to get an in-depth look at how the geopolitical landscape impacts investing.

Richards Laterman is not affiliated with or endorsed by LPL Financial or Capital Investment Advisers.

Securities and Advisory services offered through LPL Financial. A registered investment advisor. Member FINRA & SIPC.

The financial professionals associated with LPL Financial may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

================================

RESOURCES MENTIONED

Doomberg SubStack: https://newsletter.doomberg.com/

The Master and His Emissary by Iain McGilchrist: https://www.amazon.com/Master-His-Emissary-Divided-Western-ebook/dp/B07NS35S76/

=================================

CONNECT WITH RICHARD LATERMAN

ReSolve Asset Management: https://investresolve.com/team/richard-laterman/

Connect on LinkedIn: https://www.linkedin.com/in/richard-laterman-cfa-77778915?originalSubdomain=ca

=============================

CONNECT WITH EMERSON:

Website: www.CIAdvisers.com

-

8:24

8:24

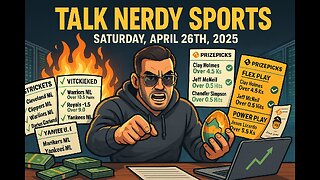

Talk Nerdy Sports - The Ultimate Sports Betting Podcast

1 hour ago4/26/25 - Saturday Annihilation: Vasil’s 8 Sharp Picks and 2 PrizePicks Built for Blood 💥📈

2.45K -

LIVE

LIVE

I_Came_With_Fire_Podcast

10 hours agoRESTRUCTURING THE WORLD- CIVICS CLASS WITH DAN HOLLAWAY

355 watching -

DVR

DVR

Bannons War Room

2 months agoWarRoom Live

14.2M3.57K -

LIVE

LIVE

Total Horse Channel

1 day agoYELLOWSTONE SLIDE I | SATURDAY

330 watching -

23:52

23:52

The Rad Factory

3 hours ago $0.67 earnedIs My Formula Race Car Faster Than a Go Kart?

7.06K2 -

20:56

20:56

marcushouse

3 hours ago $1.12 earnedStarship Flight Test 9 Vehicles FINALLY Prepare, and Huge Starbase Upgrades – It's All Happening!

11.3K12 -

23:48

23:48

CatfishedOnline

17 hours agoVictim's Life is Threatened After He Gets in Too Deep With a Crypto Scammer

8.37K2 -

8:40

8:40

Shea Whitney

4 hours ago $0.74 earned12 Fashion Mistakes Making You Look OLD & OUTDATED!

10.9K3 -

29:18

29:18

TampaAerialMedia

5 hours ago $0.24 earnedUpdate SARASOTA, FL 2025 - St Armands, Lido, & Longboat Key

7.22K1 -

15:52

15:52

ARFCOM Reviews

22 hours ago $0.42 earnedNew Entry Level RDS | Primary Arms MD 21 GLx/SLx

9.24K3