Premium Only Content

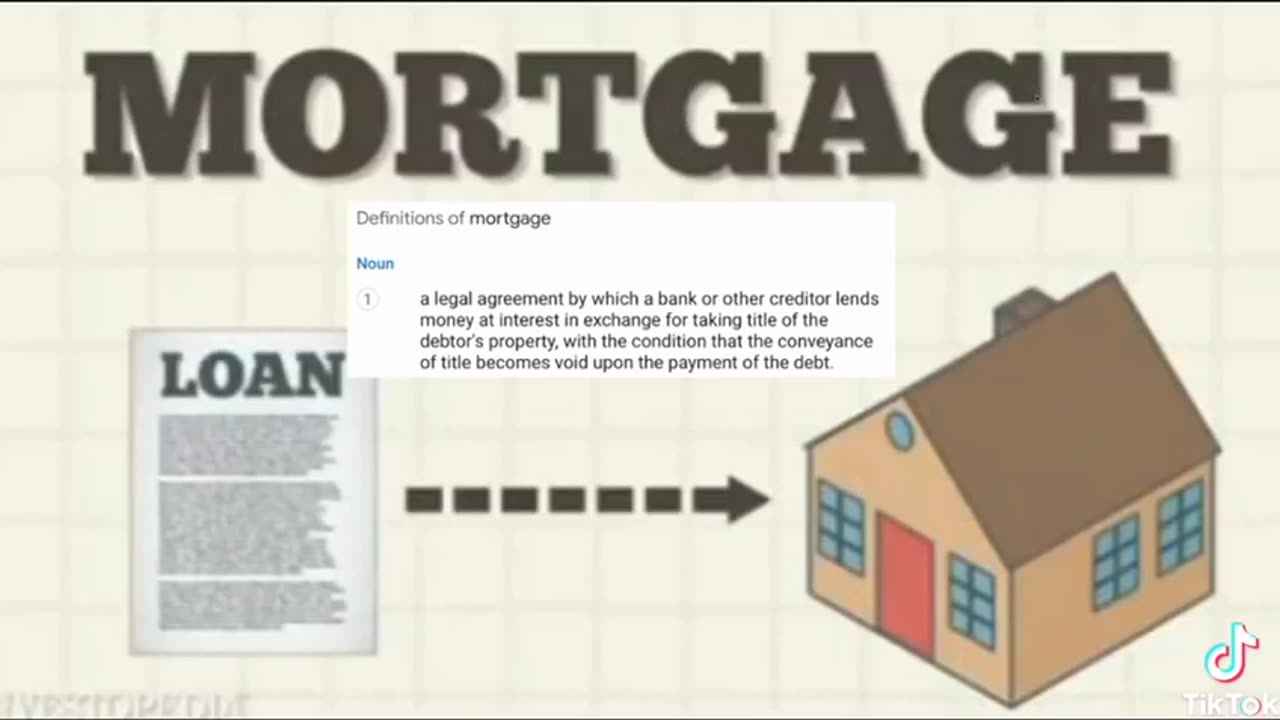

MUST WATCH!! - The Mortgage Title Deed Scam - 3min video that may help you a lot!

..and the other part of the truth is when you go for a mortgage the bank gives you a mortgage proposal agreement form to sign where they offer you the mortgage....the second you sign it the form becomes a Promisory Note that immediately takes on the value of the mortgage, that PN is then traded on the stock exchange or it can be sold on. The buyer of the house then walks away with a debt for the mortgage that they then repay in full with interest, but the reality is the second they signed the form the debt was cleared as the debt became a PN worth the value of the mortgage. What makes it worse is the buyers own Cestui Que Vie Trust provides the capital/collateral. So the buyer ...

1. Gives the bank a promisory note worth the value of the mortgage

2. The buyer repays the mortgage in full plus interest

3. The buyer pays the loan amount again using their CQV Trust

and the Bank gets paid twice, plus gets the same amount a third time in the value of the promisory note, and yet the bank put ZERO on the table

These Banks and Mortgage Lenders and those scumbags in Land Registry are ALL complicit in this gross act of theft, fraud, and whatever else you can call it.

The clock ticks.... soon

-

47:50

47:50

Candace Show Podcast

6 hours agoBREAKING: Judge Makes Statement Regarding Taylor Swift's Text Messages. | Candace Ep 155

94.3K105 -

DVR

DVR

Josh Pate's College Football Show

3 hours agoCFB’s Most Hated Teams | FSU & Clemson Future | Big Ten Win Totals | Star Rankings Overrated?

5.76K -

1:33:47

1:33:47

CatfishedOnline

4 hours agoGoing Live With Robert - Weekly Recap

19.4K -

55:18

55:18

LFA TV

1 day agoEurope’s Sudden Turn Against America | TRUMPET DAILY 3.6.25 7PM

25.5K3 -

4:21

4:21

Tundra Tactical

4 hours ago $1.38 earnedPam Bondi MUST Enforce Due Process NOW!

18.4K1 -

56:42

56:42

VSiNLive

5 hours agoFollow the Money with Mitch Moss & Pauly Howard | Hour 1

43.6K1 -

1:05:32

1:05:32

In The Litter Box w/ Jewels & Catturd

1 day agoShalom Hamas | In the Litter Box w/ Jewels & Catturd – Ep. 756 – 3/6/2025

98.7K37 -

1:23:00

1:23:00

Sean Unpaved

7 hours ago $2.98 earnedNFL Free Agency

50.9K3 -

18:25

18:25

Stephen Gardner

6 hours ago🔥The REAL REASON the Epstein Files are being HIDDEN | I CONFRONT Alan Dershowitz for details!

63.3K110 -

1:58:44

1:58:44

The Quartering

9 hours agoTrump To Charge USAID Staff, Campus RIOT Erupts, Theo Von & Candace Owens, Ukraine Gets Worse!

114K72