Premium Only Content

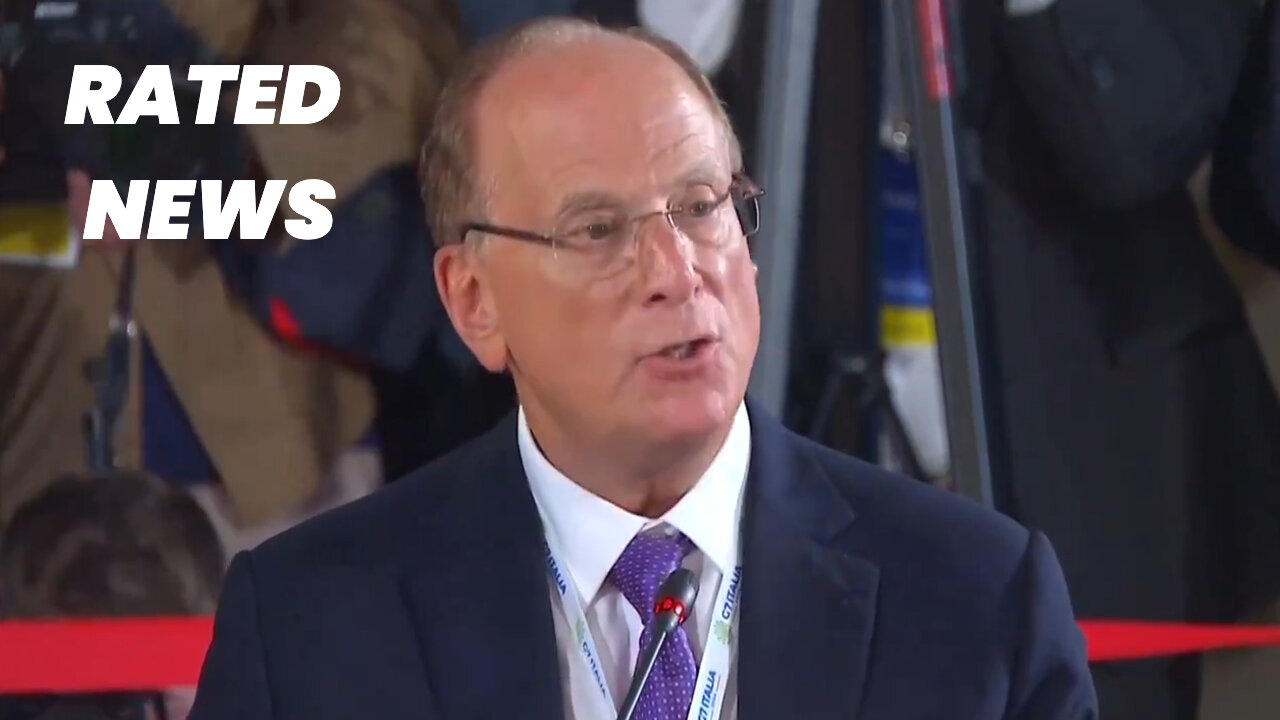

Larry Fink Highlights G7 Debt Concerns, Urges Public-Private Partnerships

BlackRock CEO Larry Fink highlighted the pressing issue of high G7 debt-to-GDP ratios, averaging 129%. Fink stressed that traditional measures like taxation and spending cuts are insufficient to address this debt. Instead, he emphasized the critical need for building new infrastructure through public-private partnerships. Watch the video to understand Fink's insights on economic stability and growth.

Context Behind the Statement:

In a recent address, BlackRock CEO Larry Fink raised alarms about the high debt-to-GDP ratios among G7 countries, which average 129%. Fink pointed out that despite efforts to tax, cut, or reduce debt, these measures alone will not suffice to address the economic challenges faced by these nations.

Fink argued that building new infrastructure is a crucial strategy for achieving economic stability and growth. He specifically advocated for public-private partnerships as a means to efficiently develop and finance these infrastructure projects. According to Fink, such partnerships can mobilize private capital, leverage expertise, and foster innovation, ultimately leading to more sustainable economic development.

This perspective underscores the importance of collaboration between governments and the private sector in tackling large-scale economic issues. By focusing on infrastructure, Fink believes that countries can create a foundation for long-term prosperity, even in the face of substantial debt burdens.

For more detailed insights and updates on this story, check out our related videos and articles. Stay informed about the latest developments in economic policy and infrastructure investment.

-

LIVE

LIVE

LFA TV

23 hours agoGermany’s Conquest of Europe | TRUMPET DAILY 2.28.25 7PM

251 watching -

LIVE

LIVE

2 MIKES LIVE

3 hours ago2 MIKES LIVE #186 Oval Office Fireworks!

146 watching -

15:36

15:36

Tactical Advisor

7 hours agoMUST HAVE AR15 Upgrades for Under $100

86.3K4 -

28:11

28:11

Rethinking the Dollar

8 hours agoTrump(verse): Trump Family Going All In On Crypto

10.5K2 -

21:49

21:49

Mrgunsngear

4 hours ago $0.74 earnedBarrett M107A1 .50 Cal Semi-Automatic Rifle Review

23.7K2 -

1:14:18

1:14:18

Tucker Carlson

8 hours agoDr. Richard Bosshardt Reveals Deadly Truth: Most Surgeons Aren’t Fit to Practice. Here’s Why.

160K93 -

3:48:32

3:48:32

Right Side Broadcasting Network

10 hours agoLIVE REPLAY: Pres. Trump and Ukrainian President Zelenskyy Meet and Hold a Press Briefing - 2/28/25

266K186 -

2:59:13

2:59:13

The Charlie Kirk Show

7 hours agoTrump vs. Zelensky Reaction + The Epstein Misfire + Charlie vs. Newsom | Schimel, Marlow, Baller | 2.28

212K76 -

55:05

55:05

The Dan Bongino Show

10 hours agoAmerica Is Back In The World Stage, And We Love To See It (Ep. 2433) - 02/28/2025

912K1.98K -

49:29

49:29

The Rubin Report

9 hours agoDetails About Joy Reid’s Weeping Farewell No One Noticed with Co-Host Megyn Kelly

120K144