Premium Only Content

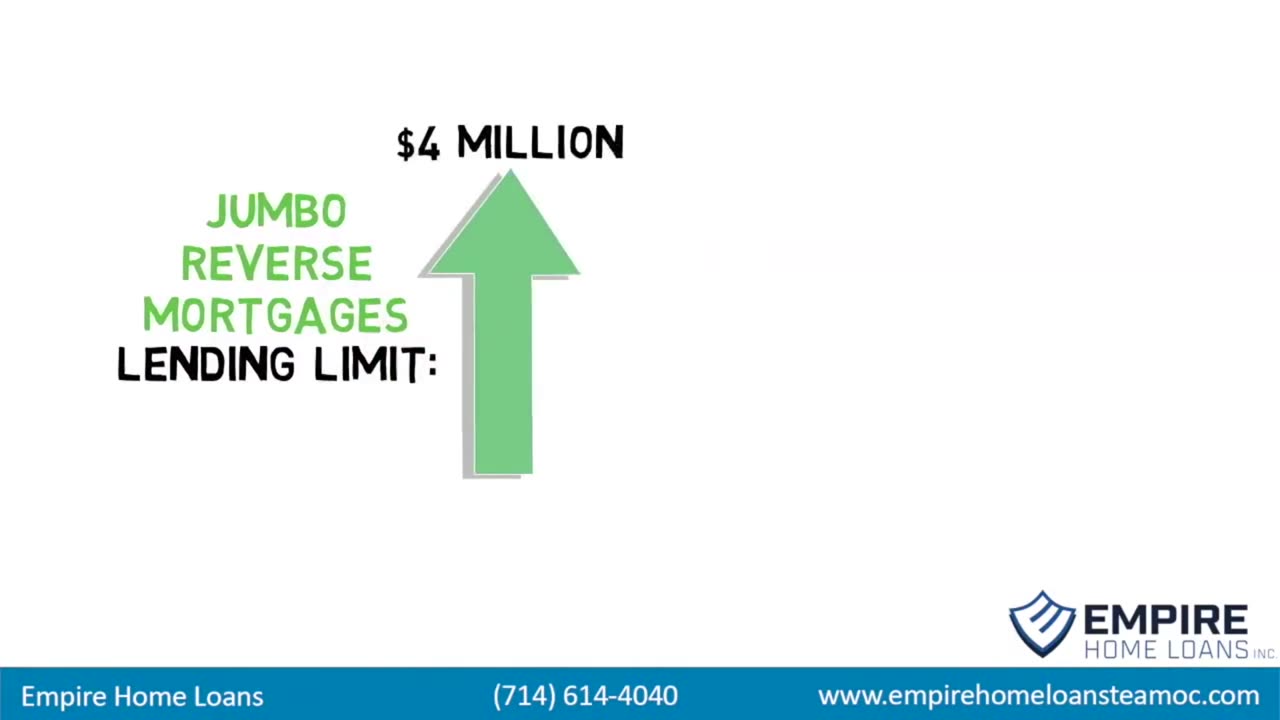

What Are the Benefits of Proprietary or Jumbo Reverse Mortgages?

Proprietary or Jumbo Reverse Mortgages offer several benefits, particularly for homeowners with high-value properties. Here are the key advantages:

1. Higher Loan Limits - Proprietary Reverse Mortgages typically offer higher loan limits compared to the federally insured Home Equity Conversion Mortgages (HECMs). I can offer loan amounts up to $4 million. This makes them attractive for homeowners with high-value properties, as it allows them to access more equity.

2. Access to More Home Equity - Since these mortgages are not subject to the Federal Housing Administration's (FHA) loan limits, homeowners can tap into a larger portion of their home equity, potentially resulting in a larger lump sum or higher monthly payments.

3. No Mortgage Insurance Premiums - Proprietary Reverse Mortgages do not require the payment of mortgage insurance premiums, which can be a significant cost in HECMs. This can make them more cost-effective in the long run.

4. Flexibility in Property Types - These loans are often available for a wider range of property types that might not qualify under HECM rules, including high-value homes, certain condos, and homes above the FHA loan limits.

5. Tailored for High-Value Properties - Proprietary Reverse Mortgages are specifically designed for homeowners with high-value properties. Lenders can offer products that better meet the needs and financial goals of this market segment.

6. Customized Loan Products - Proprietary Reverse Mortgage lenders often have more flexibility in structuring the loan terms, which can result in more customized solutions for borrowers. This might include varied payout options, loan terms, and qualifying criteria.

7. Interest Rates - Although interest rates can vary, Proprietary Reverse Mortgage products typically have slightly higher interest rates compared to HECMs. Depending on market conditions, although the rates may be higher, there is no mortgage insurance attached to this version of a Reverse Mortgage, which can save a substantial amount. We can compare by pricing out your scenario as a HECM and as a Jumbo.

9. No Impact on Social Security and Medicare - Like other Reverse Mortgages, proceeds from proprietary reverse mortgages generally do not affect Social Security or Medicare benefits, making them a viable option for supplementing retirement income without jeopardizing these benefits.

-

2:00:43

2:00:43

The Quartering

9 hours agoThe MAGA Wars Have Begun! Vivek & Elon Get Massive Backlash & Much More

98.2K29 -

1:25:53

1:25:53

Kim Iversen

3 days agoStriking Back: Taking on the ADL’s Anti-Free Speech Agenda

79.5K42 -

49:35

49:35

Donald Trump Jr.

13 hours agoA New Golden Age: Countdown to Inauguration Day | TRIGGERED Ep.202

160K179 -

1:14:34

1:14:34

Michael Franzese

12 hours agoWhat's Behind Biden's Shocking Death Row Pardons?

71.5K44 -

9:49

9:49

Tundra Tactical

10 hours ago $17.39 earnedThe Best Tundra Clips from 2024 Part 1.

98.3K8 -

1:05:19

1:05:19

Sarah Westall

10 hours agoDying to Be Thin: Ozempic & Obesity, Shedding Massive Weight Safely Using GLP-1 Receptors, Dr. Kazer

85.2K21 -

54:38

54:38

LFA TV

1 day agoThe Resistance Is Gone | Trumpet Daily 12.26.24 7PM EST

62K11 -

58:14

58:14

theDaily302

19 hours agoThe Daily 302- Tim Ballard

60.8K10 -

13:22

13:22

Stephen Gardner

13 hours ago🔥You'll NEVER Believe what Trump wants NOW!!

109K300 -

54:56

54:56

Digital Social Hour

1 day ago $11.17 earnedDOGE, Deep State, Drones & Charlie Kirk | Donald Trump Jr.

61.5K5