Premium Only Content

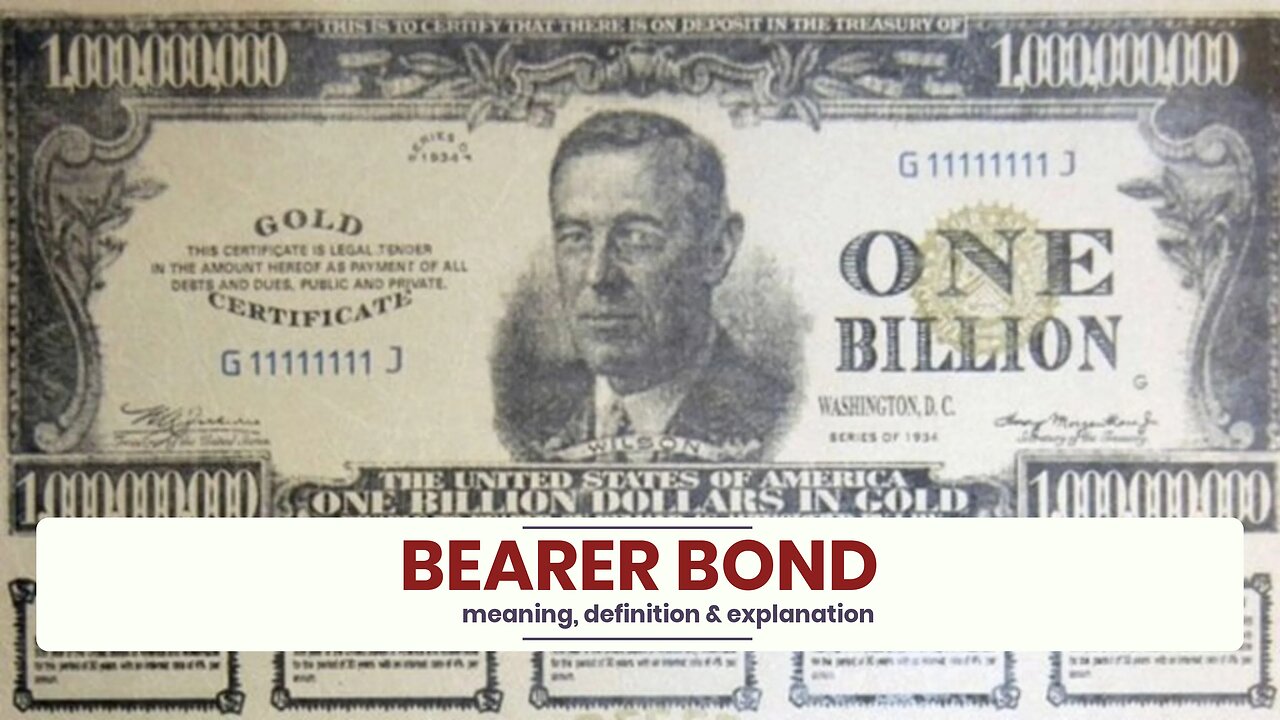

What is BEARER BOND?

✪✪✪✪✪

http://www.theaudiopedia.com

✪✪✪✪✪

What does BEARER BOND mean? BEARER BOND meaning - BEARER BOND definition - BEARER BOND explanation. What is the meaning of BEARER BOND? What is the definition of BEARER BOND? What does BEARER BOND stand for? What is BEARER BOND meaning? What is BEARER BOND definition?

A bearer bond is a bond or debt security issued by a business entity such as a corporation, or a government. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered – no records are kept of the owner, or the transactions involving ownership. Whoever physically holds the paper on which the bond is issued owns the instrument. This is useful for investors who wish to retain anonymity. Recovery of the value of a bearer bond in the event of its loss, theft, or destruction is usually impossible. Some relief is possible in the case of United States public debt.

Bearer bonds have historically been the financial instrument of choice for money laundering, tax evasion, and concealed business transactions in general. In response, new issuances of bearer bonds have been severely curtailed in the United States since 1982.

In the United States all the bearer bonds issued by the U.S. Treasury have matured. They no longer pay interest to the holders. As of May 2009, the approximate amount outstanding is $100 million.

In June 2009, Italian financial police and custom guards seized documents purporting to be U.S. bearer bonds, totaling $134.5 billion. The bonds were in $500 million and $1 billion denominations, although the highest denomination ever issued by the US Treasury was $10,000. It was unclear what the purpose of the fake bonds was; the two men carrying them were not detained after the bonds were seized.

In the United States, the Tax Equity and Fiscal Responsibility Act of 1982 substantially curtailed the issue of debt in bearer form. The Act disallowed a tax-deduction of interest paid on any such bonds issued after 1982 by the issuer in the case of corporate bonds, and removed the tax-exemption of the interest to the holder in the case of municipal bonds. In contrast, registered bonds retained the tax-exempt treatment. A challenge to this tax treatment by the U.S. state of South Carolina was heard by the U.S. Supreme Court in the case of South Carolina v. Baker (1988), which upheld the law and brought to an end the further issue of virtually all U.S. municipal bearer bonds.

-

1:26

1:26

The Audiopedia

9 months agoWhat is MOTTO?

47 -

LIVE

LIVE

Man in America

6 hours agoTECHNOCRACY INC.: Sinister Links Between Musk, USA, and the British Crown?

834 watching -

LIVE

LIVE

charwinslow

12 hours agocurrently playing Assassin's Creed: Shadows, expert mode (& Nintendo Direct reaction n yoga)

143 watching -

LIVE

LIVE

hockeymancb77

2 hours agoNEW GAME ALERT!!! R.E.P.O. Stream! Lets get it!

375 watching -

LIVE

LIVE

TwinGatz

2 hours ago🔴LIVE - 1.3 UPDATE HAS LANDED | ARMA Reforger

159 watching -

LIVE

LIVE

DLDAfterDark

33 minutes agoMinuteMan Kit For Beginners! The Do's and Don'ts of Gear/Equip.

85 watching -

LIVE

LIVE

HELMETFIRE

1 hour ago🟢Helldivers 2 🟢RUMBLE TAKEOVER!

176 watching -

LIVE

LIVE

Precision Rifle Network

1 day agoS4E10 Guns & Grub - New Gear & 2A News

62 watching -

LIVE

LIVE

svgames

4 hours ago🟢REPO with @soundboardlord @ZWOGs @PudgeTV @MissesMaam @Shawn Cav Live

70 watching -

1:56:30

1:56:30

Robert Gouveia

4 hours agoTrump FIGHTS BACK in Signal Lawsuit; Judge Boasberg BLASTED; Tesla Terrorist ARRESTED!

32.2K10