Premium Only Content

Reverse vs Traditional Mortgages

Understanding the Differences: Reverse vs. Traditional Mortgages

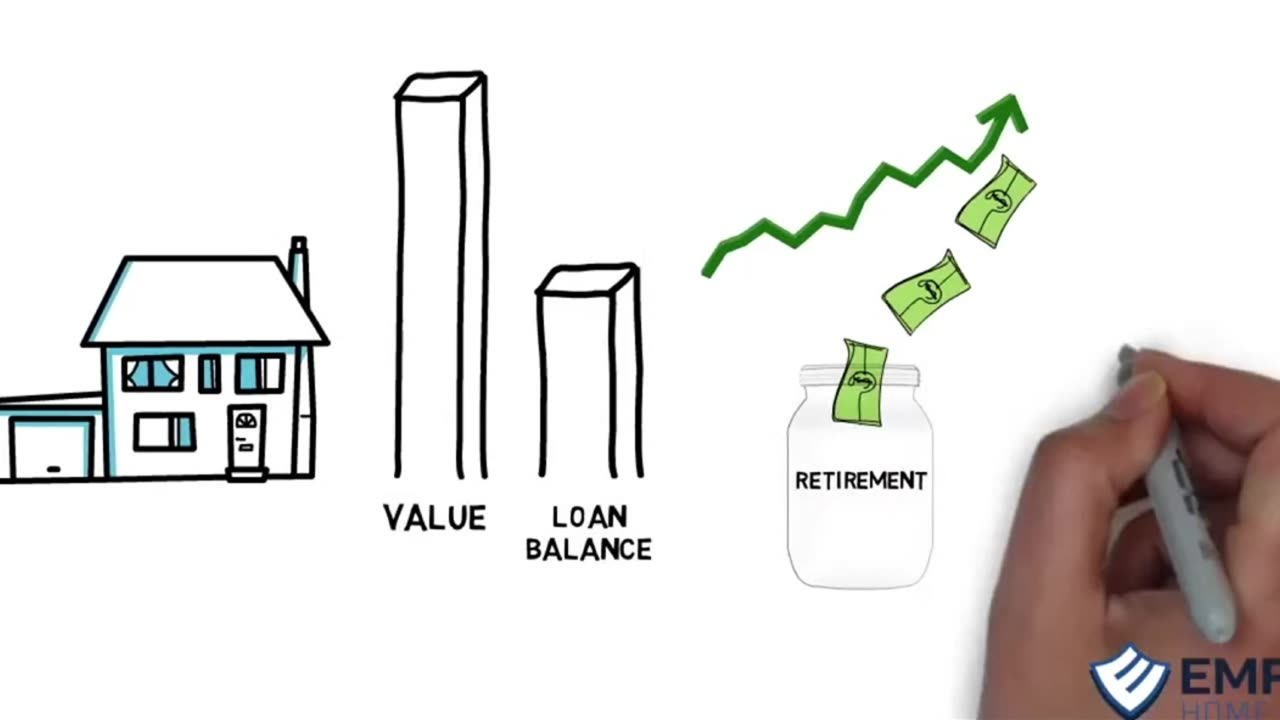

Among the various types of mortgages, reverse mortgages and traditional mortgages stand out for their distinct structures, purposes, and target audiences. While both involve borrowing against home equity, they cater to different needs and operate under different mechanisms.

Traditional Mortgage

A traditional mortgage, often referred to simply as a "mortgage," is a loan used to purchase real estate. Here’s how it generally works:

1. Purpose: The primary purpose of a traditional mortgage is to enable individuals to buy or refinance a home. In a purchase, the borrower receives a lump sum of money to purchase the property and agrees to repay this amount, plus interest, over a specified period, usually 15 to 30 years.

2. Payment Structure: The borrower makes regular monthly payments to the lender. These payments typically cover both principal and interest, with the early payments mainly going towards interest and the later payments gradually paying off the principal.

3. Equity Accumulation: As the borrower makes payments, they build equity in the property. Equity is the difference between the home's market value and the remaining mortgage balance. Over time, as the loan is paid down and if the property value appreciates, the borrower’s equity increases.

4. Loan Types: Traditional mortgages come in various forms, including fixed-rate mortgages, where the interest rate remains constant throughout the term, and adjustable-rate mortgages (ARMs), where the interest rate can fluctuate based on market conditions.

5. Qualification Requirements: Borrowers must meet certain criteria to qualify for a traditional mortgage. This typically includes a good credit score, a stable income, and a manageable debt-to-income ratio. Lenders assess these factors to determine the borrower’s ability to repay the loan.

6. Down Payment: Most traditional mortgages require a down payment, which can range from 3% to 20% or more of the property’s purchase price. A larger down payment can result in better loan terms and lower interest rates.

Reverse Mortgage

A reverse mortgage is a financial product designed for senior homeowners, allowing them to convert part of the equity in their homes into cash. The most common type is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). Here's how a reverse mortgage differs from a traditional mortgage:

1. Purpose: A reverse mortgage can be used to purchase homes or to provide income or liquid assets to senior homeowners. They are intended to help individuals aged 55+ in California supplement their retirement income by tapping into their home equity without selling the property.

2. Payment Structure: In a reverse mortgage, the lender makes payments to the borrower instead of the other way around. Homeowners can receive these payments as a lump sum, monthly installments, a line of credit, or a combination of these methods. Importantly, borrowers are not required to make monthly mortgage payments to the lender.

3. Loan Repayment: The loan becomes due when the borrower sells the home, moves out, or passes away. At that point, the proceeds from the home sale are used to repay the loan. If the home sells for more than the loan balance, the remaining equity goes to the homeowner or their heirs. If it sells for less, FHA insurance covers the shortfall, protecting the borrower’s heirs from owing more than the home’s value.

4. Equity Depletion: As the lender makes payments to the borrower, the homeowner’s equity in the property decreases. This is the reverse of a traditional mortgage, where equity increases over time with each payment made by the borrower. With a reverse mortgage, interest and fees are added to the loan balance, which can grow over time.

5. Qualification Requirements: To qualify for a reverse mortgage, homeowners must be at least 55 years old in California, have significant equity in their home, and use the home as their primary residence. Unlike traditional mortgages, income and credit score requirements are typically less stringent, though lenders do assess the borrower’s ability to maintain property taxes, insurance, and home maintenance.

6. No Required Monthly Payments: One of the key features of a reverse mortgage is that the homeowner is not required to make monthly payments on the loan. This can be particularly beneficial for seniors with limited income, as it allows them to stay in their homes without the burden of required monthly mortgage payments.

Conclusion

Both traditional and reverse mortgages serve distinct financial needs and stages of life. A traditional mortgage is a tool for homebuyers to acquire property and build equity over time through regular payments. In contrast, a reverse mortgage typically provides a way for senior homeowners to access the equity they have built in their homes, providing them with additional income during retirement without requiring monthly mortgage payments.

Understanding the differences between these two types of mortgages is crucial for making informed financial decisions. Potential borrowers should carefully consider their financial situation, long-term plans, and the specific terms and conditions of each type of mortgage before proceeding. Consulting with a reverse mortgage specialist, like me, can also provide valuable guidance tailored to individual circumstances.

-

Flyover Conservatives

1 day agoThe Great Gold Cover-Up: Is Fort Knox EMPTY?! - Clay Clark + Dr. Kirk Elliott | FOC Show

22.2K6 -

1:24:40

1:24:40

Kim Iversen

8 hours agoJeffrey Sachs Just Exposed the Truth They Don’t Want You to Hear

33.4K63 -

2:11:32

2:11:32

Glenn Greenwald

6 hours agoGlenn From Moscow: Russia Reacts to Trump; Michael Tracey Debates Ukraine War | SYSTEM UPDATE #413

93.5K48 -

2:19:23

2:19:23

Slightly Offensive

6 hours ago $8.15 earnedGOV. RAMASWAMY? Vivek to import 1 BILLION INDIANS to OHIO | Nightly Offensive

27.5K26 -

4:51:08

4:51:08

Wahzdee

9 hours agoSniper Elite Then Extraction Games—No Rage Challenge! 🎮🔥 - Tuesday Solos

64.5K3 -

2:12:58

2:12:58

Robert Gouveia

8 hours agoSenator's Wife EXPOSED! Special Counsel ATTACKS; AP News BLOWN OUT

72.8K56 -

55:07

55:07

LFA TV

1 day agoDefending the Indefensible | TRUMPET DAILY 2.25.25 7PM

33.7K14 -

6:09:26

6:09:26

Barry Cunningham

15 hours agoTRUMP DAILY BRIEFING - WATCH WHITE HOUSE PRESS CONFERENCE LIVE! EXECUTIVE ORDERS AND MORE!

86K60 -

1:46:37

1:46:37

Game On!

9 hours ago $5.56 earnedPUMP THE BRAKES! Checking Today's Sports Betting Lines!

51.6K4 -

1:27:21

1:27:21

Redacted News

9 hours agoBREAKING! SOMETHING BIG IS HAPPENING AT THE CIA AND FBI RIGHT NOW, AS KASH PATEL CLEANS HOUSE

198K262