Premium Only Content

May 16, 2024

In this comprehensive update, we delve into the Bitcoin (BTCUSD) daily and weekly timeframes and show some key Fibonacci ratios and levels, support and resistance levels, bullish diamond formations, and the continuous story they speak over time. Candlestick Ninja stresses the importance of avoiding biases, recency biases, and ignoring higher-level timeframes and price action to avoid whipsaw as the next and last short-term leg up is within a very inflated Bitcoin, S&P500, and ultimately any global “risk on” or at-risk investment that’s directly correlated to stock indices.

The goal of this video is to look at three of the most important barometers in any trader’s utility belt: the S&P500 Index, its implied counterpart the VIX (Fear Index), and Bitcoin, which we consider the S&P500 of all things crypto. It’s crucial for any trader to know where we are in the overall higher-order wave patterns, because if you don’t know where you are, you definitely don’t know where you are going, and in turn, where your trading account or investments are headed.

This comprehensive analysis serves the dual purposes of showing you our carefully thought out trend bias and trading plan and also provides a tactical trade idea on ticker RIOT towards the end.

📈 Key Insights:

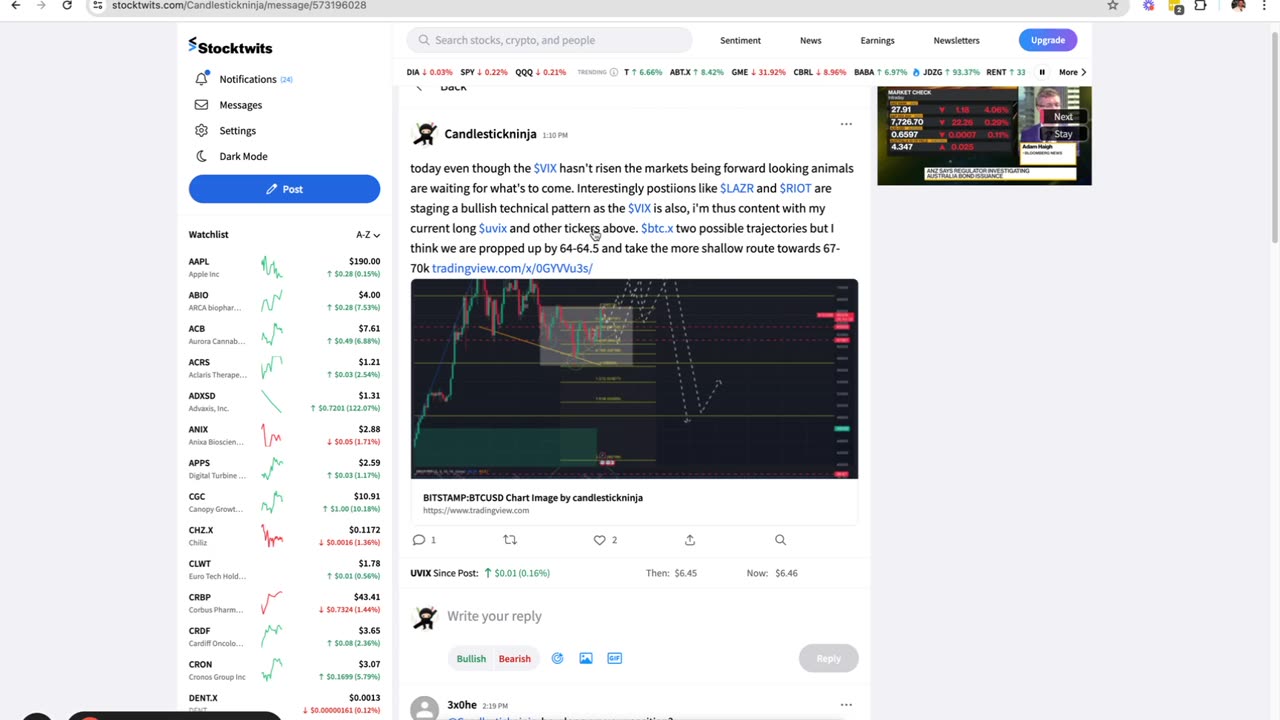

Bitcoin rallied towards $67,000 very quickly after our last prediction when we were below $62k.

We are now retracing and will most likely bounce at $63,000.

Our prediction: Bitcoin will rise towards $67,500, then $70,000 psychological level within 5 to 7 days.

Thus, we are neutral now and bullish at $63k on BTC, which probably happens by early morning or late night tonight!

📬 Disclaimer: For informational purposes only. Not financial advice. Trade at your own risk.

Handles:🥷

📈 TradingView: CandlestickNinja

🎥 TikTok: @candlestickninja

📘 Facebook: CandlestickNinja

🔗 Rumble: CandlestickNinjaTV

📬 Stocktwits: Candlestickninja

▶️ YouTube: CandlestickNinjaTV

💼 LinkedIn: CandlestickNinja (Coming Soon!)

#BitcoinAnalysis, #BTCUSD, #BitcoinOutlook, #CryptoAnalysis, #TechnicalAnalysis, #TA, #ShortTermTrends, #MarketAnalysis, #TradingPsychology, #RiskManagement #ta #iotstocks #riotgames #ewp #elliottwavetheory #cryptoanalysis #cryptonomics

-

9:05

9:05

Bearing

22 hours agoJaguar's Woke New Ad is SHOCKINGLY Bad 😬

13.1K62 -

7:55

7:55

Chris From The 740

14 hours ago $5.09 earnedWill The AK Project Function - Let's Head To The Range And Find Out

9.86K7 -

2:39

2:39

BIG NEM

10 hours agoHygiene HORROR: The "Yurt Incident"

6.2K1 -

3:19:21

3:19:21

Price of Reason

14 hours agoHollywood Celebrities FLEE the US After Trump Win! Wicked Movie Review! Gaming Journos MAD at Elon!

74K50 -

3:55:45

3:55:45

Alex Zedra

9 hours agoLIVE! Last Map on The Escape: SCARY GAME.

72.2K3 -

1:14:07

1:14:07

Glenn Greenwald

14 hours agoComedian Dave Smith On Trump's Picks, Israel, Ukraine, and More | SYSTEM UPDATE #370

170K249 -

1:09:07

1:09:07

Donald Trump Jr.

16 hours agoBreaking News on Latest Cabinet Picks, Plus Behind the Scenes at SpaceX & Darren Beattie Joins | TRIGGERED Ep.193

208K718 -

1:42:43

1:42:43

Roseanne Barr

12 hours ago $62.84 earnedGod Won, F*ck You | The Roseanne Barr Podcast #75

92.5K198 -

2:08:38

2:08:38

Slightly Offensive

13 hours ago $40.22 earnedDEEP STATE WINS?! Matt Gaetz OUSTED as AG & Russia ESCALATES War | Guest: The Lectern Guy

90.3K57 -

1:47:36

1:47:36

Precision Rifle Network

13 hours agoS3E8 Guns & Grub - the craziness continues

67.8K4