Premium Only Content

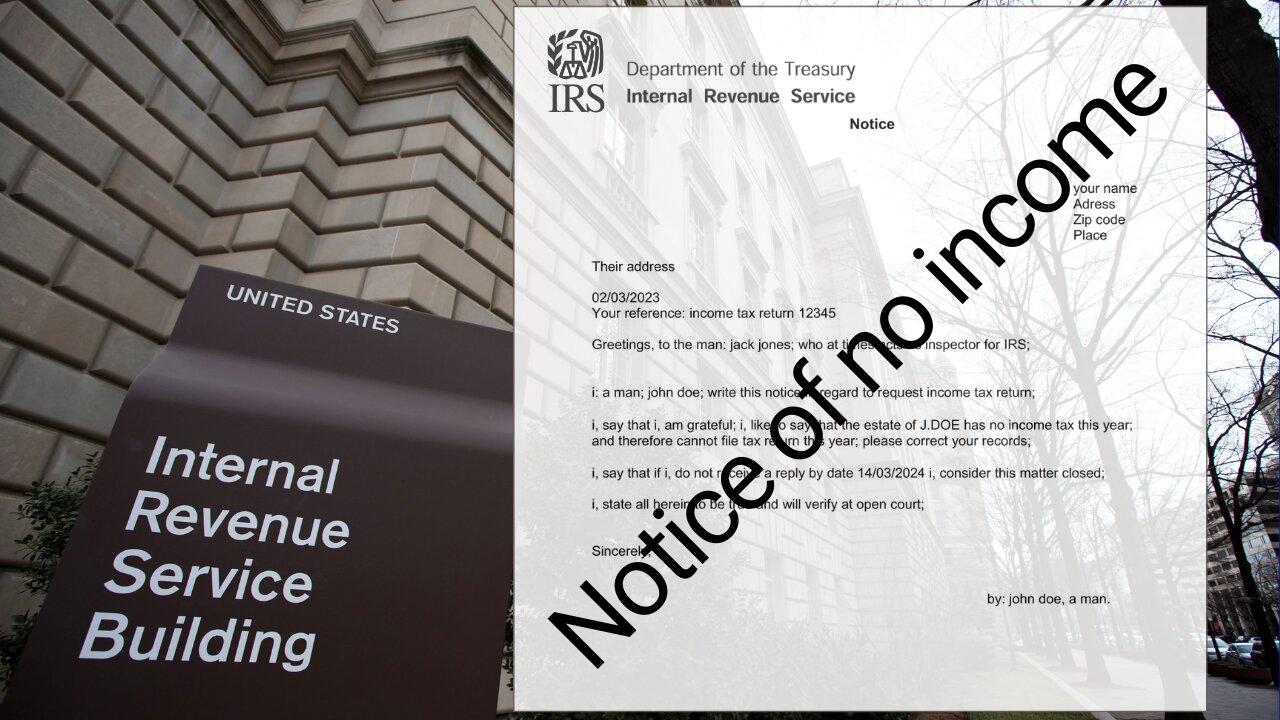

How to not having to answer to the tax authorities by way of notice

Part 5: Not having to answer to the tax authorities by way of notice

This is my last video of the 5 part video series. If you are working as a self-employed employee worker, this video can be really useful for you.

It is a different view on how to look towards the tax company.

"They don't tell you on what is created upon your birth. Being part of a society is largely seen as a privilege. However, if they were to fully disclose the concept of your personal token, your citizen token, and your estate (trust), people would start to perceive things differently.

Especially if people understood that if the ´estate´ established in (all caps your name) did not receive income, you can keep the money for yourself.In this video i will show you how to approach a notice of no income situation.

Disclaimer: To send such a notice, you need to operate fully in the private. This videoseries explains this concept.

If you wish to delve deeper into this knowledge and apply it in your life, you can connect with me through the website https://business-to-private.com/

By: Djordy Ritskes

-

7:44

7:44

Tactical Advisor

17 hours agoBest Budget Benelli Shotgun | Orthos v Panzer Arms

1.06K -

6:09

6:09

BIG NEM

9 hours agoThe Dark Truth About My Balkan Uncle's Past

6481 -

52:06

52:06

Uncommon Sense In Current Times

19 hours ago"Gerrymandering Markets: A Deep Dive with Robert Bork Jr. into Biden's Antitrust Agenda"

853 -

1:02:49

1:02:49

The Tom Renz Show

12 hours agoThe Democrats LA Fires & COVID Grand Jury

1.68K -

47:49

47:49

PMG

16 hours ago $0.02 earned"There Ain’t No Grace in It! What to do when you’re worn out!"

1.49K1 -

3:19:06

3:19:06

FreshandFit

7 hours agoAnnoying HOES Kicked Off After HEATED Debate On Rape Culture!

62.1K65 -

57:00

57:00

PMG

16 hours ago $10.86 earned"Terror Attacks or False Flags? IT DOESN'T ADD UP!!!"

37.4K12 -

1:14:42

1:14:42

Anthony Rogers

13 hours agoThoughts on the L.A. Fires

55K16 -

2:37:32

2:37:32

Kim Iversen

12 hours agoTerrorism, Act of God or “Newscum” Incompetence: What REALLY Fueled The California Wildfires

74.6K231 -

2:16:33

2:16:33

Tucker Carlson

10 hours agoTucker Carlson and Michael Shellenberger Break Down the California Fires

230K357