Premium Only Content

How Central Banks Control the Money Supply with Interest Rates

Many people think that the central bank primarily controls the money supply (M1, M2, M3). That used to be true. However, since the bulk of money creation is done by private banks, the central bank mainly controls their money creation by setting the short term interest rate (rbi policy rate, rbi repo rate, ecb deposit rate, fed funds rate, Bank of England base rate) on bank loans and on central bank reserves.

n most cases, monetary policy boils down to the following. Central bank set the interest rate on which all other rates are based. By doing so they try to control the amount of money circulating in the economy indirectly by making it more or less attractive for commercial banks to lend. Most central bankers change the interest rate as they try to control inflation. They will increase the interest if they believe the economy is overheating. This will lower inflation. They decrease the interest rate to spur the economy to grow faster which will lead to increased inflation.

Monetary policy via interest rates is part of the monetary policy toolkit of central banks. In addition to that central banks can engage in money printing, monetary finance, and quantitative easing. I have separate videos on each of these topics.

-

LIVE

LIVE

SpartakusLIVE

6 hours agoYoung Spartan STUD teams with old gamers for ultimate BANTER with a SMATTERING of TOXICITY

1,000 watching -

1:50:39

1:50:39

Kim Iversen

7 hours agoShocking Proposal: Elon Musk for Speaker of the House?! | IDF Soldiers Reveal Atrocities—'Everyone Is a Terrorist'

59.5K108 -

43:27

43:27

barstoolsports

10 hours agoOld Dog Bites Back | Surviving Barstool S4 Ep. 9

96.7K3 -

5:13:04

5:13:04

Right Side Broadcasting Network

7 days agoLIVE REPLAY: TPUSA's America Fest Conference: Day One - 12/19/24

157K27 -

1:06:01

1:06:01

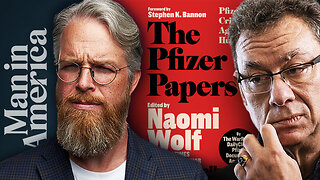

Man in America

1 day agoPfizer Has Been Caught RED HANDED w/ Dr. Chris Flowers

43.3K11 -

2:24:15

2:24:15

Slightly Offensive

8 hours ago $11.78 earnedAttempted ASSASSINATION of Nick J Fuentes LEAVES 1 DEAD! | Guest: Mel K & Breanna Morello

35.7K21 -

1:43:08

1:43:08

Roseanne Barr

8 hours ago $20.25 earned"Ain't Nobody Good" with Jesse Lee Peterson | The Roseanne Barr Podcast #79

72.9K32 -

The StoneZONE with Roger Stone

5 hours agoTrump Should Sue Billionaire Governor JB Pritzker for Calling Him a Rapist | The StoneZONE

45.2K5 -

1:36:58

1:36:58

Flyover Conservatives

1 day agoAmerica’s Psychiatrist Speaks Out: Are We Greenlighting Violence? - Dr. Carole Lieberman | FOC Show

29.1K5 -

DVR

DVR

LittleSaltyBear

7 hours ago $2.57 earnedNecromancing Path of Exile 2 4K

27.3K4