Premium Only Content

Iowa Legislature Recap: Key Taxpayer Victories

This episode of ITR Live takes a look at some of the high points for Iowa taxpayers out of the 2024 Iowa legislative session. The conclusion of this year’s session has brought with it several key outcomes that signal a brighter future for Iowa taxpayers. The acceleration toward a flat income tax structure is expected to make Iowa one of the states with the lowest income tax rates, a notable departure from its previous high-tax regime. The reduction to a 3.8% flat tax rate from the progressive system that had rates as high as nearly 9% marks a significant milestone in the state's tax policy evolution.

As Iowa continues on this path of fiscal reform and responsibility, the implications extend beyond immediate tax savings. The measures implemented today lay the groundwork for a more prosperous and financially stable future for all Iowans. With a continued focus on responsible spending, investment in essential services like education, and a commitment to maintaining a competitive tax environment, Iowa sets a precedent for fiscal policy that balances growth with responsibility.

Moreover, the discussion around potential future tax legislation indicates an ongoing commitment to adjusting and refining Iowa's fiscal policies to meet the evolving needs of its residents and the economy. The considerations of spending restraints alongside these reforms highlight a holistic approach to governance that prioritizes both taxpayer relief and the sustainable provision of state services.

The regulatory reform bill introduced this session, albeit with some provisions pared down, represents a crucial step in recalibrating the balance between necessary oversight and economic freedom. With new rules requiring cost-benefit analysis and a sunset provision on regulations, Iowa aims to prune excessive regulation, thereby fostering a more conducive environment for business and innovation.

-

27:25

27:25

CatfishedOnline

6 hours agoMan Goes Missing After Romance Scammer Reveals Herself!

891 -

LIVE

LIVE

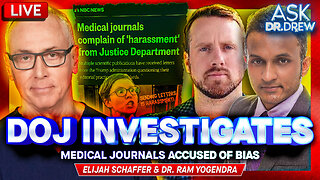

Dr. Drew

4 hours agoBREAKING: DOJ Investigating Medical Journals For Fraud; Publishers Call Letters "Harassment" w/ Elijah Schaffer & Dr. Ram Yogendra – Ask Dr. Drew

522 watching -

1:15:45

1:15:45

Redacted News

2 hours agoBREAKING! RFK JR. EXPOSES TRUTH BEHIND CHEM TRAILS AND CHILD TRAFFICKING AT HHS | REDACTED NEWS

85.4K120 -

1:09:57

1:09:57

vivafrei

6 hours agoTrump's First 100 Days RECAP! Alberta Referendum on the Horizon? AND MORE!

59.9K31 -

LIVE

LIVE

LFA TV

21 hours agoALL DAY LIVE STREAM - WEDNESDAY 4/30/25

1,587 watching -

13:35

13:35

IsaacButterfield

13 hours ago $1.76 earnedEXPOSING FAKE “Down Syndrome” OnlyFans Models...

18.6K20 -

1:58:53

1:58:53

Darkhorse Podcast

5 hours agoMisinformed Consent: The 274th Evolutionary Lens with Bret Weinstein and Heather Heying

44K21 -

30:09

30:09

Iggy Azalea

2 hours ago $1.61 earnedplaying motherland

30.5K7 -

2:12:09

2:12:09

The Quartering

6 hours agoUkraine Mineral Deal Today, China Suffering From Tariffs, Epstein Suicide Letter, Meme Ban!

145K44 -

1:17:36

1:17:36

The White House

5 hours agoPress Secretary Karoline Leavitt Briefs Members of the New Media, Apr. 30, 2025

70.7K33