Premium Only Content

Facts and Fiction About Reverse Mortgages

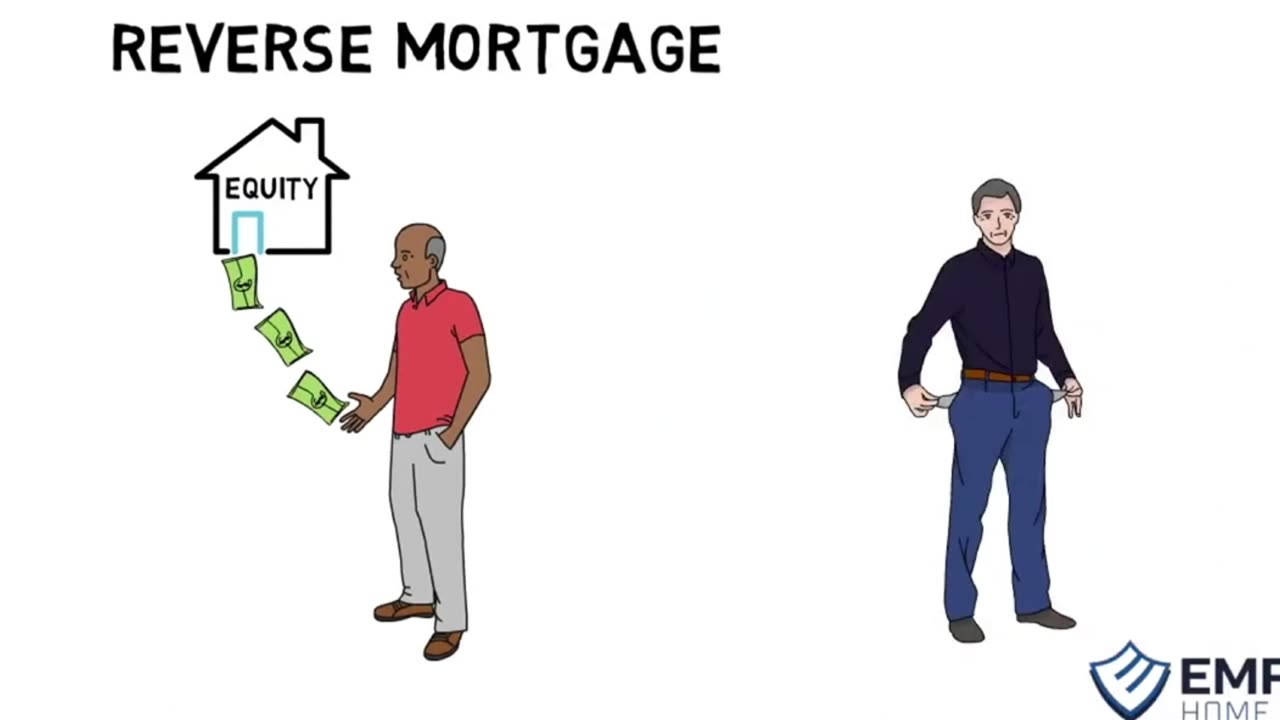

Hey seniors, let’ss talk about reverse mortgages, a financial option tailored for folks aged 62 and older (55+ in California) who want to access the equity in their homes while still living there. But before making any important financial decisions, it's crucial to clear up some common misconceptions and understand the facts.

Fact: With reverse mortgages, homeowners can tap into their home equity and receive cash through various means, like a lump sum, monthly payments, or a line of credit.

Fiction: Some folks worry that taking out a reverse mortgage means giving up ownership of their home. But in reality, as long as they keep up with property taxes, homeowners insurance, and property maintenance, they retain ownership.

Fact: Unlike traditional mortgages, reverse mortgages don't require monthly payments. Instead, the loan balance grows over time and is typically repaid when the homeowner moves out, sells the home, or passes away.

Fiction: While there have been cases of abuse in the past, today's reverse mortgages are regulated by the government and have strict eligibility requirements. They're not scams or predatory loans.

Fact: Reverse mortgages can be a lifeline for retirees needing extra income or wanting to supplement their savings. The funds can cover various expenses, from paying off debt to home improvements.

Fiction: Some folks think reverse mortgages are only for those in financial trouble, but they can benefit financially stable homeowners looking to enhance their retirement lifestyle.

Fact: Keep in mind that reverse mortgages come with costs, like origination fees and closing costs. It's essential to understand these fees and how they affect the overall loan balance.

Fiction: Concerns about leaving a burden for heirs are common, but reverse mortgages are non-recourse loans. That means if the loan balance exceeds the home's value, the homeowner's estate isn't responsible for the difference.

In conclusion, reverse mortgages can be a valuable tool for eligible homeowners, but it's crucial to understand the facts and dispel any myths. By doing so, seniors can make informed decisions about whether a reverse mortgage fits their financial needs and goals.

-

4:27:48

4:27:48

ThePope_Live

6 hours agoLIVE - First time playing The Finals in over a YEAR! Still good? with @Arrowthorn

26.9K1 -

3:06:26

3:06:26

TruthStream with Joe and Scott

11 hours agoRoundtable with Patriot Underground and News Treason Live 4/26 5pm pacific 8pm Eastern

45.2K33 -

8:52

8:52

Tundra Tactical

9 hours ago $9.58 earnedSCOTUS Denies Appeal, Minnesota Courts Deal 2a Win!

47.6K11 -

10:36:01

10:36:01

a12cat34dog

11 hours agoONE WITH THE DARK & SHADOWS :: The Elder Scrolls IV: Oblivion Remastered :: FIRST-TIME PLAYING {18+}

65.2K5 -

22:27

22:27

Exploring With Nug

18 hours ago $12.72 earnedSwamp Yields a Chilling Discovery in 40-Year Search for Missing Man!

61.1K17 -

1:23:26

1:23:26

RiftTV/Slightly Offensive

12 hours ago $12.07 earnedThe LUCRATIVE Side of Programming and the SECRETS of the "Tech Right" | Guest: Hunter Isaacson

68.2K36 -

27:57

27:57

MYLUNCHBREAK CHANNEL PAGE

1 day agoDams Destroyed India

73.4K24 -

11:42:02

11:42:02

Phyxicx

13 hours agoLast minute practice before Sunday - 4/26/2025

54K3 -

LIVE

LIVE

The Official Steve Harvey

10 days ago $5.14 earned24 HOURS OF MOTIVATION w/ STEVE HARVEY

34 watching -

![Nintendo Switch It UP Saturdays with The Fellas: LIVE - Episode #16 [Clue]](https://1a-1791.com/video/fww1/eb/s8/1/L/3/n/F/L3nFy.0kob-small-Nintendo-Switch-It-UP-Satur.jpg) 4:36:25

4:36:25

MoFio23!

18 hours agoNintendo Switch It UP Saturdays with The Fellas: LIVE - Episode #16 [Clue]

27.5K3