Premium Only Content

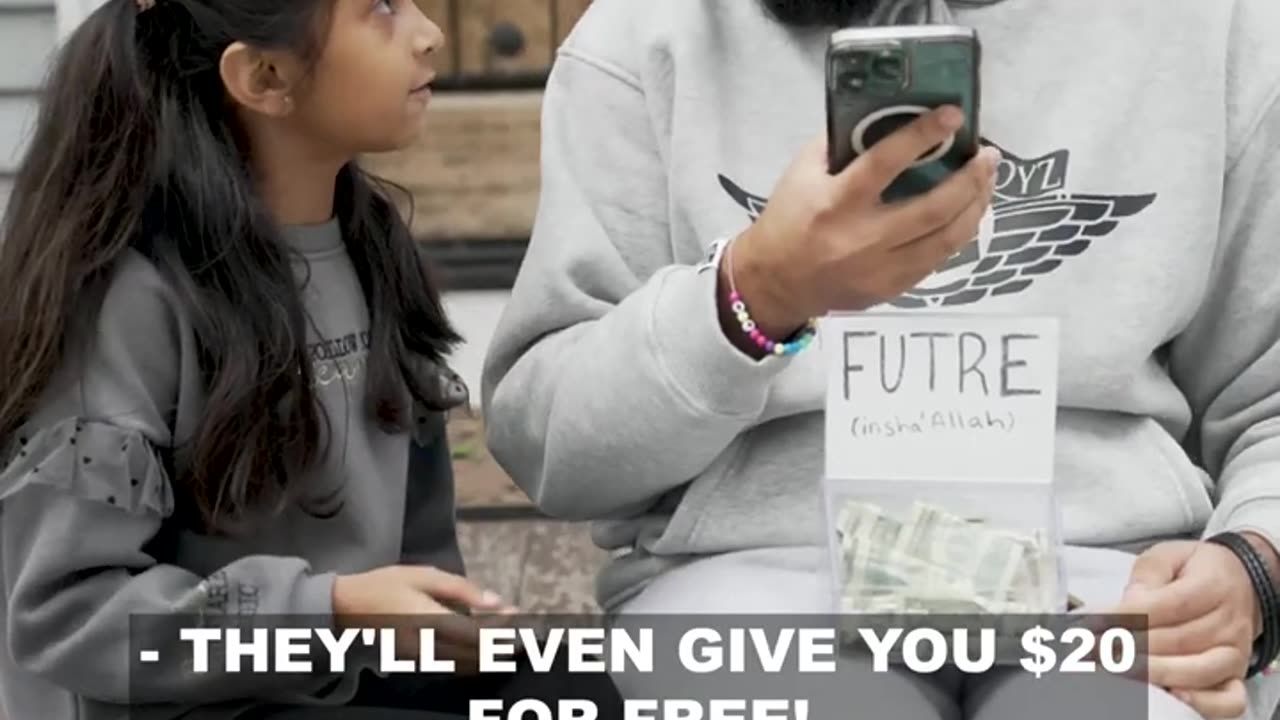

Child explains islamic finances!

Child explains islamic finances!

In the bustling city of Dubai, where the gleaming skyscrapers pierced the sky and the call to prayer echoed through the bustling streets, lived a young Muslim boy named Ali. At just ten years old, Ali had a keen interest in Islamic finances, a topic that fascinated him and filled him with a sense of pride in his faith's economic principles.

Ali's fascination with Islamic finances began when he overheard his parents discussing the concept of Sharia-compliant banking at the dinner table. Eager to learn more, Ali turned to his parents for guidance. They explained that Islamic finances are based on the principles of Sharia, the Islamic law derived from the Quran and the teachings of the Prophet Muhammad (peace be upon him).

Ali's parents explained that in Islamic finance, transactions must adhere to certain ethical and moral guidelines. For example, the charging or paying of interest (riba) is prohibited, as it is considered exploitative and unjust. Instead, Islamic financial institutions operate on the principle of profit-sharing (mudarabah) and risk-sharing (musharakah), where profits and losses are shared between the parties involved in a transaction.

Excited by what he had learned, Ali decided to delve deeper into the world of Islamic finances. He visited the local mosque, where he spoke with the Imam about the importance of ethical and responsible financial practices in Islam. The Imam explained that Islamic finances extend beyond banking and encompass various aspects of economic activity, including investment, trade, and charity.

As Ali continued to explore the topic, he discovered the concept of Zakat, one of the Five Pillars of Islam. Zakat is a form of obligatory charity that requires Muslims to donate a portion of their wealth to those in need. Ali was impressed by the emphasis Islam places on helping the less fortunate and ensuring the equitable distribution of wealth in society.

Inspired by what he had learned, Ali decided to share his knowledge of Islamic finances with his classmates at school. He prepared a presentation outlining the basic principles of Sharia-compliant banking and the importance of ethical financial practices in Islam. His classmates were intrigued by Ali's insights and asked thoughtful questions about how Islamic finances differed from conventional banking systems.

Ali's passion for Islamic finances continued to grow as he learned more about its practical applications in the modern world. He discovered that Islamic financial institutions offer a wide range of products and services, including savings accounts, investment funds, and home financing options, all designed to adhere to Sharia principles.

Ali also learned about the global impact of Islamic finance, which has grown significantly in recent years, with Islamic banks and financial institutions operating in countries around the world. He was proud to learn that Islamic finance promotes economic stability and resilience by emphasizing risk-sharing and discouraging speculative and unethical practices.

As Ali shared his newfound knowledge with his friends and family, he realized the importance of educating others about the principles of Islamic finances. He believed that by promoting ethical and responsible financial practices, Muslims could contribute to building a more just and equitable world, where prosperity is shared and opportunity is accessible to all.

With each passing day, Ali's passion for Islamic finances grew stronger. He dreamed of one day becoming a banker or financial advisor, using his knowledge and expertise to help others manage their finances in accordance with Islamic principles. Through his dedication and commitment, Ali hoped to make a positive impact on the world and uphold the values of justice, fairness, and compassion that lie at the heart of Islam.

-

LIVE

LIVE

SynthTrax & DJ Cheezus Livestreams

17 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream THE NEW MODEL - Variety Edition

217 watching -

4:25:53

4:25:53

Nerdrotic

7 hours ago $23.78 earnedMarvel Is SCREWED | Daredevil Afterbirth | G20 is ABSOLUTE Cinema - Friday Night Tights 349 w MauLer

102K23 -

LIVE

LIVE

VapinGamers

1 hour agoGedonia 2 - Early Release Preview and Co-Stream! - !game #Sponsored

102 watching -

LIVE

LIVE

EnDuEnDo

56 minutes ago🚨Vairety Stream 🎮 Push to 500 Followers 🚀 Chill Vibes 😎

65 watching -

2:21:40

2:21:40

Keepslidin

2 hours ago$20K BONUS HUNT | ROAD TO 100K | Mother.land

8.73K2 -

56:03

56:03

BonginoReport

6 hours agoICE Boss Wants Deportations To Run like Amazon Prime - Nightly Scroll w/Hayley Caronia (Ep.25)

107K53 -

45:12

45:12

Sarah Westall

3 hours ago“Most Important Story of the Decade” Globalists Move to Fund World Gov w/ Alex Newman & Sam Anthony

34.4K10 -

16:23

16:23

China Uncensored

4 hours agoChina STRIKES BACK Against Trump Tariffs

18.6K2 -

13:52

13:52

Tundra Tactical

4 hours ago $0.71 earnedDOJ's 2A Task Force: Too Little Too Late?

15.6K2 -

8:32

8:32

Colion Noir

10 hours agoCaught on Camera: Armed Florida Home Owner Uses Shotgun Against Burglar

28.1K12