Premium Only Content

The Money Masters (1996) Documentary on the ‘Concepts of Money’ and ‘Federal Reserve System’

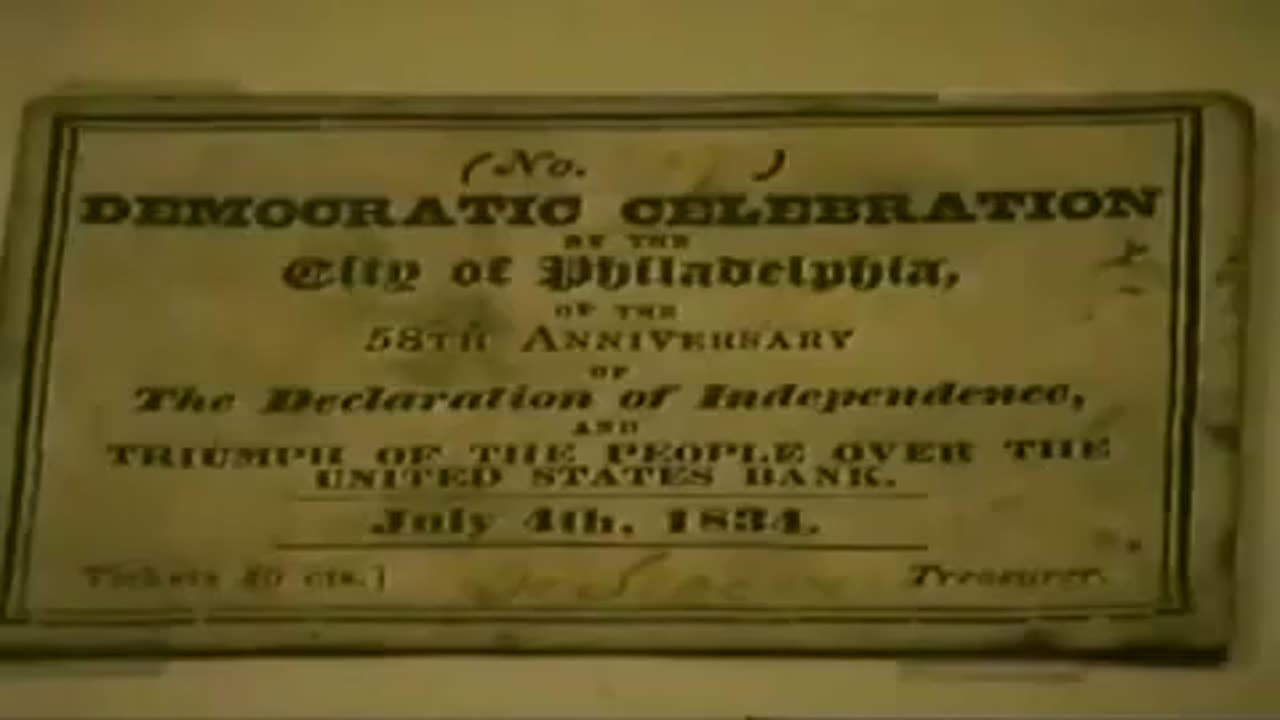

The Money Masters (1996) is a 3½ hour non-fiction, historical documentary film. It discusses the concepts of money, debt and taxes, and describes their development from biblical times onward. It covers the history of fractional-reserve banking, central banking, monetary policy, the bond market, and the Federal Reserve System in the United States.

Introduction to the documentary ‘The Money Masters’

BASEL I. In 1988 a faceless, un-elected group of bankers met in Basel, Switzerland at the Bank for International Settlements (“BIS”) – the “Central Banker’s bank” which even Swiss authorities may not enter – and in their “Basel I accords” agreed to a set of minimum capital requirements (8%) for banks. This was a number fine for some banks, but higher than what was in place for France and especially Japanese banks. To raise more capital to reach the 8% level, French and Japanese banks had to reduce loans, causing a recession in France and a depression in Japan, one from which Japan has never fully recovered.

BASEL II. In 2004, the same group met and agreed to Basel II (“The Return of Basel I”)– which required banks to value their capital based on market values, or “mark-to-the-market.” These rules were approved for the US on November 1, 2007. The declining housing market set off a chain reaction due in part to Basel II which banks knew was coming and constricted credit in anticipation of. The next month, December, 2007 the stock market collapsed and the Great Recession began in earnest. This should have been no surprise to the Japanese, nor to the BIS bankers. Full implementation of Basel II was subsequently delayed in the US until 2009. Basel II has been blamed for actually increasing the effect of the housing crisis as banks had to reduce lending to increase their capital as the value of mortgages they hold declined. This produced a downhill snowball effect on home prices and then on nearly everything else as lending and the economy contracted.

BASEL III. Not content with two massive regulatory failures, the same bankers have now produced Basel III (“The Revenge of Basel I & II”). Like Basel I & II, Basel III increases capital requirements yet again, in a series of steps beginning in 2013 with the start of the gradual phasing-in of the higher minimum capital requirements not completed until 2018. The BIS bankers have imposed this and are forcing their home governments to get in line, as has the UK, the US and most other developed nations. It is truly a global rule by central bankers acting in concert/cabal.

An OECD study estimates that the medium-term harmful impact of Basel III implementation on GDP growth is in the range of −0.05% to −0.15% per year – just what’s needed in a worldwide recession! To meet the capital requirements effective in 2015 banks are estimated to need to increase their lending spreads on average by about .15%. The capital requirements effective as of 2019 could increase bank lending spreads by about .5%. Rising interest rates could significantly hurt small bank capital positions because a 3% upward swing in interest rates could drop a bank’s capital by 30%, placing the bank in an undercapitalized position, forcing it dramatically to reduce loans. Again, the downhill snowball effect.

The proposed Basel III regulatory capital requirements are an immense and unnecessary burden that will actually threaten the existence of banks with under $1billion in assets. These new regulations will further drive consolidation into a few bigger banks. Some on Wall Street, like mergers and acquisitions expert John Slater, predict that Basel III’s compliance costs will lead to a merger boom, and that in the next 3-5 years 20-30 percent of all banks will merge, further consolidating wealth in fewer and fewer hands. That is the object – world bank/economic and hence political control by a handful of un-elected, unaccountable, international bankers beholden to no one, many of whom have ethics only Machiavelli could admire and worldviews that most people on earth would consider abhorrent.

International Monetary Fund Researchers Back Full Reserve Banking

Our Monetary Reform Act, written in 1996 by Patrick S.J. Carmack, J.D., and supported by Dr. Milton Friedman is largely based on the monetary reform plan that came out of the University of Chicago during the Great Depression in 1933, with added safeguards. Recently two researchers working for the IMF (perhaps not for long now!) discovered the Plan, dusted it off and have noted five major – and real – benefits of the plan. While there is slim to no chance the IMF will promote the plan despite it’s obvious advantages to the public, still it is very interesting that it’s own researchers discovered, compliment and hoped to advance it.

THE ADVANTAGES OF THE CHICAGO PLAN/MONETARY REFORM ACT

1.) Better Control/Reduction of Business Cycle Fluctuations (the Boom/Bust Cycles)

2.) Elimination of Bank Runs

3.) Dramatic Reduction of the National Debt (elimination when fully implemented)

4.) Dramatic Reduction of Private Debt

5.) National Output Gains of 10%

The IMF authors noted that all five benefits of the Plan were supported by their research. That is true.Caveat: however, absent safeguards the Chicago Plan per se would dangerously increase Leviathan’s (the State) control over the economy (while reducing direct private bank control – a good thing in itself), and it does not abolish fiat money which would be even more subject to political control under the Chicago Plan. As noted in the Monetary Reform Act and by Dr. Friedman, remedies to those two deficiencies would be that either monetary growth must be regulated by a Constitutional Amendment establishing either a zero (i.e., stable supply – no change) or a low fixed rate of annual growth (such as 3%) or by legislation, or, fiat money must be abolished and replaced with a commodity-based money such as gold (and/or silver or whatever a real free market develops as money).

Unfortunately, legislation is subject to political manipulation (such as the how CPI is currently manipulated to indicate inflation is under 2% when it is closer to 10%) and relatively easy change, so this is not the ideal, but is of course much more easily passed. Such a Constitutional Amendment would far less subject to manipulation, as would be a commodity/gold-backed money (but even those can be manipulated in various ways) – they would be preferable to legislation.

If those safeguarding elements were added, we believe this would be a huge improvement over the current system; it would in fact have the 5 advantages noted by the IMF researchers, and if bankers’ back it they would be either marvelously philanthropically motivated or will have given up on their scheme’s for world economic control. Neither is very likely, so beware of any push to implement the Chicago Plan without those or similar safeguards.

The combination of international bank control of the world economy via the BIS/IMF/World bank and State control is, as we all know, gradually heading for international totalitarianism. Any increase in power to either element is fraught with danger and must be very carefully examined.

To read the IMF paper visit: link to http://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

The Money Masters explains the history behind the current world depression and the bankers’ goal of world economic control by a very small coterie of private bankers, above all governments.

The Central bankers’ Bank for International Settlements (BIS) in 1988 in the “Basel I” regulations imposed an 8% capital reserve standard on member central banks. This almost immediately threw Japan into a 15 year economic depression. In 2004 Basel II imposed “mark to the market” capital valuation standards that required international banks to revalue their reserves according to changing market valuations (such as falling home or stock prices). The US implemented those standards in November, 2007. In December 2007 the US stock market collapsed and credit began drying up as banks withheld loans to comply with the 8% capital requirement as collateral valuations began to drop. The snowball effect of tightening credit, which reduces economic activity and values further, which resulted in further tightening of credit, etc., has produced a worldwide depression which is worsening.

Those capital standards have not been relaxed despite the crushing effects on the world economy* the credit contraction it requires has caused. Why? Because:

“The purpose of this financial crisis is to take down the U.S. dollar as the stable datum of planetary finance and, in the midst of the resulting confusion, put in its place a Global Monetary Authority [GMA – run directly by international bankers freed of any government control] -a planetary financial control organization”- Bruce Wiseman

*The U.S did modify these rules somewhat a year after the devastation had taken place here, but the rules are still fully in place in the rest of the world and the results are appalling.

“The powers of financial capitalism had a far-reaching plan, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole… Their secret is that they have annexed from governments, monarchies, and republics the power to create the world’s money…” .- Prof. Carroll Quigley renowned, late Georgetown macro-historian (mentioned by former President Clinton in his first nomination acceptance speech), author of Tragedy and Hope. “He [Carroll Quigley] was one of the last great macro-historians who traced the development of civilization…with an awesome capability.” – Dr. Peter F. Krogh, Dean of the School of Foreign Service (Georgetown)

The Two Step Plan to National Economic Reform and Recovery

1. Directs the Treasury Department to issue U.S. Notes (like Lincoln’s Greenbacks; can also be in electronic deposit format) to pay off the National debt.

2. Increases the reserve ratio private banks are required to maintain from 10% to 100%, thereby terminating their ability to create money, while simultaneously absorbing the funds created to retire the national debt.

These two relatively simple steps, which Congress has the power to enact, would extinguish the national debt, without inflation or deflation, and end the unjust practice of private banks creating money as loans (i.e., fractional reserve banking). Paying off the national debt would wipe out the $400+ billion annual interest payments and thereby balance the budget. This Act would stabilize the economy and end the boom-bust economic cycles caused by fractional reserve banking.

VERITY BASE (https://veritybase.info)

SOURCE: The Money Masters (http://www.themoneymasters.com)

-

46:36

46:36

Mally_Mouse

2 hours agoLet's Play!! -- Jak 2! pt. 6

14.6K -

2:04:21

2:04:21

Tim Pool

7 hours agoAmerica's Obesity & Health Crisis, MAKE AMERICA HEALTHY AGAIN | The Culture War with Tim Pool

109K40 -

1:00:20

1:00:20

The Tom Renz Show

4 hours agoCDC Will Study Link Between Vaccines and Autism, AOC Says Musk is Unintelligent & SDNY

49K26 -

59:53

59:53

Ben Shapiro

4 hours agoEp. 2153 - The Democratic Collapse CONTINUES!

77.9K55 -

1:28:11

1:28:11

Steven Crowder

7 hours agoWhat We've Missed | A Pop Culture Catch-Up

441K302 -

42:22

42:22

CryptoWendyO

3 hours ago $1.29 earnedTRUMP MAKES CRYPTO HISTORY! Bitcoin To $1.5 Million By 2030 says Cathie Wood!

16.6K3 -

58:57

58:57

The Big Mig™

4 hours agoGlobal Finance Forum From Bullion To Borders We Cover It All

30.2K4 -

2:26:20

2:26:20

Benny Johnson

6 hours ago🚨Trump SHOCK Announcement LIVE Right Now | Trump Assassination Report Release, Assassin in Court

189K131 -

1:06:46

1:06:46

The Rubin Report

6 hours agoDems Furious at Gavin Newsom for Admitting This to Charlie Kirk

101K58 -

2:01:07

2:01:07

LFA TV

20 hours agoDEATH OF THE DEMOCATS! | LIVE FROM AMERICA 3.7.25 11AM

97.3K43