Premium Only Content

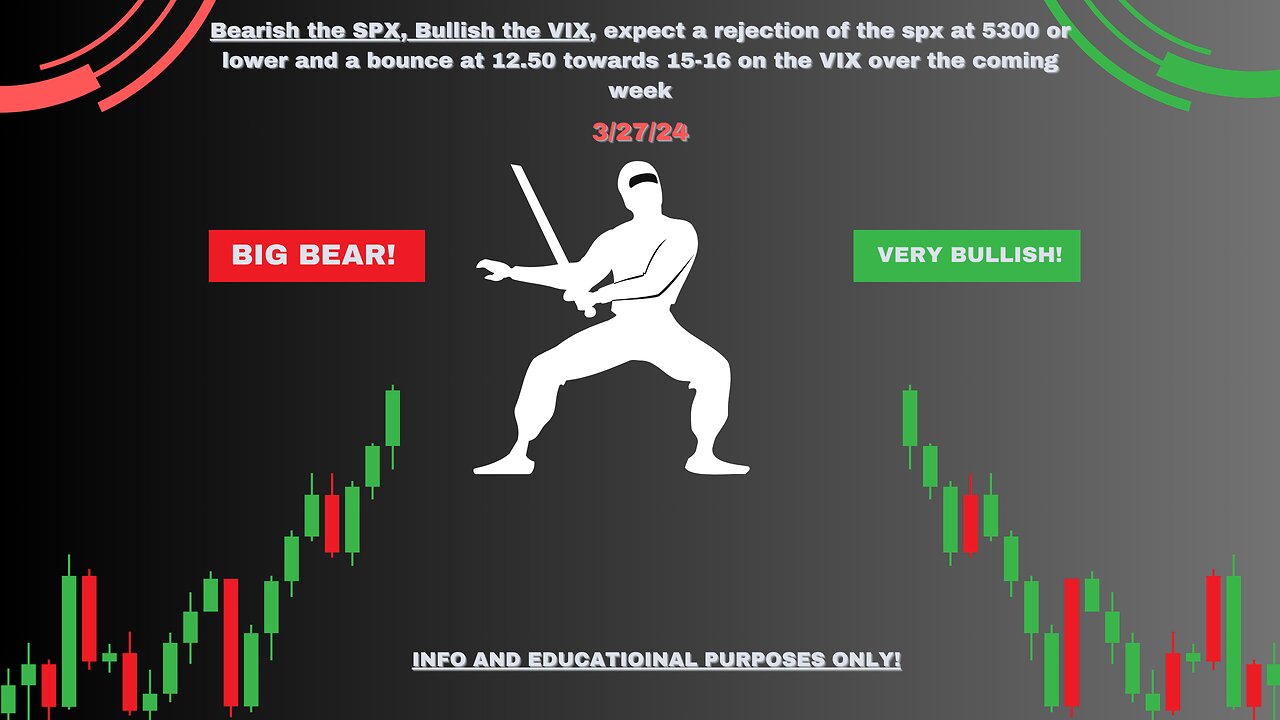

📈 Post Market Close Update (3/27/24): SPX & VIX Analysis | Potential Market Manipulation?

Join us for a comprehensive update on the SPX and VIX after market close on March 27th, 2024. Discover the latest insights into the SPX movement, including intraday and intrahour patterns revealing a rising wedge formation. Despite official closes above the 4790-4800 top, the SPX has yet to close on the 3-month or quarterly above this critical level, suggesting possible market manipulation influenced by government intervention and monetary policy.

Meanwhile, the VIX, or "Fear Index," is poised for a bounce around the 12.50 level amidst struggles in the SPX around 5260-5262, possibly forming a double top. However, this scenario may be short-lived, as we anticipate the wedge to eventually break. Despite recent propping above 4790, a close below this level by March 31st could signal a significant shift in market dynamics.

In uncertain market conditions, it's crucial to remain vigilant and consider the impact of global government actions and market maker activity. Our target remains a close just above 4790, reflecting ongoing uncertainty and potential manipulation tactics.

Stay informed and exercise caution in your trading decisions.

Information purposes only. Educational content. Do your own due diligence before making any trades.

Handles:

📈 TradingView: CandlestickNinja

📬 Stocktwits: @Candlestickninja

🎥 TikTok: @candlestickninja

Tags (comma-separated): SPX, VIX, MarketAnalysis, RisingWedge, GovernmentIntervention, MonetaryPolicy, MarketManipulation, RiskManagement

Hashtags: #SPX #VIX #MarketAnalysis #RisingWedge #GovernmentIntervention #MonetaryPolicy #MarketManipulation #RiskManagement

-

56:45

56:45

VSiNLive

7 hours ago $5.09 earnedFollow the Money with Mitch Moss & Pauly Howard | Hour 1

68.1K2 -

52:44

52:44

Candace Show Podcast

7 hours agoMy Conversation with Only Fans Model Lilly Phillips | Candace Ep 122

86K320 -

LIVE

LIVE

tacetmort3m

8 hours ago🔴 LIVE - RELIC HUNTING CONTINUES - INDIANA JONES AND THE GREAT CIRCLE - PART 5

190 watching -

26:52

26:52

Silver Dragons

6 hours agoCoin Appraisal GONE WRONG - Can I Finally Fool the Coin Experts?

32.6K2 -

6:49:16

6:49:16

StoneMountain64

10 hours agoNew PISTOL meta is here?

34.9K1 -

20:58

20:58

Goose Pimples

12 hours ago7 Ghost Videos SO SCARY You’ll Want a Priest on Speed Dial

19.8K3 -

2:24:59

2:24:59

The Nerd Realm

10 hours ago $2.80 earnedHollow Knight Voidheart Edition #09 | Nerd Realm Playthrough

36.2K2 -

1:21:14

1:21:14

Awaken With JP

12 hours agoDrones are for Dummies - LIES Ep 70

119K58 -

1:47:29

1:47:29

vivafrei

10 hours agoJustin Trudeau Regime ON THE VERGE OF COLLAPSE! And Some More Fun Law Stuffs! Viva Frei

92K81 -

1:52:22

1:52:22

The Quartering

10 hours agoNew Brett Cooper Drama, Madison Feminist Manifesto, Sydney Sweeney Outrage & More

92.4K37