Premium Only Content

What School Failed to Teach You About Money: Escaping the Rat Race

School failed to teach you about the importance of financial planning. Does it really matter if you earn six figures and there is still nothing to show for it by the end of the month. Let me ask, What is Money? Money is commonly defined as a medium of exchange. An instrument that facilitates sale, trade or purchase of goods and services between parties. What school failed to teach you about money is that it doesn’t tell you much about what money actually represents. I think a better way of looking at money is the expression of value. Creating Value is solving problems for people. A device that solves a lot of problems is said to have much value. The person who invented that device is the person who has created something valuable and he gets huge rewards for that. I’m sure you’ve heard money is the root of all evil. We look at someone who seems to have a large amount of money as being lucky, evil, as someone who took advantage of someone to make the money, as someone who cheated someone to gain. We never ask what value was created in order to make such an amount of money, what problem has he solved to make such money

The rat race is an endless self defeating or pointless pursuit. Sometimes, the rat race is conflicted with working a 9-5 job. It’s a comparison often used by certain individuals to make you buy some programs and books for them. Meanwhile, there are some people who love their 9-5 jobs. Being in a rat race is not by having a 9-5 job. A real rat race is one that is living on a financial edge, being one paycheck away from broke constantly. The moment money enters your life, it disappears and the more responsibility you have, the more dangerous this relationship becomes is what is referred to as being in a rat race. The loss of a job, unexpected health accident or any other unexpected circumstances can throw your entire financial position into a big mess

The reality is that most schools do not teach us how to escape the rat race, or the endless pursuit of financial security. This can lead to individuals finding themselves in debt, living paycheck to paycheck, and struggling to build wealth. Americans currently have the highest credit card debt in history, highlighting the fact that we are not learning how to manage money effectively. Debt is an invisible burden that is carried by the country’s most vulnerable. This issue is not unique to the US or the UK; it is a global problem. We need to start examining our attitudes towards money and how it exists in our lives. What is money to you? Does it come into your life and leave just as quickly? Have you ever found yourself in a vulnerable position because of money? These are all important questions that we need to answer in order to escape the rat race. So, how can you escape the rat race?

DISCLAIMER:

This channel is for educational purpose only. All videos, presentations and writing are for only educational purposes, and are not intended as investment advise

You can implement this while investing at your own risk and after consulting your financial advisor.

-

3:03:27

3:03:27

vivafrei

15 hours agoEp. 242: Barnes is BACK AGAIN! Trump, Fani, J6, RFK, Chip Roy, USS Liberty AND MORE! Viva & Barnes

108K85 -

8:09:50

8:09:50

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - MARVEL RIVALS - GOLD VANGUARD

186K30 -

1:15:00

1:15:00

Awaken With JP

12 hours agoMerry Christmas NOT Happy Holidays! Special - LIES Ep 71

169K136 -

1:42:21

1:42:21

The Quartering

13 hours agoTrump To INVADE Mexico, Take Back Panama Canal Too! NYC Human Torch & Matt Gaetz Report Drops!

133K100 -

2:23:15

2:23:15

Nerdrotic

13 hours ago $12.27 earnedA Very Merry Christmas | FNT Square Up - Nerdrotic Nooner 453

103K11 -

1:14:05

1:14:05

Tucker Carlson

13 hours ago“I’ll Win With or Without You,” Teamsters Union President Reveals Kamala Harris’s Famous Last Words

195K361 -

1:58:31

1:58:31

The Dilley Show

12 hours ago $33.68 earnedTrump Conquering Western Hemisphere? w/Author Brenden Dilley 12/23/2024

149K40 -

1:09:59

1:09:59

Geeks + Gamers

14 hours agoSonic 3 DESTROYS Mufasa And Disney, Naughty Dog Actress SLAMS Gamers Over Intergalactic

101K21 -

51:59

51:59

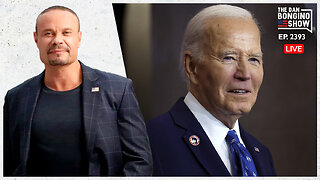

The Dan Bongino Show

15 hours agoDemocrat Donor Admits The Scary Truth (Ep. 2393) - 12/23/2024

890K3K -

2:32:15

2:32:15

Matt Kohrs

1 day agoRumble CEO Chris Pavlovski Talks $775M Tether Partnership || The MK Show

134K34