Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

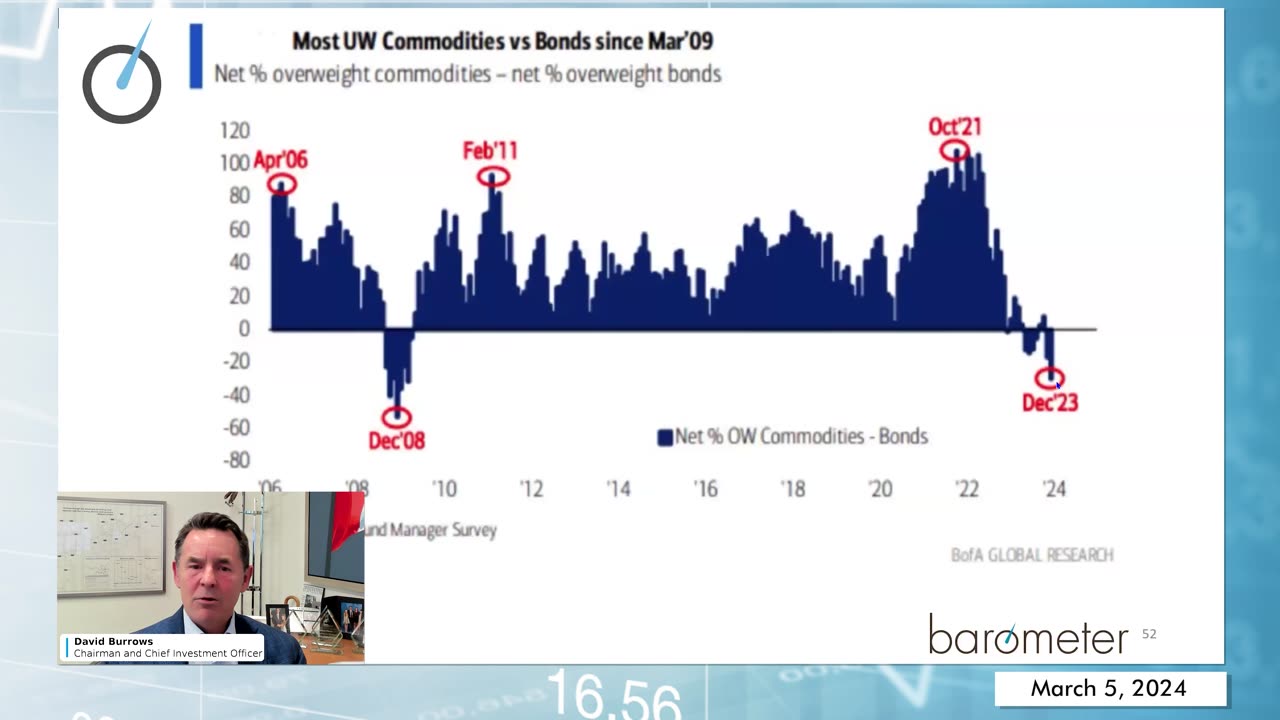

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

1:45:26

1:45:26

vivafrei

3 hours agoSantos Sentenced to 87 MONTHS! Corrupt Judges ARRESTED! Some Canada Stuff & MORE!

60.2K31 -

LIVE

LIVE

Nerdrotic

2 hours ago $5.21 earnedStar Wars GRAPED? Hollywood In Freefall, Silver Surfer is a MAN! | Friday Night Tights 351

4,385 watching -

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - PUBG - 5 CHICKEN DINNERS CHALLENGE

8,121 watching -

1:36:46

1:36:46

RiftTV/Slightly Offensive

3 hours ago $4.48 earnedTrump SHUTS DOWN War with Iran! Bibi IN RAGE | Guest: Joel Webbon | The Rift Report

23.4K8 -

LIVE

LIVE

Jamie Kennedy

18 hours agoThe Illusion of Time, Portals, and Paranormal Activity | Ep 203 with Jay Wasley of Ghost Adventures

228 watching -

14:34

14:34

Bearing

9 hours agoUK Transgender Protesters are NUTS 🦄⚧🏳️⚧️

10.5K28 -

1:41:53

1:41:53

The Quartering

5 hours agoWoke Judges ARRESTED, Rachel Zegler FAILS, McDonalds & Cancer & More

136K72 -

2:56:07

2:56:07

The Dana Show with Dana Loesch

5 hours agoSEC DEF HEGSETH'S NEW SIGNAL CHAT CONTROVERSY | The Dana Show LIVE on Rumble!

32.9K2 -

LIVE

LIVE

LFA TV

20 hours agoALL DAY LIVE STREAM - 4/25/25

3,161 watching -

1:14:15

1:14:15

The Illusion of Consensus

2 days agoMaxime Bernier on Canada's Mass Immigration Crisis

26.7K