Premium Only Content

2 Inverted Yield Curve Strategies (Rules and backtest)

✅→ The 2 free backtested strategies are available here: https://www.quantifiedstrategies.com/...

=================================

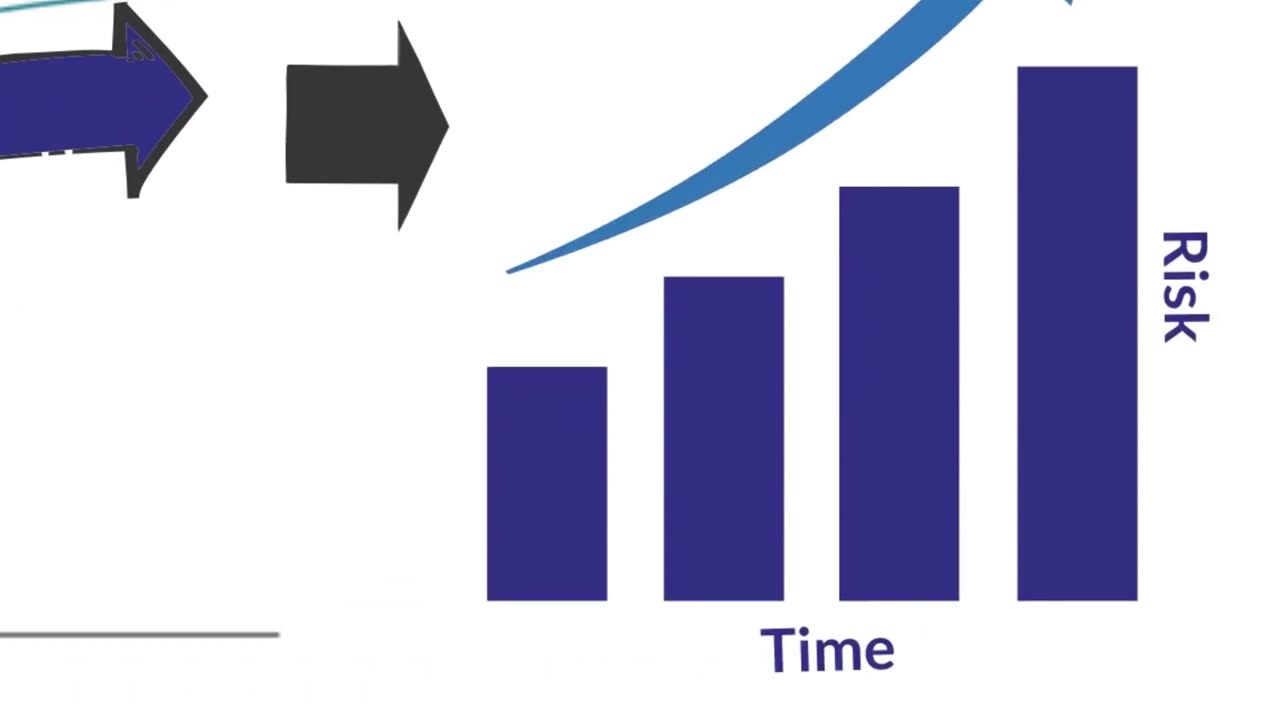

Looking to understand the impact of an inverted yield curve on the US economy and how to trade it? Look no further than this informative video. In this video, we'll explore what the inverted yield curve is and how it signals changes in investors' risk appetite, along with how to use a yield inversion strategy with Treasury futures for risk management and yield enhancement purposes.

Additionally, we'll discuss the implications of an inverted yield curve on the stock market and whether it can be used as a successful indicator. Don't miss out on this valuable information for traders and investors alike. Watch now to learn more!

#InvertedYieldCurve #YieldInversion #YieldCurve #EconomicIndicators

#USMarkets #InvestingTips #TreasuryFutures #treasurybonds #MarketTrends #FinancialStrategy #StockMarketInsights #interestrates #bonds #bondmarket

You can read more about it here:

https://www.quantifiedstrategies.com/...

=================================

WHERE TO FOLLOW US:

✅ TWITTER: https://bit.ly/Twitter_QS

✅ INSTAGRAM: https://bit.ly/Instagram_QS

✅ NEWSLETTER: https://bit.ly/substack_QS

=================================

LEARN ABOUT OUR STRATEGIES

https://www.quantifiedstrategies.com

=================================

©Quantified Strategies - For all business inquiries contact sialofjord@gmail.com

✅ This video is not to be reproduced without prior authorization. The original YouTube video may be distributed & embedded if required. For our private coaching, book a call at support@quantifiedstrategies.com

=================================

✅ RISK DISCLAIMER

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone who is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

#InvertedYieldCurve #BondMarket #InterestRates #EconomicIndicators

#YieldSpread #TreasuryBonds #FederalReserve #tradingstrategies #tradingstrategy #quantifiedstrategies #trading

-

22:01

22:01

DeVory Darkins

1 day ago $37.55 earnedHakeem Jeffries SHUTS DOWN The View as Matt Gaetz Speaks out

85.6K140 -

2:02:54

2:02:54

Mally_Mouse

15 hours agoLet's Play!! - Spicy Saturday

64.3K2 -

1:33:06

1:33:06

Slightly Offensive

16 hours ago $31.89 earnedAre You Ready for What's Coming Next? | Just Chatting Chill Stream

80.6K42 -

32:10

32:10

MYLUNCHBREAK CHANNEL PAGE

1 day agoThe Gate of All Nations

151K67 -

13:07

13:07

Sideserf Cake Studio

20 hours ago $3.92 earnedIS THIS THE MOST REALISTIC SUSHI CAKE EVER MADE?

66.6K4 -

21:08

21:08

Clownfish TV

1 day agoElon Musk Tells WotC to BURN IN HELL for Erasing Gary Gygax from DnD!

53.9K16 -

48:22

48:22

PMG

16 hours ago $11.91 earned"IRS Whistleblowers Speak Out on Biden Family with Mel K In-Studio"

42.6K25 -

2:59

2:59

BIG NEM

18 hours agoLost in the Wrong Hood: Who Do I Check In With?

31.7K4 -

1:29:32

1:29:32

I_Came_With_Fire_Podcast

1 day ago"UFOs, Nukes, & Secrecy: Bob Salas on the 1967 Malmstrom Incident, UAPs, & Disclosure"

142K29 -

1:57:05

1:57:05

The Quartering

22 hours agoElon Musk To BUY MSNBC & Give Joe Rogan A Spot, MrBeast Responds Finally To Allegations & Much More

138K113