Premium Only Content

Fibonacci Trading Strategy for Bitcoin and Cryptocurrencies

🚀 Welcome to an in-depth exploration of the Fibonacci Trading Strategy tailored specifically for Bitcoin and other cryptocurrencies! In this comprehensive guide, we'll delve into the intricacies of using Fibonacci retracements and extensions to analyze price movements, identify potential entry and exit points, and optimize your trading performance in the dynamic world of digital assets. Whether you're a seasoned trader or just starting out, understanding this powerful tool can significantly enhance your trading arsenal and increase your chances of success in the crypto markets. Let's embark on this exciting journey together! 💡

📈 The Fibonacci sequence and its associated ratios, such as the golden ratio (0.618) and its inverse (1.618), have long been revered by traders for their remarkable ability to predict price levels and market trends with uncanny accuracy. By applying Fibonacci retracement levels to key swing highs and lows on a price chart, traders can identify potential support and resistance levels where price reversals are likely to occur. This provides invaluable insights into market sentiment and helps traders make informed decisions based on probabilistic outcomes.

💼 In this video, we'll walk you through the process of setting up Fibonacci retracement levels on popular charting platforms and demonstrate how to interpret these levels effectively in the context of Bitcoin and cryptocurrency trading. We'll discuss common Fibonacci retracement strategies, including using them in conjunction with other technical indicators to validate signals and refine your trading approach. Whether you're a day trader, swing trader, or long-term investor, incorporating Fibonacci analysis into your trading toolkit can significantly improve your overall performance and profitability.

📊 Furthermore, we'll explore advanced Fibonacci techniques such as Fibonacci extensions, which enable traders to anticipate potential price targets beyond the initial retracement levels. By projecting Fibonacci extension levels based on significant price swings, traders can identify areas of interest for profit-taking or setting price targets for their trades. This strategic approach empowers traders to ride trends effectively and capture larger market moves, thereby maximizing their trading opportunities in the fast-paced world of cryptocurrencies.

🔍 Throughout the video, we'll provide real-world examples of Fibonacci trading setups in Bitcoin and various altcoins, illustrating how these principles can be applied in practice to analyze price action and make informed trading decisions. From identifying trend reversals to spotting continuation patterns, you'll gain a deeper understanding of how Fibonacci analysis can enhance your trading precision and profitability in the ever-evolving crypto market.

🔑 As with any trading strategy, it's important to exercise caution and manage risk effectively. While Fibonacci analysis can provide valuable insights into market dynamics, it's not a foolproof method and should be used in conjunction with other forms of analysis and risk management techniques. Remember to always trade responsibly, adhere to proper risk management principles, and never risk more than you can afford to lose. With the right knowledge, skills, and mindset, you can harness the power of Fibonacci trading to navigate the exciting world of cryptocurrencies with confidence and success! 🌟

#Fibonacci #Bitcoin #Cryptocurrency #TradingStrategy #TechnicalAnalysis #CryptoTrading #RiskManagement #Investing #FinancialEducation #MarketAnalysis #TradingTips #FibonacciRetracement #FibonacciExtension #BitcoinTrading #CryptoInvesting #TradingEducation #TradingPsychology #TradeResponsibly #CryptocurrencyMarket #BitcoinAnalysis #CryptoCharts #PriceAction #MarketTrends #CryptoCommunity #TradingSignals #Profitability #CryptoEducation #Altcoins

-

12:34

12:34

Trading_Soldier

8 days agoHow Your Environment Shapes Your Trading Success – Trading Lesson #17

312 -

1:13:16

1:13:16

We Like Shooting

15 hours ago $0.04 earnedDouble Tap 399 (Gun Podcast)

21.1K -

1:00:20

1:00:20

The Tom Renz Show

22 hours agoTrump Schools Zelensky, The Epstein Files FAIL, & What RFK Will Mean for Cancer

28.7K13 -

42:47

42:47

Kimberly Guilfoyle

8 hours agoThe Trump effect: More Major Investment, Plus America First at Home & Abroad. Live w/Ned Ryun & Brett Tolman | Ep. 201

97.1K34 -

1:29:23

1:29:23

Redacted News

7 hours agoWW3 ALERT! Europe pushes for war against Russia as Trump pushes peace and cutting off Zelensky

138K260 -

57:56

57:56

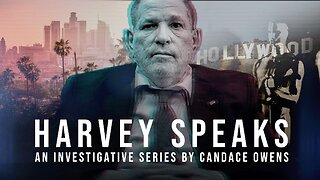

Candace Show Podcast

11 hours agoHarvey Speaks: The Project Runway Production | Ep 1

136K81 -

56:31

56:31

LFA TV

1 day agoEurope’s Relationship With America Is Over | TRUMPET DAILY 3.3.25 7PM

35.2K6 -

2:04:45

2:04:45

Quite Frankly

9 hours ago"European Deth Pact, Blackout Data Breach, Epstein" ft. Jason Bermas 3/3/25

36.7K13 -

1:32:46

1:32:46

2 MIKES LIVE

6 hours ago2 MIKES LIVE #187 Deep Dive Monday!

20.4K1 -

44:25

44:25

CatfishedOnline

7 hours ago $1.41 earnedRacist Lady Shocked After Sending Money to a Nigeria Romance Scammer

29.9K8