Premium Only Content

What the Mainstream Media Isn’t Telling You About Your Money | The Gold Standard 2404

https://www.midasgoldgroup.com/

We tackle a more relevant topic than ever: the truth about your money and why the mainstream media isn’t telling you what you need to know. Jennifer Horn and Ken Russo dive deep into the challenging landscape of today’s media environment.

In a world where opinions often overshadow facts, it’s become increasingly difficult to discern the truth from the noise. The mainstream media provides narratives, but are they aligned with your best interests? As we witness unprecedented levels of government spending and escalating debt, there’s a notable absence of discussion regarding the associated risks. Does it make sense to assume that everything is going to be OK? Or should we consider the alternative? Ken Russo asks, “What if it’s not?” In this episode, we unravel the intricacies of safety, privacy, and the value of our money, all while exploring the crucial role that gold and silver play in navigating these uncertain financial waters.

The Inciting Incident

Nixon’s decision to take the US dollar off the gold standard in 1971 marked a pivotal moment in economic history, ushering in the fiat currency era. This significant move severed the link between the US dollar and physical assets like gold, making the currency solely reliant on government promises. It represented a departure from the traditional monetary system backed by tangible reserves. It shifted the world towards a more flexible but inherently riskier monetary regime. This decision fundamentally altered how currencies operated, setting the stage for modern fiat currencies, which are no longer tied to physical assets and rely on trust in government stability and fiscal policies.

The Fed & Intrusive Transaction Searches

Here’s an eye-opening revelation brought to light by the House Judiciary Committee. Federal investigators have raised eyebrows by asking banks to scrutinize customer transactions using terms like “MAGA” and “Trump” as part of an investigation into the events of January 6. In a shocking twist, purchases of “religious texts” have been flagged as potential indicators of “extremism.” This action is an unprecedented intrusion into your rights of privacy. It has startling implications for your financial freedoms and privacy. Amidst these revelations, Ken explores the enduring value of gold and silver to protect your wealth and preserve your financial autonomy.

Fractured Fractional Banking

Many are concerned about the fractional banking system, and there’s been an ongoing debate. Fractional banking operates on the idea that banks lend out most of the funds deposited with them, holding only a fraction in reserve. Although inherently flawed, this system has existed for centuries. Banks may not have enough cash to meet depositors’ demands during political unrest or financial stress. Banks in trouble run to the government for assistance. They need bailouts to stay afloat. It’s probably a good thing if you’re wondering about the stability and safety of your savings within the traditional banking system.

Consider turning to physical precious metals like gold and silver to safeguard your wealth as a precautionary measure. Unlike fiat currency, these tangible assets hold intrinsic value and can provide a hedge against potential economic instability.

Safety of Your Spending Power

Gold has proven itself as a timeless store of value, and it offers a unique way to protect your spending power from the erosive effects of inflation. Gold maintains its intrinsic worth, unlike fiat currencies, which can lose weight over time due to economic fluctuations and government policies. Its scarcity and enduring demand make it a reliable asset to preserve wealth. As inflation erodes the purchasing power of traditional currencies, gold tends to hold or even increase in value, making it a valuable addition to any well-diversified financial portfolio. Whether you’re looking to safeguard your savings or secure a portion of your wealth against the uncertainties of the financial markets, gold has a long history of serving as a dependable hedge against the corrosive nature of inflation.

Your Buying Power – Looking Ahead

As we look ahead to the next 5 to 10 years, it’s crucial to consider the value of our dollars in the future. In an era of economic uncertainty and unprecedented monetary policies, the question becomes, “How much will my dollar afford then, and how much will it lose in value?” History has shown that over extended periods, the purchasing power of fiat currency tends to decline, and the erosion caused by inflation can be significant. This realization prompts us to think about ways to protect our wealth from the devaluing effects of time. It’s a reminder that for anything beyond the short term, holding onto excessive cash can be a risky proposition. Diversifying into assets like precious metals, real estate, or investments that have the potential to outpace inflation can help ensure your financial security in the years to come.

________________________________________________________________________________________________________

Listen to The Gold Standard: https://www.midasgoldgroup.com/gold-standard-radio-show/

Gold IRA: https://www.midasgoldgroup.com/gold-ira/

Invest in Gold: https://www.midasgoldgroup.com/buy-gold/

Guide to Owning Bullion & Coins: https://www.midasgoldgroup.com/bullion-guide/

Read the latest precious metals news: https://www.midasgoldgroup.com/news/

-

25:04

25:04

Midas Gold Group

5 months agoInflation Busters | The Gold Standard 2434

28 -

LIVE

LIVE

Wahzdee

2 hours agoSniper Elite Then Extraction Games—No Rage Challenge! 🎮🔥 - Tuesday Solos

1,477 watching -

LIVE

LIVE

Robert Gouveia

2 hours agoSenator's Wife EXPOSED! Special Counsel ATTACKS; AP News BLOWN OUT

3,734 watching -

LIVE

LIVE

Barry Cunningham

8 hours agoTRUMP DAILY BRIEFING - WATCH WHITE HOUSE PRESS CONFERENCE LIVE! EXECUTIVE ORDERS AND MORE!

1,548 watching -

LIVE

LIVE

Game On!

3 hours agoPUMP THE BRAKES! Checking Today's Sports Betting Lines!

362 watching -

1:27:21

1:27:21

Redacted News

2 hours agoBREAKING! SOMETHING BIG IS HAPPENING AT THE CIA AND FBI RIGHT NOW, AS KASH PATEL CLEANS HOUSE

72.3K102 -

1:08:28

1:08:28

In The Litter Box w/ Jewels & Catturd

22 hours agoCrenshaw Threatens Tucker | In the Litter Box w/ Jewels & Catturd – Ep. 749 – 2/25/2025

46.8K33 -

44:57

44:57

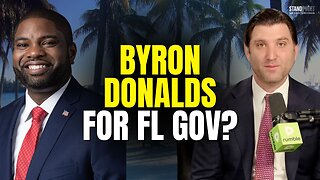

Standpoint with Gabe Groisman

23 hours agoWill Byron Donalds Run for Florida Governor? With Congressman Byron Donalds

15.2K2 -

1:06:25

1:06:25

Savanah Hernandez

2 hours agoEXPOSED: FBI destroys evidence as NSA’s LGBTQ sex chats get leaked?!

29.8K4 -

1:59:58

1:59:58

Revenge of the Cis

4 hours agoEpisode 1452: Hindsight

28K3