Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

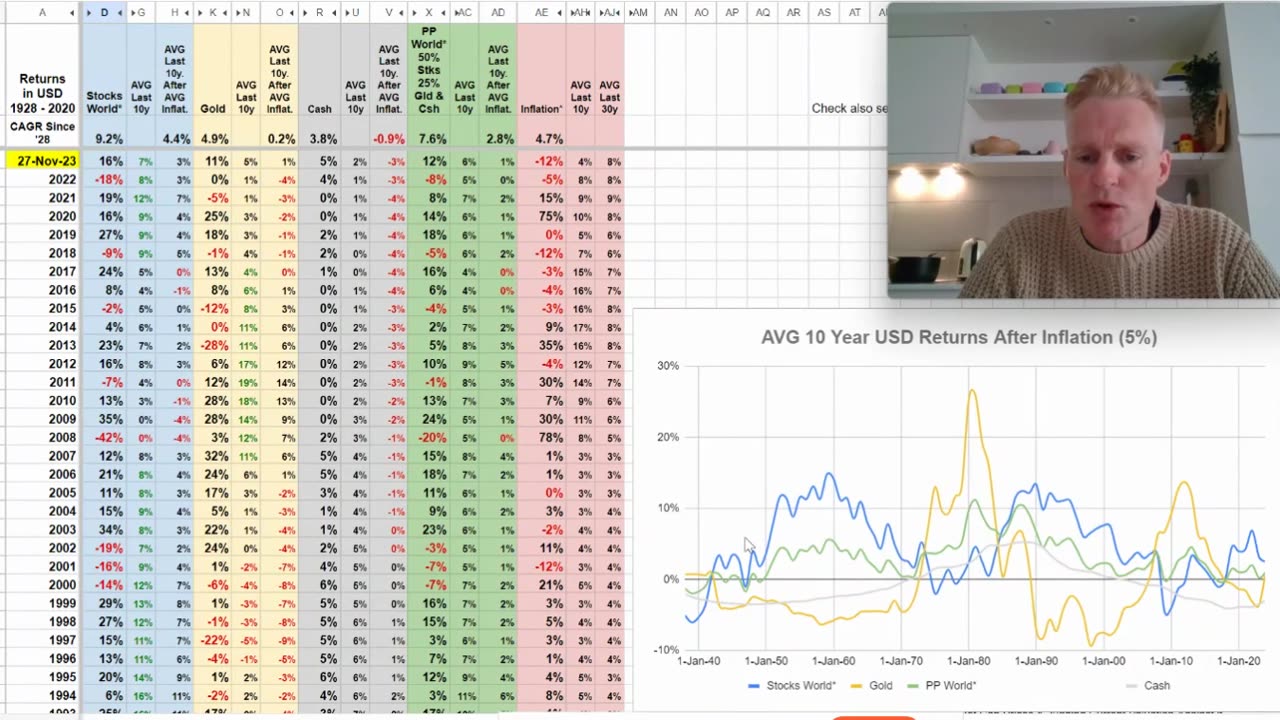

Returns Since 1928 for Stocks, Gold, Cash & Permanent Portfolio

1 year ago

152

Updated returns, stocks (16%) as well as gold (11%) did well this year, unlike last year where stocks did poorly (-18%) and gold just ok (0%). The surprise is again cash that is again returning 5% this year, which is zero after deducting 5% inflation. Last 10y, deducting also 5% for inflation, stocks still returned 7%, whereas gold only 1%.

The trend is still very clear if you look at the long term chart since 1928. A reversal in returns is unlikely given how short and weak this stock market cycle has been. Stocks can return a lot more and typically do if you look at previous cycles, and the inverse is true for gold. Gold held up well still but it can get a lot worse.

Loading 1 comment...

-

1:08:31

1:08:31

Kim Iversen

7 hours agoWhat Happens If You Refuse to Vaccinate Your Kids? | Days After CHD Sues Meta, Zuckerberg Says ‘No More Censorship’, Coincidence?

95.7K96 -

LIVE

LIVE

Nobodies Live

6 hours ago $3.22 earnedNobodies Rumble TEST STREAM

797 watching -

47:03

47:03

Man in America

11 hours agoEXPOSED: The Dark Web of UK Rape Gangs, Political Blackmail, and Corruption w/ David Vance

32.7K12 -

54:35

54:35

LFA TV

1 day agoTrump’s Vision for North America | TRUMPET DAILY 1.8.25 7pm

23.8K15 -

1:25:34

1:25:34

ChiefsKingdomLIVE

3 hours ago2025 NFL Playoffs Preview Show!

14.4K -

58:20

58:20

Flyover Conservatives

23 hours agoA Detailed Plan on How to ELIMINATE Income Tax w/ PBD, John Stossel, Dr. Kirk Elliott | FOC Show

48.3K4 -

1:09:33

1:09:33

Glenn Greenwald

8 hours agoThe View From Tehran: Iranian Professor On The Middle East, Israel, Syria, And More | SYSTEM UPDATE #385

63K61 -

1:58:49

1:58:49

Space Ice

8 hours agoSpace Ice & Redeye: Steven Seagal's True Justice Feat. Sensei Seagal

36.1K4 -

1:00:18

1:00:18

The StoneZONE with Roger Stone

6 hours agoRobert Davi on The Goonies & Fighting for Trump | Stone for Governor of Canada? | The StoneZONE

33.7K3 -

3:07:07

3:07:07

b0wser

6 hours agoIs Chivalry Dead? | Get Off My Lawn Gaming | b0wser did it

63.2K6