Premium Only Content

Deal Spotlight Episode 1 Part 2 – The guys cover the Eddy County and Matador in the Wolfcamp A.

This is the second part of the Matador in Eddy County Deal Evaluation.

Because of the enormous requests from investors evaluating oil and gas, we are starting a new series showing people how to assess oil and gas M&A or invest. Accredited investors, family offices, and E&P operators are our largest market, asking for these evaluation pieces of training.

We want your feedback and recommendations for deals.

Reach out to Stu and Michael at https://energynewsbeat.co/ to get your deal reviewed.

Highlights of the Podcast

00:20 - Divided into two parts, focusing on the Matador deal.

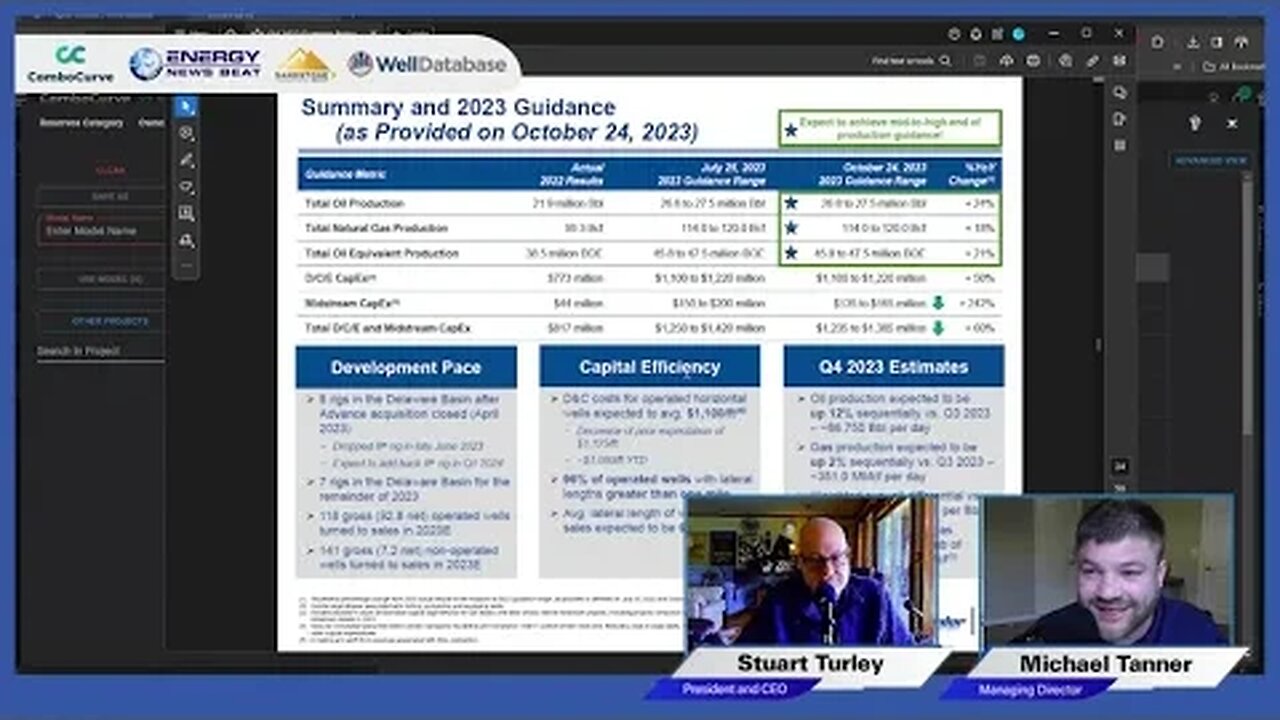

00:45 - Explanation of setting up a new type curve for Wolfcamp A.

01:08 - Understanding production curves normalized to time zero.

09:15 - Discussion on the distribution of EURs (P10, P50, P90).

14:21 - Incorporating strip pricing and natural gas liquids (NGL) data.

16:37 - Creating individual forecasts for specific wells.

19:30 - Incorporating production taxes and ownership interests.

20:47 - Analyze cash flows and calculate the internal rate of return (IRR).

22:02 - Determining the potential acquisition cost and assessing deal value.

A shout-out to our sponsors! WellDatabase and ComboCurve.

*We do not offer investment advice; you must contact your tax professional to get the appropriate tax information for your investments. This is only for educational purposes.

-

![🔴LIVE : THE FINALS Season5 [The World's STRONGEST Gamer] 1080p 60fps](https://1a-1791.com/video/s8/1/4/m/-/L/4m-Lv.0kob-small-LIVE-THE-FINALS-Season5-The.jpg) 2:14:36

2:14:36

PacPowerTV

5 hours ago🔴LIVE : THE FINALS Season5 [The World's STRONGEST Gamer] 1080p 60fps

54K9 -

5:11:27

5:11:27

Joe Donuts Gaming

6 hours ago🟢Live : City Boy Inherits A Ranch 😧😓

31.2K5 -

3:41:12

3:41:12

Fresh and Fit

12 hours agoDaniel Penny ACQUITTED & BLM Meltdown

87.6K23 -

42:46

42:46

barstoolsports

10 hours agoThe Shred Line with Coach Gruden, Dave Portnoy and Steven Cheah | Week 15

60.5K4 -

3:43:53

3:43:53

EricJohnPizzaArtist

6 hours agoAwesome Sauce PIZZA ART LIVE Ep. #27: Christmas Special! Dr. Disrespect is Coming to Town!

35.5K8 -

1:42:14

1:42:14

TheDozenPodcast

12 hours agoConnor McGregor, Raoul Moat, Burglary, BKFC Heavyweight Champion: Mick Terrill

57.4K3 -

2:10:02

2:10:02

vivafrei

15 hours agoEp. 241: Stephanopoulos PAYS for Defamation! Accused CEO Shooter Gets ELITE Attorney! Drone Madness

176K100 -

6:05:13

6:05:13

Right Side Broadcasting Network

6 days agoLIVE REPLAY: NYYRC 112th Annual Gala Ft. Steve Bannon, Nigel Farage, and Dan Scavino - 12/15/24

227K15 -

1:22:45

1:22:45

Josh Pate's College Football Show

10 hours ago $4.73 earnedCFP First Round Predictions | Travis Hunter Heisman | Transfer Portal Intel | Biggest Misses In 2024

41.3K -

LIVE

LIVE

Vigilant News Network

10 hours agoTsunami of Devastating News Crashes Down on COVID Vaccines | Media Blackout

1,700 watching