Premium Only Content

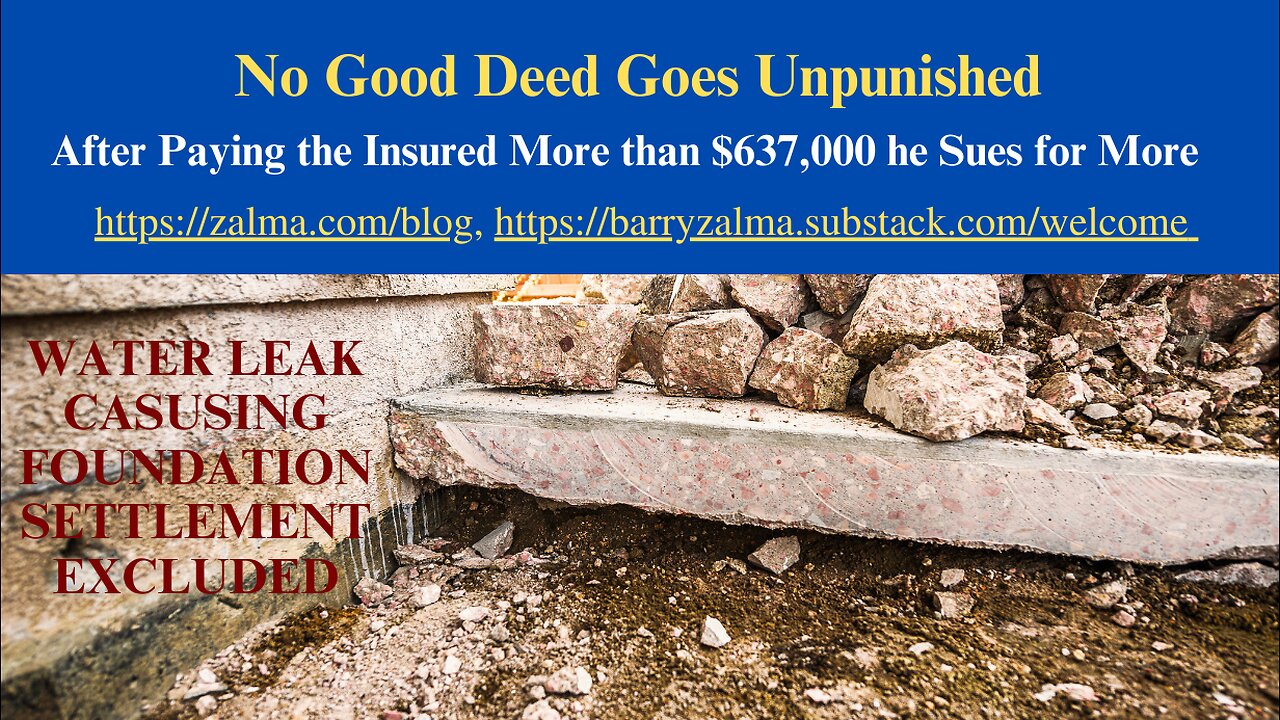

No Good Deed Goes Unpunished

After Paying the Insured More than $637,000 he Sues for More

Vahagun Safarian appealed from the judgment entered after the trial court granted the summary judgment motion filed by Fire Insurance Exchange (Fire). Safarian sued Fire for breach of contract and related claims after Fire denied in part Safarian's claim for coverage under his homeowner's insurance policy for damage to the foundation of his home resulting from a burst pipe that flooded the soil around the home.

In Vahagun Safarian v. Fire Insurance Exchange, B323862, California Court of Appeals, Second District, Seventh Division (November 14, 2023) Safarian asked the Court of Appeals to provide coverage for damages over the almost $700,000 received for damages due to a water line break and water damages.

FACTUAL BACKGROUND

Fire issued Safarian homeowner's insurance policy effective from June 13, 2017 through June 13, 2018 (Policy). The insured property was Safarian's three-level hillside home on Sunset Drive in Los Angeles (Property).

Paragraph 12, states, "We do not insure loss or damage consisting of, composed of or which is the movement, settling, cracking, bulging, shrinking, heaving, or expanding of any part of covered property, whether natural or otherwise .... [¶] [This] includes by way of example but not limited to foundations, foundation fill material, foundation piers, foundation beams, slabs, pads, patios, walls, floors."

The policy also provided that "This water exclusion applies even if water combines or contributes in any way with any other excluded cause of loss or damage hereunder to cause loss or damage..." And the policy at paragraph (f) specifically excludes foundation damage.

PROPERTY DAMAGE, CLAIM, AND LAWSUIT

Water flooded the exterior of the Property as well. Safarian submitted a claim to Fire for water damage to the Property. Fire ultimately paid Safarian $637,999 in policy benefits, including $313,371 for damage to the Property, with the remainder for damage to personal property and loss of use.

Safarian hired William Musakhanyan, a licensed public adjuster, to handle his claim. Musakhanyan notified Hodson that the Property may have sustained foundation damage as a result of the plumbing breach. On March 12, 2018 a structural engineer retained by Safarian reported, "The water leak also appears to have caused fill soils in the crawl [space] . . . to settle," which in turn caused interior floor tiles to separate and an exterior foundation wall to develop cracks. Musakhanyan transmitted the engineer's report to Hodson, who on April 10 responded by email, "Per our conversation-as you know, Earth movement is not covered."

Fire denied Safarian's claim for foundation damage. Safarian sued .

FIRE'S MOTION FOR SUMMARY JUDGMENT

Fire argued it paid all covered damages and therefore did not breach the Policy. The trial court found the language of the Policy was undisputed and the trial court found that Safarian failed to meet his burden to prove Fire intentionally relinquished its right to invoke the paragraph (f) foundation damage exclusion, and he could not meet this burden based only on Fire's denial of coverage in light of Fire's reservation of rights in the denial letter. Finally, the court found that because there was no breach of contract, Fire was entitled to summary judgment as to the entire action.

DISCUSSION

In general, interpretation of an insurance policy is a question of law that is decided under settled rules of contract interpretation. The insured has the burden of establishing that a claim, unless specifically excluded, is within basic coverage, while the insurer has the burden of establishing that a specific exclusion applies.

On appeal, Safarian contended the water coverage extension provided coverage for any damage to the Property resulting from a plumbing breach, regardless of whether the damage was an uninsured loss under the Policy's general terms. The Court of Appeal agreed with the trial court that foundation damage is not a covered loss under the Policy, regardless of the cause, and Fire was entitled to judgment as a matter of law.

The dispositive issue here was not, as argued by Safarian, the convergence of a covered peril (flooding from the burst pipe) and an excluded peril (earth movement, water, soil conditions, and settling) because the purported covered peril is not covered at all. The water damage extension for a burst pipe itself has an exclusion in paragraph (f) for foundation damage. Thus, neither peril provides coverage.

Safarian contended that Fire waived its right to enforce the paragraph (f) foundation damage exclusion by failing to assert it during the adjustment of his claim. Waiver is not established merely by evidence that the insurer failed to specify the exclusion in a letter reserving rights. Safarian did not present evidence that Fire intentionally relinquished its right to assert the paragraph (f) foundation damage exclusion. Fire was free to develop one defense without impliedly waiving another.

ZALMA OPINION

No insurance policy covers every possible risk of loss. Fire found coverage for the damage done by the burst pipe and paid the insured what he agreed to concerning damage to the structure and his contents for more than $670,000. He then sought payment for damages due to settlement of the structure and its foundation that was clearly and unambiguously excluded by trying to create coverage without a basis in the policy or in the facts of the claims handling.

(c) 2023 Barry Zalma & ClaimSchool, Inc.

Please tell your friends and colleagues about this blog and the videos and let them subscribe to the blog and the videos.

Subscribe to Excellence in Claims Handling at locals.com at https://zalmaoninsurance.locals.com/subscribe or at substack at https://barryzalma.substack.com/publish/post/107007808

Go to Newsbreak.com https://www.newsbreak.com/@c/1653419?s=01

Follow me on LinkedIn: www.linkedin.com/comm/mynetwork/discovery-see-all?usecase=PEOPLE_FOLLOWS&followMember=barry-zalma-esq-cfe-a6b5257

Daily articles are published at https://zalma.substack.com. Go to the podcast Zalma On Insurance at https://podcasters.spotify.com/pod/show/barry-zalma/support; Go to Barry Zalma videos at Rumble.com at https://rumble.com/c/c-262921; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – http://zalma.com/blog/insurance-claims-library.

-

8:57

8:57

Barry Zalma, Inc. on Insurance Law

1 year agoNo Coverage for Benefits no Right to Bad Faith Damages

193 -

14:49

14:49

Clownfish TV

18 hours agoNintendo Switch 2 BACKLASH! Gamers BOYCOTT Over Pricing?!

9714 -

24:17

24:17

JasminLaine

17 hours agoCTV Reporter DESTROYS Carney By Quoting His BOOK—His INSANE Answer STUNS Host

31015 -

24:47

24:47

World2Briggs

23 hours ago10 Cities Where The High Cost Of Living Just Isn't Worth It

1332 -

LIVE

LIVE

SoundBoardLord

1 hour agoSaturday Variety Gaming with Friends!!

205 watching -

8:35

8:35

ARFCOM News

21 hours ago $0.04 earnedThis Is How We End The NFA | Booker's Hypocrisy | ATF Facial Recognition

3572 -

10:51

10:51

IsaacButterfield

1 day ago $0.20 earnedToddler Expelled From School For Being “Transphobic”

1.18K3 -

24:52

24:52

Degenerate Jay

20 hours agoIs Marvel Ruining Venom Now? Why Is Mary Jane Venom?

2283 -

LIVE

LIVE

Rotella Games

2 hours agoSaturday Morning Family Friendly Fortnite

94 watching -

1:10:16

1:10:16

Squaring The Circle, A Randall Carlson Podcast

3 hours agoEP043-PT2: A Biographical Look Into The Life of Randall Carlson With Guest Warren Steury

3711